Please use a PC Browser to access Register-Tadawul

A Look At HealthEquity (HQY) Valuation As New Guidance And Split Analyst Calls Draw Attention

HealthEquity Inc HQY | 78.89 | +0.02% |

New guidance and divided analyst opinions put HealthEquity in focus

HealthEquity (HQY) is back on investors’ radar after issuing fresh revenue guidance for its fiscal year ending January 31, 2027, alongside reaffirmed expectations for the current year.

The company now targets full year 2027 revenue between US$1.38b and US$1.41b, an update that arrives just as Wall Street views on the stock have moved in different directions.

The shares have come under pressure recently, with a 1 day share price return of a 10.19% decline and a 30 day share price return of a 12.64% decline. This contrasts with the 3 year total shareholder return of 39.65% and the 18.39% total shareholder return decline over the past year, suggesting momentum has cooled as investors weigh fresh guidance against mixed analyst opinions.

If this kind of conflicting sentiment has you rethinking your watchlist, it could be a good moment to scan other healthcare stocks for ideas in the same space.

With shares pulling back despite new guidance and mixed analyst calls, you are left with a familiar puzzle: is HealthEquity now trading below its intrinsic worth, or is the market already baking in all the future growth?

Most Popular Narrative: 29.6% Undervalued

Against the last close of US$84.56, the most followed narrative points to a fair value near US$120.19, framing HealthEquity as materially underpriced on that view.

The recent regulatory expansion, allowing direct primary care, pre-deductible telehealth, and millions of new ACA bronze/catastrophic plan members to qualify for HSAs, creates the largest addressable market increase in two decades and is described as poised to accelerate new account openings and AUM growth, meaningfully boosting future revenue.

Read the complete narrative. Read the complete narrative.

Curious what kind of revenue path, profit margin shift, and future P/E all have to line up to support that higher value? The full narrative walks through the growth assumptions and valuation math step by step, so you can judge whether those numbers feel realistic for yourself.

Result: Fair Value of $120.19 (UNDERVALUED)

However, you also have to factor in the flip side, where slower HSA account growth in a weaker labor market or lower custodial yields from falling interest rates could undercut this upbeat narrative.

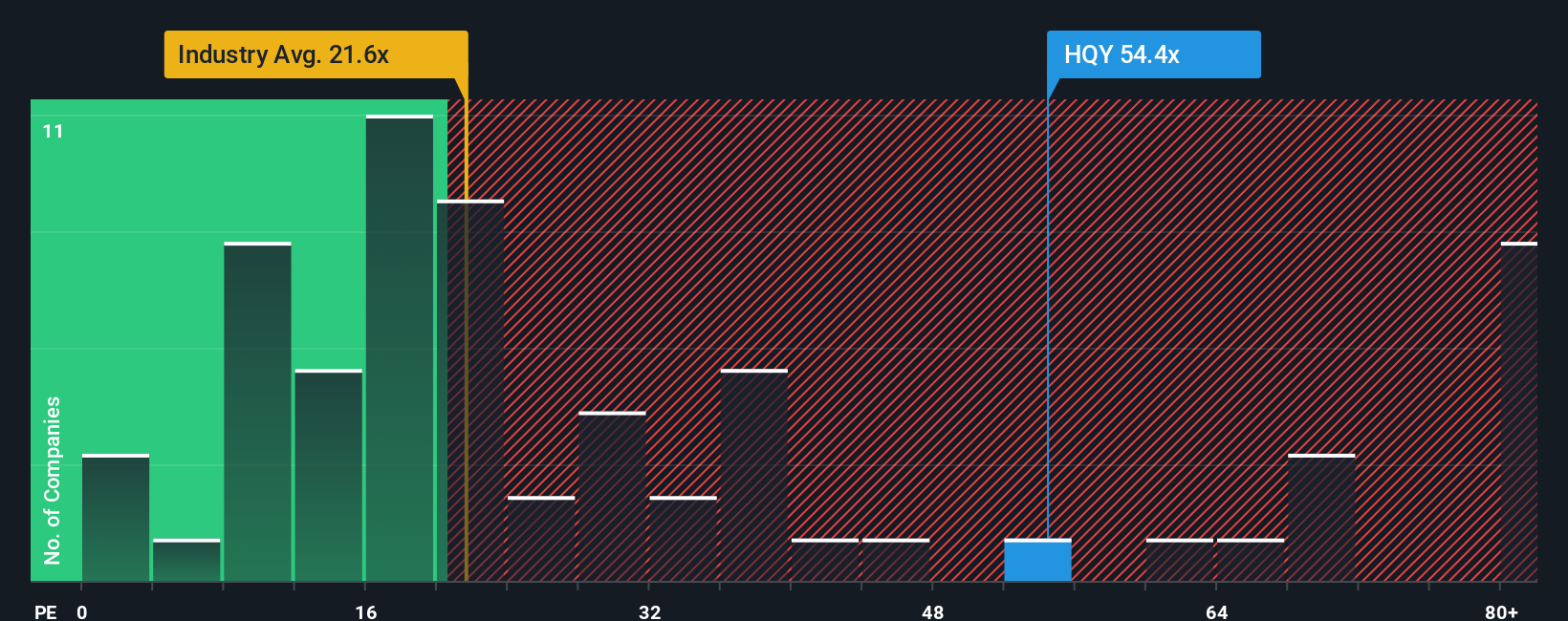

Another View: Rich P/E Ratios Keep Expectations High

That 29.6% “undervalued” narrative sits alongside a very different signal from simple P/E comparisons. HealthEquity trades at 37.7x earnings. The US Healthcare industry sits at 22.9x, peers at 23.7x, and the fair ratio points to 27.4x. In practice, that means the current price already assumes a lot of good news, and any stumble could hit the multiple faster than the business fundamentals.

Build Your Own HealthEquity Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to do your own research, you can build a custom view in minutes, Do it your way.

A great starting point for your HealthEquity research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one ticker on your radar. Broaden your search with focused stock ideas that match the type of opportunities you want to pursue today.

- Target potential mispricings by reviewing these 879 undervalued stocks based on cash flows that may offer more attractive entry points than what you see in your current watchlist.

- Explore major technology trends by checking out these 26 AI penny stocks that connect artificial intelligence themes with listed companies you can research and track.

- Strengthen your income focus by scanning these 12 dividend stocks with yields > 3% that already meet a 3% yield threshold instead of sifting through the entire market yourself.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.