Please use a PC Browser to access Register-Tadawul

A Look At Helios Technologies (HLIO) Valuation After Recent Share Price Momentum

Helios Technologies, Inc. HLIO | 74.23 | +0.73% |

Why Helios Technologies Is On Investors’ Radar

Helios Technologies (HLIO) has drawn attention after a recent stretch of strong share price performance, with the stock up over the past month and past 3 months, prompting investors to take a closer look.

Zooming out, Helios Technologies’ recent share price momentum looks strong, with a 30 day share price return of 17.76% and a year to date share price return of 27.98%. The 1 year total shareholder return sits at 62.79%, pointing to improving sentiment around its growth prospects and risk profile.

If Helios’ recent run has caught your attention, it could be a good moment to broaden your watchlist with our screener of 22 top founder-led companies as potential next ideas.

With Helios trading close to analyst price targets and only a modest implied discount to some intrinsic value estimates, you have to ask yourself: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 7.4% Overvalued

Helios Technologies’ most followed narrative pegs fair value at $65.20, slightly below the last close at $70.02, which raises questions about what is baked into expectations.

Rapid expansion in new product launches including incremental, non cannibalizing value add solutions and IoT enabled platforms positions Helios to capture greater share from ongoing adoption of automation, robotics, and digitalization in global industrial markets, likely increasing future revenue and supporting higher average selling prices. The shift in the industry towards electrification of mobile and industrial equipment is driving OEM demand for sophisticated electro hydraulic and electronic control solutions, areas where Helios is actively innovating, supporting both top line growth and margin expansion over the medium to long term.

Curious what kind of revenue path, margin lift, and future earnings multiple need to line up to justify that $65.20 fair value? The full narrative lays out a detailed earnings ramp, a profitability reset, and an assumed valuation level that together underpin this target.

Result: Fair Value of $65.20 (OVERVALUED)

However, you still need to weigh risks such as cyclical end market exposure and potential margin pressure if electrification and digital solutions adoption moves slower than expected.

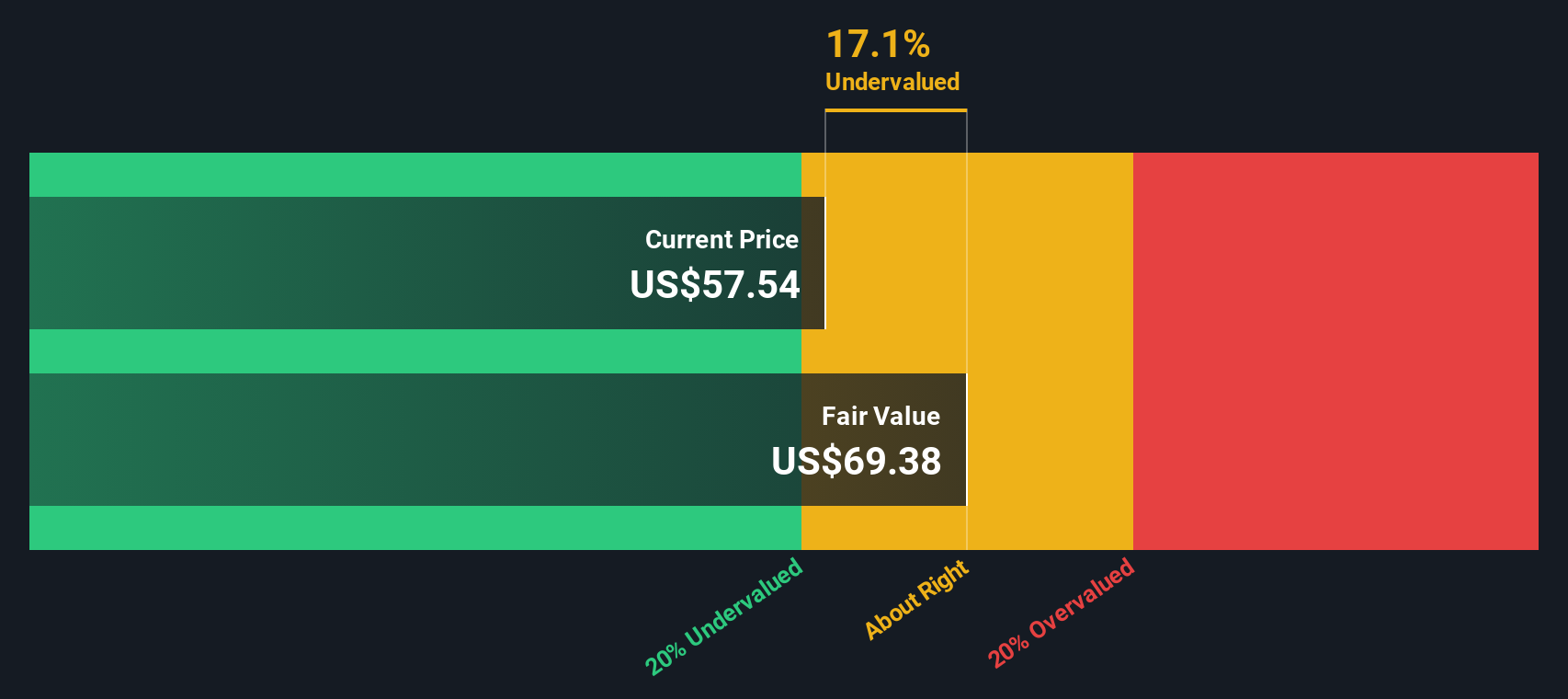

Another Angle: DCF Says Slightly Undervalued

While the most popular narrative suggests Helios Technologies looks around 7.4% overvalued at a fair value of $65.20, our DCF model arrives at a fair value of $74.16, compared with the current price of $70.02. On that view, the shares trade at about a 5.6% discount. Which set of assumptions feels more realistic to you?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Helios Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Helios Technologies Narrative

If you see the story differently or simply want to stress test these assumptions against your own view, you can build a personalized Helios thesis in just a few minutes, starting with Do it your way.

A great starting point for your Helios Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Helios is already on your radar, do not stop there. Use the Simply Wall St Screener to uncover more companies that might fit your style and goals.

- Target potential value opportunities by scanning our list of 55 high quality undervalued stocks that combine healthy fundamentals with what may be appealing prices.

- Strengthen the quality of your watchlist by focusing on businesses flagged in our solid balance sheet and fundamentals stocks screener (46 results) with resilient financial foundations.

- Spot under the radar prospects by reviewing our screener containing 25 high quality undiscovered gems that the market may not be paying full attention to yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.