Please use a PC Browser to access Register-Tadawul

A Look At Helix Energy Solutions Group (HLX) Valuation After Alliance Extension On Subsea Well Intervention Systems

Helix Energy Solutions Group, Inc. HLX | 8.94 | -1.76% |

Alliance extension and why it matters for Helix Energy Solutions Group (HLX)

Helix Energy Solutions Group (HLX) has extended its long running alliance for subsea well intervention systems to October 5, 2026, keeping an existing global collaboration in place for design, development and marketing.

The extended alliance lands at a time when Helix Energy Solutions Group’s share price has a 30 day return of 21.3% and a 90 day return of 32.31%, while its 5 year total shareholder return of 61.35% points to stronger long term compounding than the shorter term figures alone imply.

If this kind of contract news has you thinking about where else growth and infrastructure themes might show up, you can take a look at our screener of 25 power grid technology and infrastructure stocks as a starting point for further ideas.

With the shares up strongly in recent months, a value score of 2, an intrinsic discount of 38.41% and a 16.28% gap to the latest analyst target, is Helix still undervalued or is the market already pricing in future growth?

Most Popular Narrative: 11.8% Undervalued

At a last close of $8.60 against a widely followed fair value estimate of $9.75, the current price sits below where the narrative models place Helix Energy Solutions Group. This sets up a story that leans on long term contract visibility and earnings expansion.

The pronounced long-term uptick in global demand for well abandonment, decommissioning, and offshore maintenance (as more aging fields require regulatory-compliant retirement) will expand Helix's core addressable market, supporting durable revenue growth, backlog expansion, and reduced earnings volatility. Expansion and strong utilization in the Robotics segment, particularly with high vessel activity in offshore wind installation, trenching, and renewables site clearance, aligns with the accelerating shift to renewable energy infrastructure and supports both diversified, higher-margin revenues and future net margin improvement.

Curious how that fair value is built? The narrative leans heavily on steadier revenue, higher margins, and a future earnings base that looks very different to today. The tension lies in the profit multiple the market might be willing to pay for that earnings profile. If you want to see exactly which assumptions are most influential, the full narrative lays it all out.

Result: Fair Value of $9.75 (UNDERVALUED)

However, persistent project deferrals and pressure in spot markets could keep vessel utilization and margins choppy, challenging the more upbeat earnings and fair value story.

Another way to look at valuation

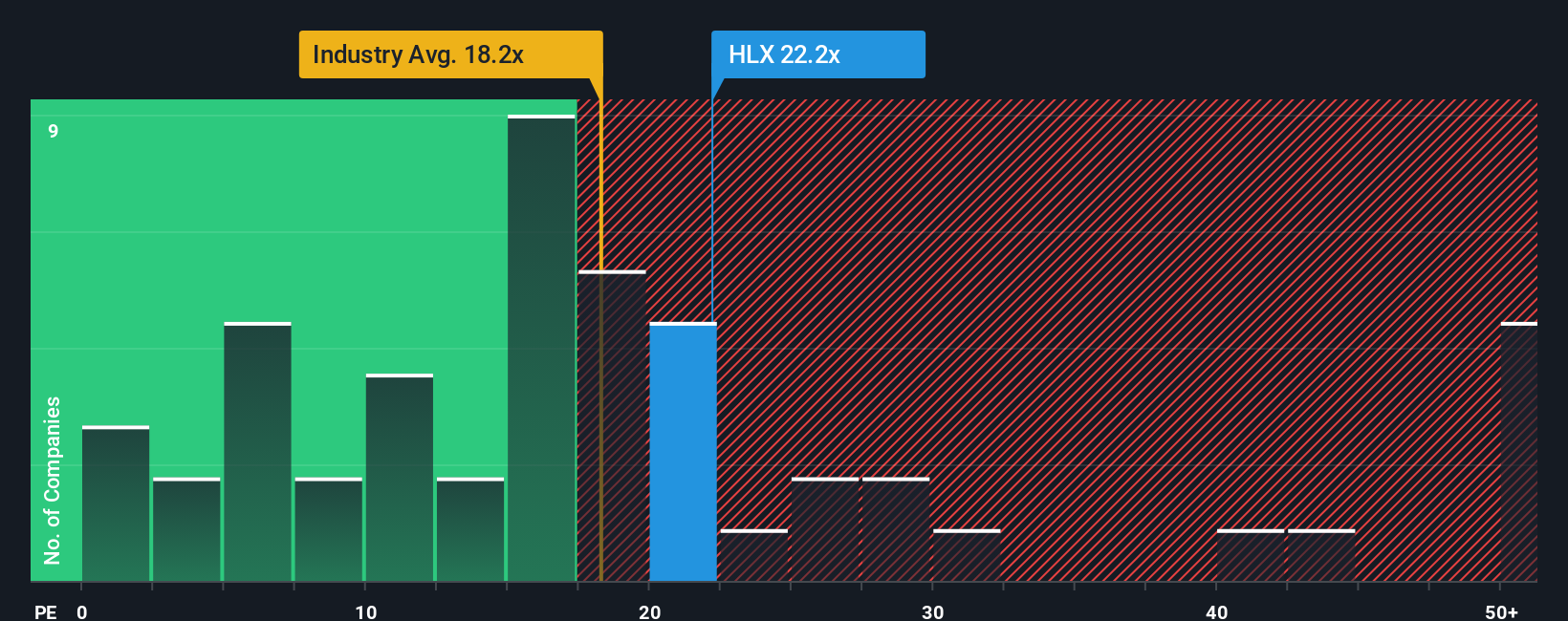

So far the story leans on fair value and cash flow, but the current P/E of 29.7x tells a different story. It sits above the US Energy Services industry at 25x, peers at 21.9x, and a fair ratio of 17.5x. This points to valuation risk if sentiment cools.

Numbers like that can be tricky to weigh. See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helix Energy Solutions Group Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Helix Energy Solutions Group.

Looking for more investment ideas?

If you are serious about strengthening your portfolio, do not stop at one company. Use these focused ideas to pressure test your thinking and spot fresh opportunities.

- Spot potential value early by scanning our list of screener containing 24 high quality undiscovered gems before they show up on everyone else’s radar.

- Strengthen the quality of your core holdings with the solid balance sheet and fundamentals stocks screener (44 results) that can help you focus on companies with financial foundations you might feel comfortable holding through different conditions.

- Reduce portfolio stress by checking the 83 resilient stocks with low risk scores that highlights businesses with lower risk scores, so you are not relying on a single story to carry your returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.