Please use a PC Browser to access Register-Tadawul

A Look At Helmerich & Payne (HP) Valuation As Earnings And CEO Transition Draw Market Attention

Helmerich & Payne, Inc. HP | 35.63 | -0.92% |

Helmerich & Payne (HP) heads into a busy week, with investors watching the upcoming fiscal first quarter 2026 earnings release alongside a CEO transition and rig reactivations in Saudi Arabia.

The recent 31.18% 3 month share price return and 14.40% year to date share price return to US$34.25 suggest momentum has picked up ahead of the earnings release and leadership change, even though the 3 year total shareholder return of a 13.27% decline contrasts with a 55.77% gain over 5 years.

If events at Helmerich & Payne have you watching the energy patch more closely, it could be a good moment to scan other aerospace and defense stocks that are drawing investor attention.

With HP trading at US$34.25, a 36.47% estimated intrinsic discount sits alongside a share price that is already above the average analyst target. Is this still a value opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 13.2% Overvalued

Helmerich & Payne's most followed narrative pegs fair value at about $30.27, which sits below the current $34.25 share price and frames the earnings story ahead.

The analysts have lifted their price target for Helmerich & Payne from about US$27.20 to roughly US$30.27, citing updated assumptions around fair value, discount rate, revenue growth, profit margin and future P/E as the key drivers of the change.

Want to see what is behind that higher fair value line? The narrative leans on moderate revenue growth, a shift to positive margins, and a richer earnings multiple. Curious how those ingredients fit together over time and what kind of earnings profile that implies for HP?

Result: Fair Value of $30.27 (OVERVALUED)

However, risks around prolonged U.S. shale softness and potential overcapacity in high spec rigs could still pressure day rates and undercut the fair value case.

Another Take: Multiples Point to Value

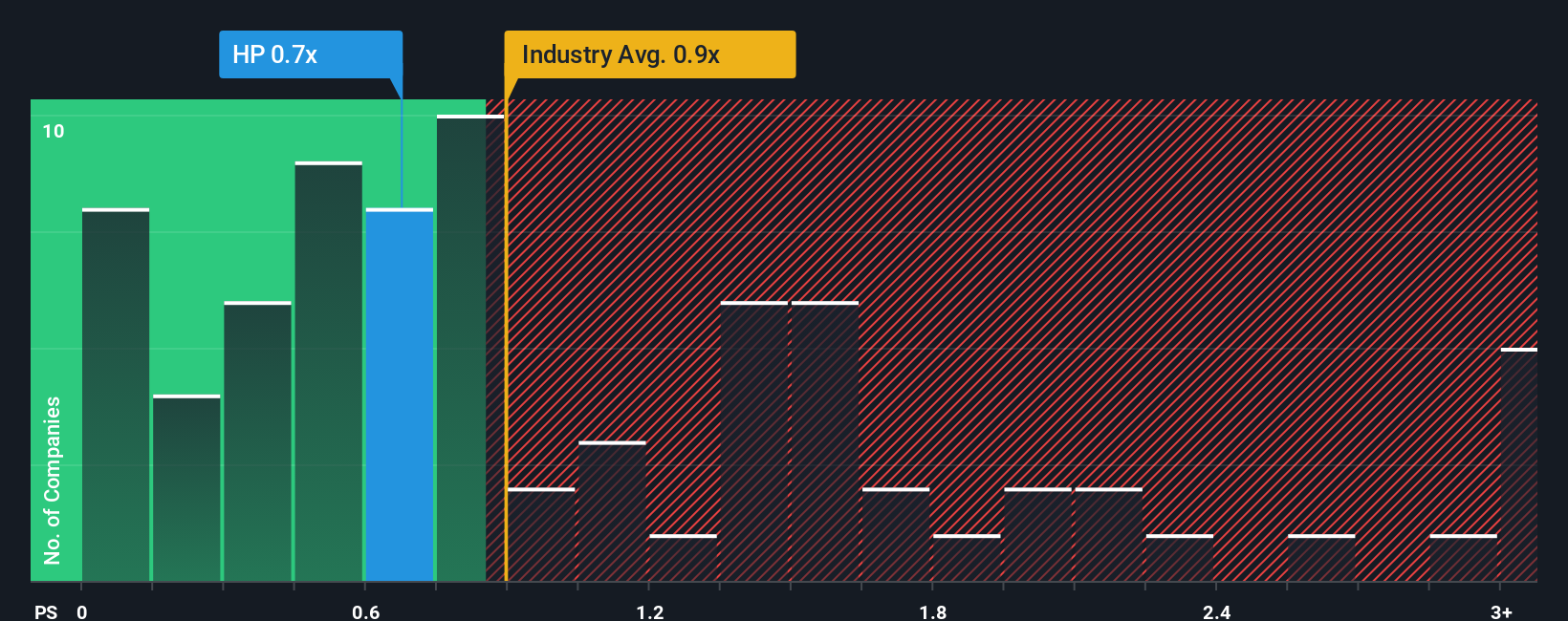

While the popular narrative sees Helmerich & Payne as 13.2% overvalued versus a fair value of about $30.27, the current P/S of 0.9x looks cheaper than both the US Energy Services industry at 1.3x and peers at 1.4x. A fair ratio of 1x suggests the market could shift closer to that level. Is this a warning that the narrative is too cautious, or a sign that expectations around future cash flows need a closer look?

Build Your Own Helmerich & Payne Narrative

If this view does not quite fit how you see HP, or you prefer to lean on your own research and assumptions, you can pull the same data, test your inputs, and build a custom narrative in just a few minutes with Do it your way.

A great starting point for your Helmerich & Payne research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If HP has sharpened your focus, do not stop here. Use the screener to hunt for other opportunities that fit the way you like to invest.

- Spot potential turnaround candidates by scanning these 3533 penny stocks with strong financials that already carry stronger balance sheets and cash flows than their low share prices suggest.

- Target the next wave of automation and data tools by reviewing these 111 healthcare AI stocks that connect medical workflows with machine learning in practical ways.

- Position your portfolio around dependable income by shortlisting these 13 dividend stocks with yields > 3% that can help anchor total returns with regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.