Please use a PC Browser to access Register-Tadawul

A Look At Hims & Hers Health (HIMS) Valuation As Amazon Targets The Weight Loss Segment

Hims & Hers Health, Inc. Class A HIMS | 28.89 28.98 | -5.19% +0.31% Post |

Hims & Hers Health (HIMS) is back in focus after Amazon Pharmacy said it will offer Novo Nordisk’s Wegovy weight loss pill, sharpening competition in a category Hims & Hers has been building into.

The Amazon Pharmacy move comes after a choppy stretch for Hims & Hers, with a 30 day share price return decline of 13.46% and a 90 day share price return decline of 48.69%. However, the 1 year total shareholder return of 22.85% and the 3 year total shareholder return of over 3x suggest that longer term holders have still seen substantial gains.

If this kind of competition in digital health has your attention, it could be worth seeing how other healthcare stocks compare on growth, resilience and market positioning.

With Hims & Hers shares down 49% over the past 90 days but still up 23% over the past year, and trading at a discount to both analyst targets and some intrinsic value estimates, is this pullback a reset, or is the market already pricing in future growth?

Most Popular Narrative: 27.4% Undervalued

On this narrative, Hims & Hers’ fair value of about $44.36 sits above the recent $32.20 close, framing the current pullback as a valuation gap that depends on execution in newer categories.

The company's expansion into new categories such as hormonal health (including menopause and low testosterone) and at home lab testing demonstrates ongoing diversification and taps into large, underserved patient populations. This is likely to support better revenue retention as more customers engage with multi condition offerings.

Curious what kind of revenue ramp, margin path, and future earnings multiple stand behind that higher fair value? The narrative connects growth assumptions, changing profitability, and a premium P/E that is usually reserved for market leaders. The full story is in how those pieces fit together.

Result: Fair Value of $44.36 (UNDERVALUED)

However, that upside story depends on GLP 1 pricing not compressing margins too far and on international expansion not adding more regulatory cost than expected.

Another Angle on Valuation

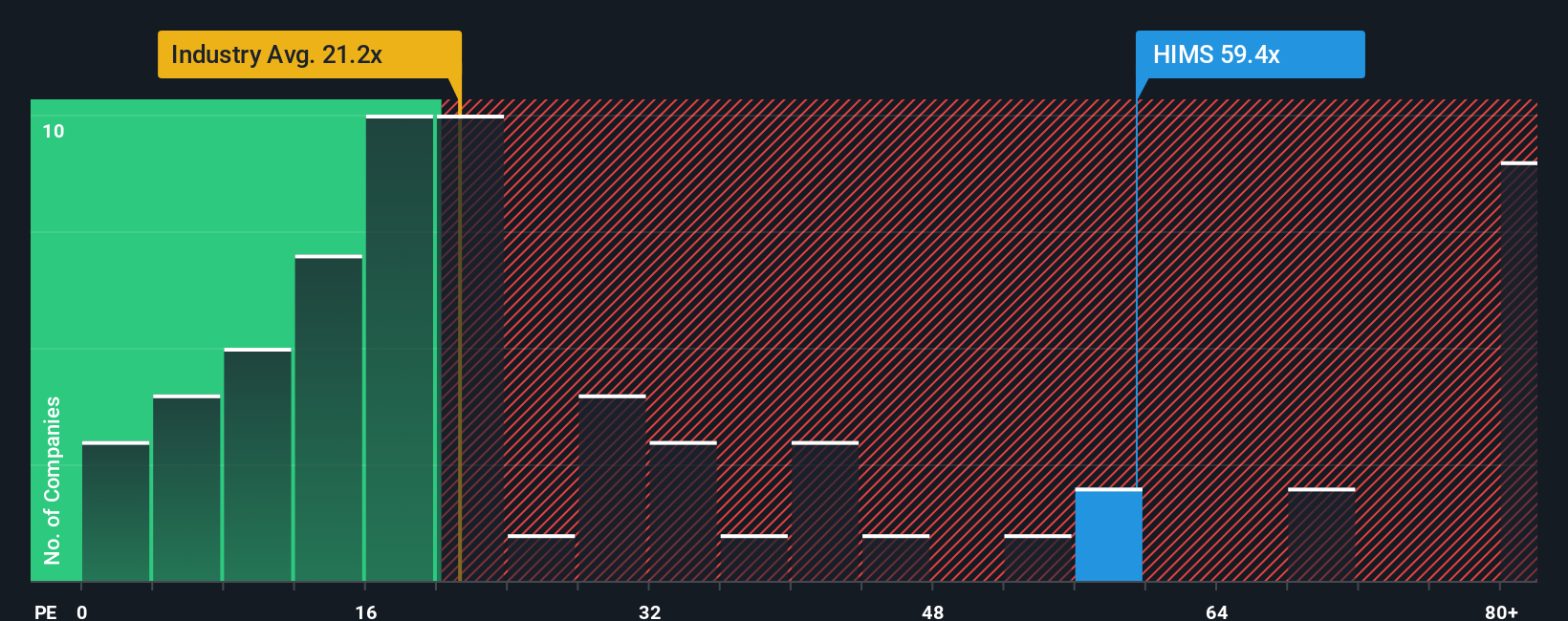

Those fair value estimates around $44.36 suggest upside from the recent US$32.20 price, but the current P/E of 54.8x tells a different story. It is much higher than the US Healthcare industry at 23.1x, its peer average at 32.7x, and a fair ratio of 27.4x, which points to meaningful valuation risk if sentiment cools.

That kind of gap can close in different ways. The key question for you is whether earnings can grow into this premium, or whether the multiple itself is the part that eventually adjusts.

Build Your Own Hims & Hers Health Narrative

If you look at this and feel the story plays out differently, or just want to test your own assumptions against the data, you can build a tailored view in minutes, starting with Do it your way.

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at a single stock, you cut yourself off from other possibilities, so use the screener to quickly spot fresh ideas that fit your style.

- Zero in on potential value plays by checking out these 884 undervalued stocks based on cash flows that line up with your expectations on price and fundamentals.

- Tap into long term technology themes by scanning these 25 AI penny stocks that are tied to AI driven products and services.

- Hunt for income ideas by reviewing these 13 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.