Please use a PC Browser to access Register-Tadawul

A Look At Intellia Therapeutics (NTLA) Valuation After ARK’s Added Stake And J.P. Morgan Conference Spotlight

Intellia Therapeutics, Inc. NTLA | 14.63 | -7.99% |

Intellia Therapeutics (NTLA) is back in focus after ARK Investment added 40,000 shares to its position, just as the gene editing company prepares to present at the 44th Annual J.P. Morgan Healthcare Conference.

That renewed interest comes after a volatile stretch for Intellia, with the share price at $12.02 and a 30 day share price return of 31.51% and 7 day return of 18.66%, contrasting with a 90 day share price return decline of 51.75% and longer term total shareholder return declines over three and five years. This suggests that recent momentum has picked up even as longer horizon investors have faced steep drawdowns.

If ARK’s move has you looking beyond a single gene editing name, this could be a good moment to scan other healthcare stocks that might fit your watchlist.

So with the stock at $12.02, recent gains on the board and analysts’ average price target sitting higher, should you see Intellia as undervalued today, or assume the market is already pricing in future growth potential?

Most Popular Narrative: 46% Undervalued

At a last close of $12.02 versus a fair value estimate of about $22.27, the most followed narrative sees a wide gap that hinges on Intellia turning its clinical pipeline into meaningful future earnings.

The sustained expansion of the addressable market for Intellia's programs is reinforced by demographic trends, especially aging populations and the continued rise in genetic and chronic conditions like ATTR amyloidosis and HAE, supporting higher future patient volumes and underpinning potential multi-launch revenue inflection points. Rapid technological and regulatory advancements in gene-editing, including increased healthcare investments, accelerating review pathways, and support for first-in-class CRISPR therapies, create a favorable environment for Intellia's platform to secure approvals, forge additional partnership/licensing opportunities, and achieve sustainable, recurring non-dilutive revenues through both commercialization and collaborations, increasing top-line growth and earnings potential.

Want to see what kind of revenue ramp, margin shift, and future earnings multiple are baked into that gap to fair value? The narrative leans on aggressive top line expansion, a sharp swing in profitability and a premium P/E usually reserved for highly rated growth names. Curious which specific assumptions have to line up for that to hold? The full breakdown lays out those moving parts in detail.

Result: Fair Value of $22.27 (UNDERVALUED)

However, this upbeat case still runs into real hazards, including safety questions around liver events in ATTR trials and the risk of future shareholder dilution if funding tightens.

Another Way to Look at Valuation

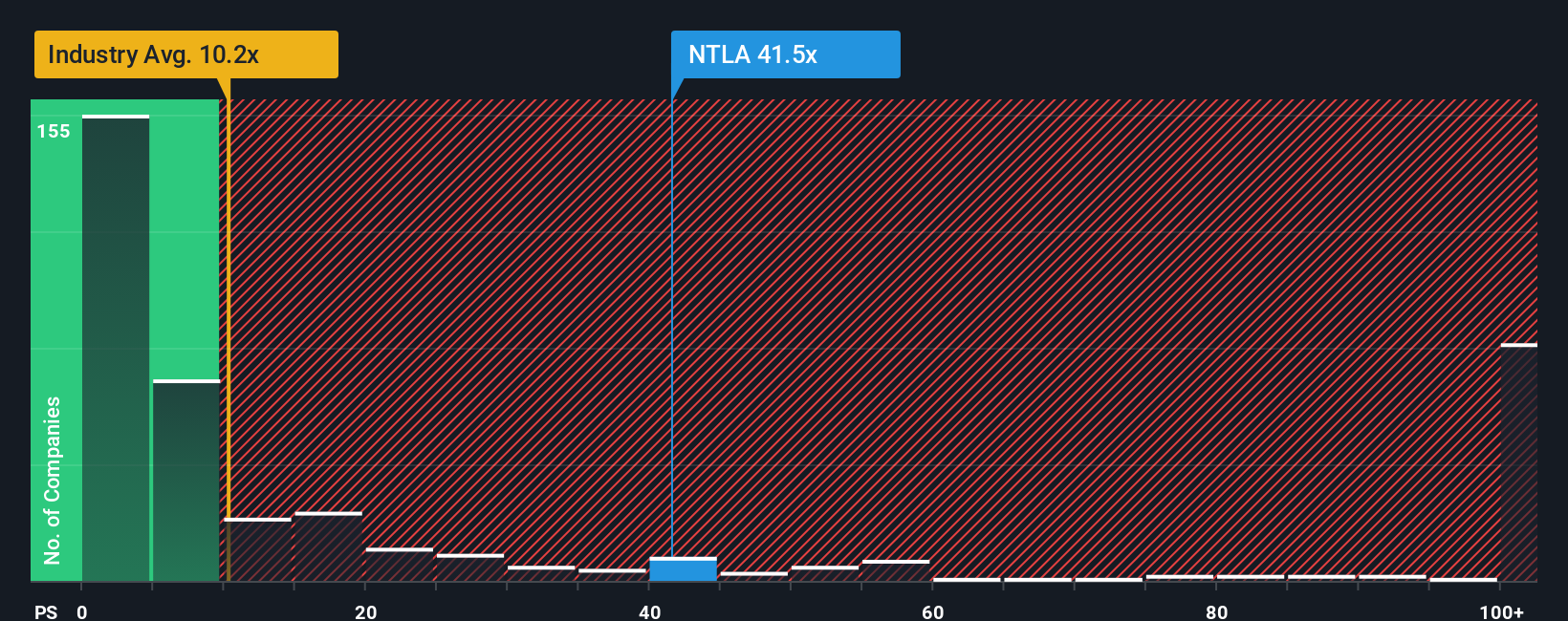

The narrative model points to Intellia trading well below an estimated fair value of about US$22.27, yet the simple P/S check paints a very different picture. At 24.2x sales versus 12.8x for the US biotech group and a fair ratio of 0x, the stock screens as expensive, not cheap. This raises the question of whether the story and simple multiples are pulling in opposite directions.

Build Your Own Intellia Therapeutics Narrative

If you are not fully aligned with this view or simply prefer to weigh the data yourself, you can assemble a tailored narrative in just a few minutes: Do it your way.

A great starting point for your Intellia Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your watchlist, do not stop at one stock. Use targeted screeners to zero in on opportunities that actually fit your style.

- Spot early stage potential by scanning these 3533 penny stocks with strong financials that pair smaller price tags with solid underlying metrics.

- Target the intersection of healthcare and AI by reviewing these 30 healthcare AI stocks shaping new ways to treat and manage disease.

- Hunt for income ideas by filtering for these 12 dividend stocks with yields > 3% that can help anchor a yield focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.