Please use a PC Browser to access Register-Tadawul

A Look At InterDigital (IDCC) Valuation After Record Results And Expanded AI And Licensing Growth

InterDigital, Inc. IDCC | 358.50 | +2.92% |

InterDigital (IDCC) has drawn fresh attention after reporting record 2025 results, supported by long term smartphone and electronics licensing agreements, expanding AI and video technology efforts, and updated 2026 earnings guidance.

Following the 2025 results and fresh 2026 guidance, InterDigital’s share price has surged, with a 1 month share price return of 20.06% and a 1 year total shareholder return of 83.40%, building on a very large 5 year total shareholder return.

If this AI and wireless story has your attention, it could be a good moment to scan other opportunities through our list of 56 profitable AI stocks that aren't just burning cash.

With the share price up sharply and analysts’ average target sitting above the current US$371.08 level, the key question now is whether InterDigital’s recent success is still underappreciated by the market or whether any future growth is already fully reflected in the price.

Most Popular Narrative: 19.8% Undervalued

InterDigital’s most followed narrative pegs fair value at about $462.67 per share versus the last close of $371.08, putting a spotlight on what is driving that gap.

The combination of modest revenue growth assumptions and higher margins is framed by bullish analysts as a way to support cash generation and earnings quality. They see this as important for sustaining the revised target range.

Some bullish analysts argue that using a lower future P/E in their models still results in a price target above the current level. They interpret this as room for valuation upside if the company meets its revenue and margin assumptions.

Curious how modest top line assumptions still support that higher fair value? The narrative emphasizes margin strength, cash generation and a re rated earnings multiple. The exact mix of these drivers might surprise you.

Result: Fair Value of $462.67 (UNDERVALUED)

However, this upbeat fair value story still leans heavily on the raised 2026 guidance and on continued success in renewing a handful of large licensing deals.

Another Angle: Multiples Point to a Richer Price

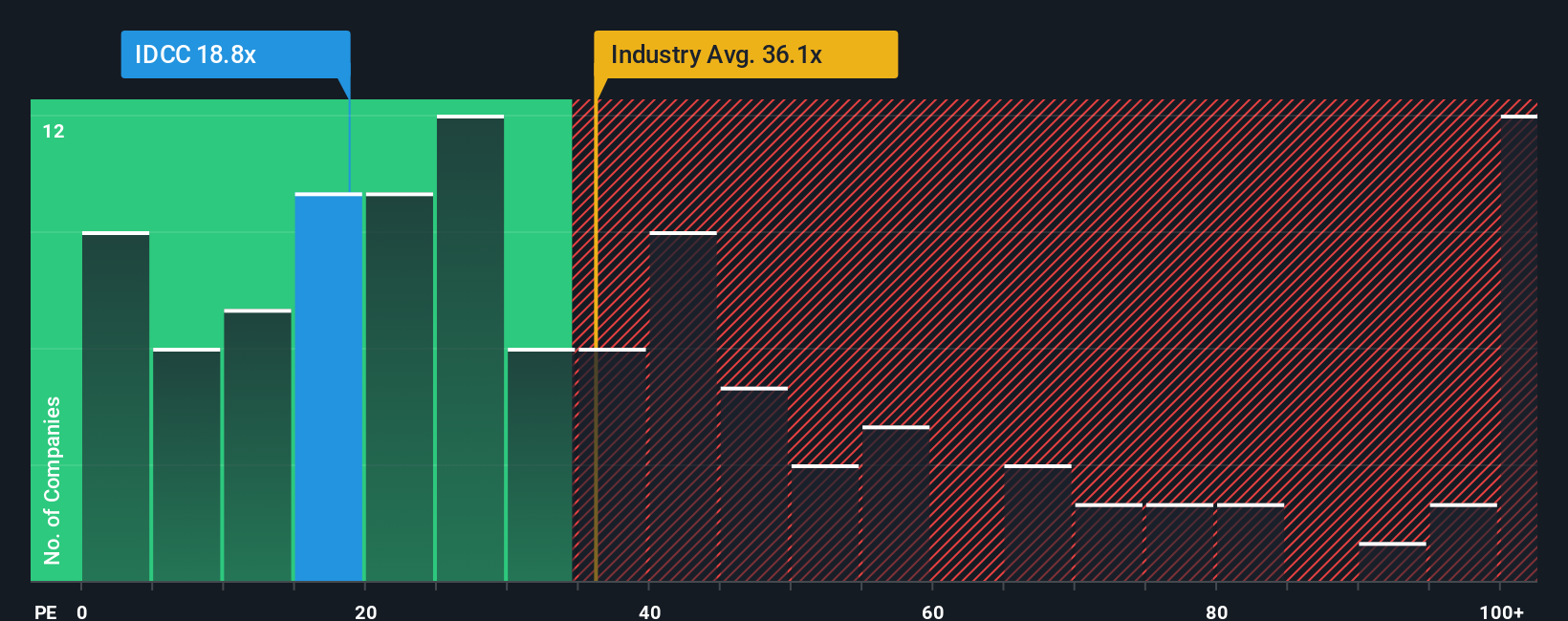

That 19.8% undervalued fair value hinges on narrative assumptions, but the current P/E of 23.4x paints a more cautious picture. It sits below the US Software industry at 26.9x, yet above both peers and the fair ratio, each at 22.3x. That premium suggests less room for error if earnings disappoint. Which signal do you put more weight on: the narrative gap or the P/E premium?

Build Your Own InterDigital Narrative

If you see the story differently or prefer to rely on your own view, you can stress test the same data and build a custom perspective in minutes, Do it your way.

A great starting point for your InterDigital research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to Hunt for Your Next Idea?

If InterDigital has sharpened your appetite for opportunities, do not stop here; broaden your watchlist with fresh ideas tailored to different risk and return preferences.

- Target potential value opportunities by checking companies our screener flags as 52 high quality undervalued stocks with solid fundamentals backing their current pricing.

- Strengthen your income focus by reviewing companies in our list of 14 dividend fortresses that combine higher yields with resilience potential.

- Protect your capital first by scanning the 82 resilient stocks with low risk scores that our models suggest have more resilient risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.