Please use a PC Browser to access Register-Tadawul

A Look At J&J Snack Foods (JJSF) Valuation After Weak First Quarter Earnings And Share Price Reaction

J & J Snack Foods Corp. JJSF | 84.65 | -0.49% |

J&J Snack Foods (JJSF) is back in focus after first quarter earnings showed sales of US$343.8 million and net income of US$883,000, along with fresh share repurchase announcements and Project Apollo cost savings.

The weak first quarter numbers and earnings miss were followed by a sharp market reaction, with a 1 day share price return of 15.44% decline and a 1 year total shareholder return of 33.2% decline. This points to fading momentum despite cost savings and buybacks aimed at supporting confidence in the business.

If J&J Snack Foods’ pullback has you reassessing opportunities in consumer names, this can be a good moment to broaden your search with fast growing stocks with high insider ownership.

With J&J Snack Foods trading at US$80.50 and sitting at a sizeable discount to analyst targets and some intrinsic estimates, the key question is whether recent weakness signals an opportunity or whether the market is already correctly pricing future growth.

Most Popular Narrative: 26.8% Undervalued

With J&J Snack Foods last closing at $80.50 against a narrative fair value of $110, the core debate is how its earnings and margins evolve from here.

The analysts have a consensus price target of $136.0 for J&J Snack Foods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of $122.0.

Want to see what sits behind that valuation gap? The narrative focuses on revenue growth, firmer margins and a richer future earnings multiple. The exact mix might surprise you.

Result: Fair Value of $110 (UNDERVALUED)

However, the story can change quickly if increases in ingredient costs put pressure on margins, or if weaker Retail segment trends point to more persistent revenue softness.

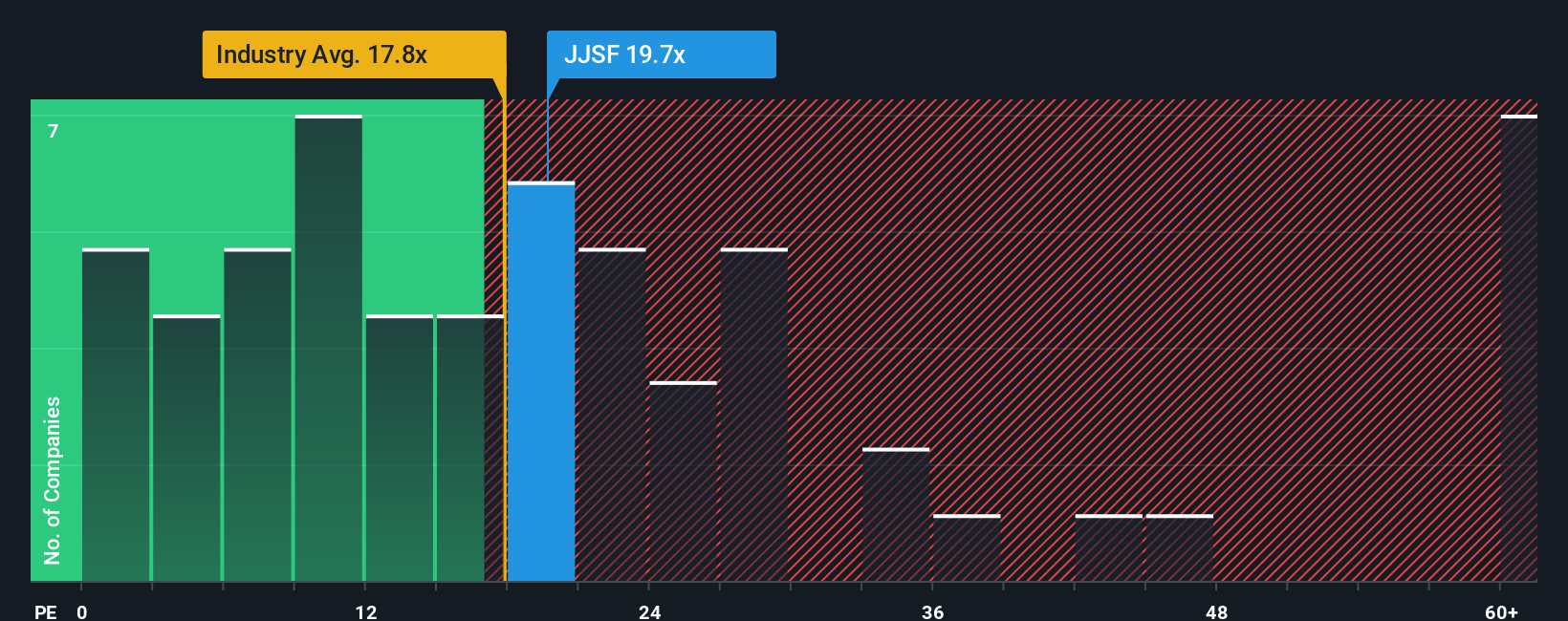

Another View: Earnings Multiple Signals Caution

There is a twist once you look at J&J Snack Foods through its P/E. The shares trade on 23.3x earnings compared with a fair ratio of 16x, the US Food industry at 21.1x and peers at 71x. That premium to the fair ratio raises a simple question: how much valuation risk are you comfortable with?

Build Your Own J&J Snack Foods Narrative

If you see things differently, or simply like running your own numbers, you can test the assumptions, shape your view and Do it your way in just a few minutes.

A great starting point for your J&J Snack Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If you stop with just one stock, you risk missing out on other opportunities, so take a few minutes to scan the market with focused screeners.

- Spot potential mispricing quickly by checking these 867 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Tap into fast-moving trends by scanning these 25 AI penny stocks that are tied to advances in artificial intelligence.

- Boost your income focus by reviewing these 13 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.