Please use a PC Browser to access Register-Tadawul

A Look At Kinetik Holdings (KNTK) Valuation After Dividend Hike And ECCC Pipeline Progress

Kinetik Holdings Inc. Class A KNTK | 45.56 | +1.90% |

Kinetik Holdings (KNTK) recently lifted its quarterly dividend by 4%, and that decision, together with progress on its ECCC pipeline project, is shaping how investors are reassessing the stock today.

The recent dividend increase and progress on the ECCC pipeline come as Kinetik’s short term share price momentum has turned positive, with a 30 day share price return of 14.52% and a 90 day share price return of 27.30%. This is occurring even though the 1 year total shareholder return is 26.47% lower and the 3 year total shareholder return is 78.31% higher.

If this kind of rebound in pipelines has your attention, it could be a good moment to see what else is moving in the sector via our 24 power grid technology and infrastructure stocks.

With Kinetik’s share price rebounding, a higher dividend in place and the ECCC project progressing, the big question now is whether the current valuation still leaves upside on the table or if the market is already pricing in future growth.

Most Popular Narrative: 8.1% Undervalued

At a last close of $41.87 versus a narrative fair value of about $45.54, Kinetik is framed as modestly undervalued, with that view resting heavily on future project driven growth.

The analysts have a consensus price target of $51.5 for Kinetik Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $57.0, and the most bearish reporting a price target of just $43.0.

Curious what justifies that higher fair value? The narrative leans on faster earnings growth, thicker margins and a richer future earnings multiple than the sector. The exact mix of those assumptions may surprise you.

Result: Fair Value of $45.54 (UNDERVALUED)

However, the bullish story around new projects and dividend growth still runs into real pressure points, including Permian concentration risk and hefty, ongoing capital and leverage demands.

Another Angle On Valuation

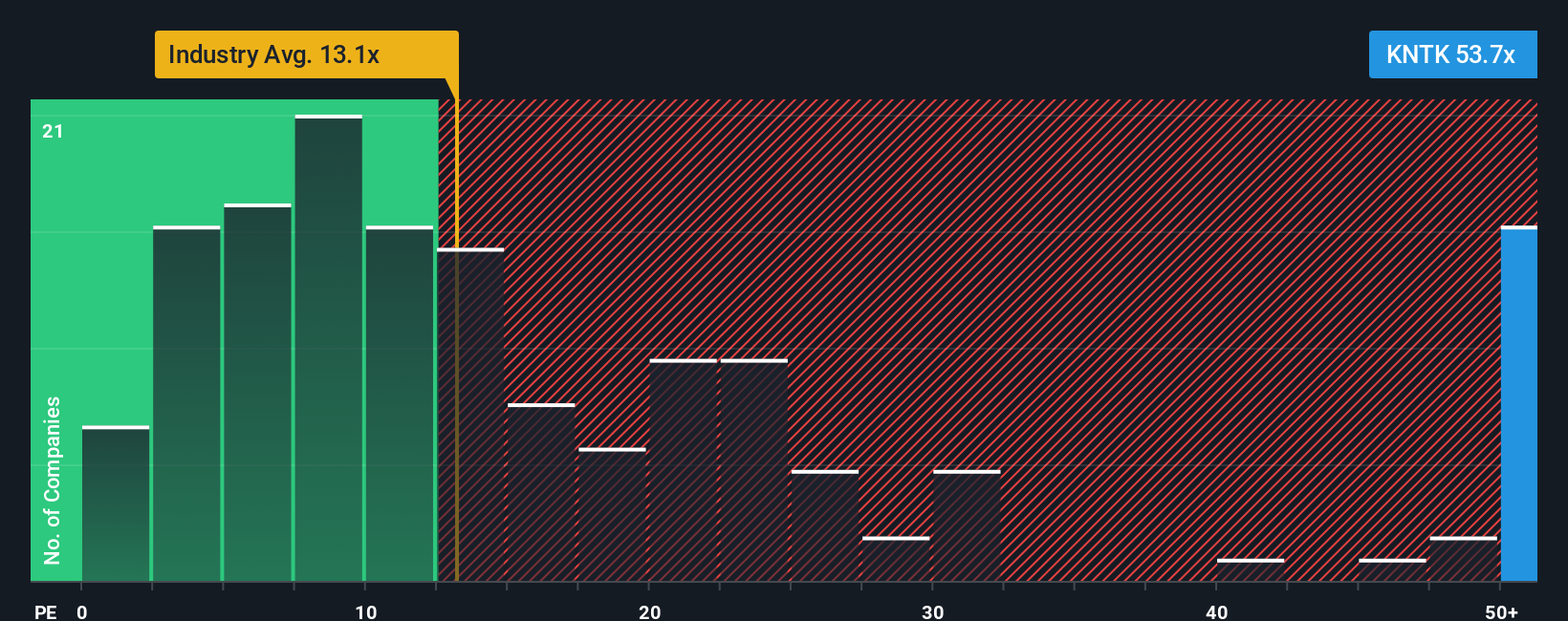

The fair value narrative suggests Kinetik is about 8.1% undervalued at $41.87 versus $45.54, but the earnings based ratios tell a different story. On a P/E of 105x versus a fair ratio of 23.8x, the stock screens as expensive, which raises a simple question: what exactly are you paying up for here?

Build Your Own Kinetik Holdings Narrative

If you feel the story here does not quite fit your view, or you simply prefer to test the numbers yourself, you can build a personalised Kinetik narrative in just a few minutes, starting with Do it your way.

A great starting point for your Kinetik Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Kinetik has sharpened your thinking, do not stop here. Use the Simply Wall St screener to spot fresh ideas before everyone else does.

- Target quality at a discount by scanning our 51 high quality undervalued stocks and see which companies currently line up with strong fundamentals and lower prices.

- Focus on reliability by reviewing the 85 resilient stocks with low risk scores and find businesses with more resilient risk profiles that may better suit steadier portfolios.

- Hunt for future standouts with the screener containing 24 high quality undiscovered gems, where smaller, less followed names with solid financials are easier to spot before they gain wider attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.