Please use a PC Browser to access Register-Tadawul

A Look At LeMaitre Vascular (LMAT) Valuation After Recent Share Price Move And Mixed Return Profile

LeMaitre Vascular, Inc. LMAT | 92.94 | +1.18% |

LeMaitre Vascular (LMAT) is back on investors’ radar after a recent 1 day move of 1.2%, prompting a closer look at how its current share price of US$87.66 lines up with fundamentals.

That 1.2% move sits within a broader pattern where the share price return is up 9.34% year to date, yet the 1 year total shareholder return is a 10.32% decline, while the 3 and 5 year total shareholder returns of 78.76% and 86.69% point to momentum that has built over a longer horizon.

If this health care name has caught your attention, it could be a good moment to widen the lens and see which other medical names are on the move through our 25 healthcare AI stocks.

With revenue and net income growth in the high single digits and a share price of US$87.66, the key question is whether LeMaitre Vascular is still trading below its potential or if the market is already pricing in future growth.

Most Popular Narrative: 16.3% Undervalued

With LeMaitre Vascular trading at $87.66 against a narrative fair value of $104.78, the current price sits below what this widely followed storyline suggests.

Expanding addressable patient population due to global demographic shifts, especially an aging population and increasing prevalence of diabetes and obesity, is likely to drive sustained demand for vascular interventions and LeMaitre's portfolio, supporting ongoing unit sales and top-line revenue expansion over time.

Curious what kind of revenue path and margin profile need to line up for that valuation? The narrative leans on steady compounding, richer mix, and a punchy future earnings multiple.

Result: Fair Value of $104.78 (UNDERVALUED)

However, you also need to weigh the risk that pricing power and recent unit demand prove temporary, and that regulatory or product hurdles slow the expected earnings path.

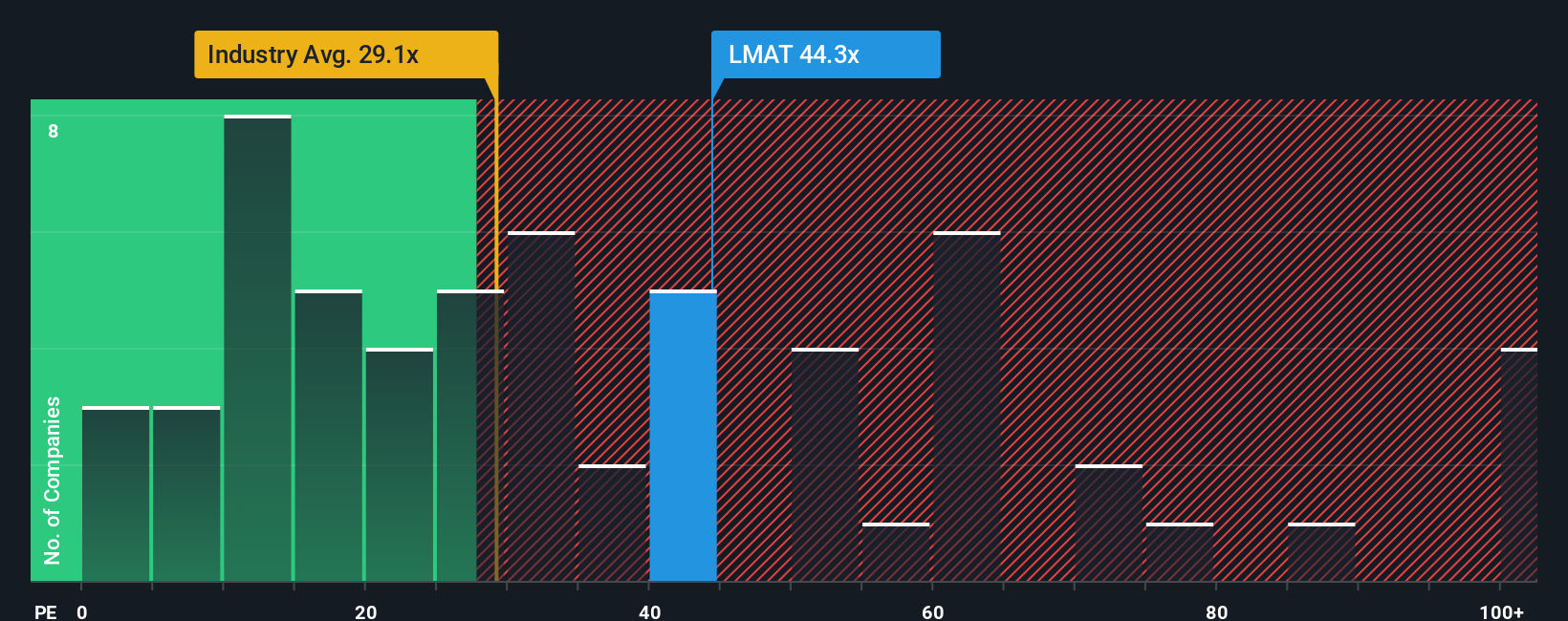

Another View: Rich P/E Puts Pressure On The Story

That 16.3% “undervalued” narrative sits alongside a very different signal from the P/E. At 37.3x, LeMaitre Vascular trades well above its own fair ratio of 19.8x, the US Medical Equipment industry at 29.7x, and peers at 32.6x. This raises a simple question: how much optimism is already in the price?

Build Your Own LeMaitre Vascular Narrative

If you see the data differently or just want to test your own assumptions, you can build a custom view of LeMaitre in a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding LeMaitre Vascular.

Looking for more investment ideas?

If you are serious about sharpening your watchlist, do not stop at one stock. Use the screener to surface fresh ideas that might fit your style.

- Spot potential value candidates early by scanning our 53 high quality undervalued stocks built from companies with solid fundamentals and prices that may not fully reflect them.

- Focus on resilience by checking out the 85 resilient stocks with low risk scores designed to highlight businesses with fewer red flags in their risk profile.

- Hunt for future standouts with our screener containing 23 high quality undiscovered gems so you are not only looking at the same names as everyone else.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.