Please use a PC Browser to access Register-Tadawul

A Look At LivaNova (LIVN) Valuation After KeyBanc Upgrade And Renewed Medtech Optimism

LivaNova Plc LIVN | 68.42 | +0.78% |

LivaNova (LIVN) is back on investor radars after KeyBanc Capital Markets shifted to a more favorable rating, linking the move to a broadly positive view on Medical Technology stocks.

The upgrade comes after a period of rebuilding confidence, with the share price at US$65.71 and a 90 day share price return of 21.82% alongside a 1 year total shareholder return of 36.72%. This suggests momentum has picked up recently, even though longer term total shareholder return over 5 years is slightly negative.

If LivaNova has you looking closer at medical technology, this could be a good moment to broaden your watchlist with healthcare stocks that are catching market attention.

With shares at US$65.71, trading at an estimated 27% discount to one intrinsic value measure and about 11% below the average analyst target, the key question is whether this represents genuine value or if the market is already factoring in future growth.

Most Popular Narrative: 10% Undervalued

Against the last close at $65.71, the most widely followed narrative points to a fair value of $73.00, framing LivaNova as undervalued on its own fundamentals.

The company's clinical innovations, including strong, durable VNS study data in epilepsy and depression, launch of disruptive next-generation OSA neurostimulation (p-HGNS), and continued product upgrades (such as the Essenz platform's software upgradability), position LivaNova to capture share from the long-term shift toward minimally invasive, personalized therapies, which can support pricing power and higher net margins.

Curious what kind of revenue runway, margin shift, and future earnings multiple are reflected in that $73 view? The narrative focuses on cash flow compounding, rising profitability, and a specific forward P/E framework that could reshape how you think about this price.

Result: Fair Value of $73 (UNDERVALUED)

However, you still need to weigh up risks such as tighter reimbursement pressure or rivals pushing lower cost devices, either of which could undermine this upbeat thesis.

Another View: What The Ratios Are Saying

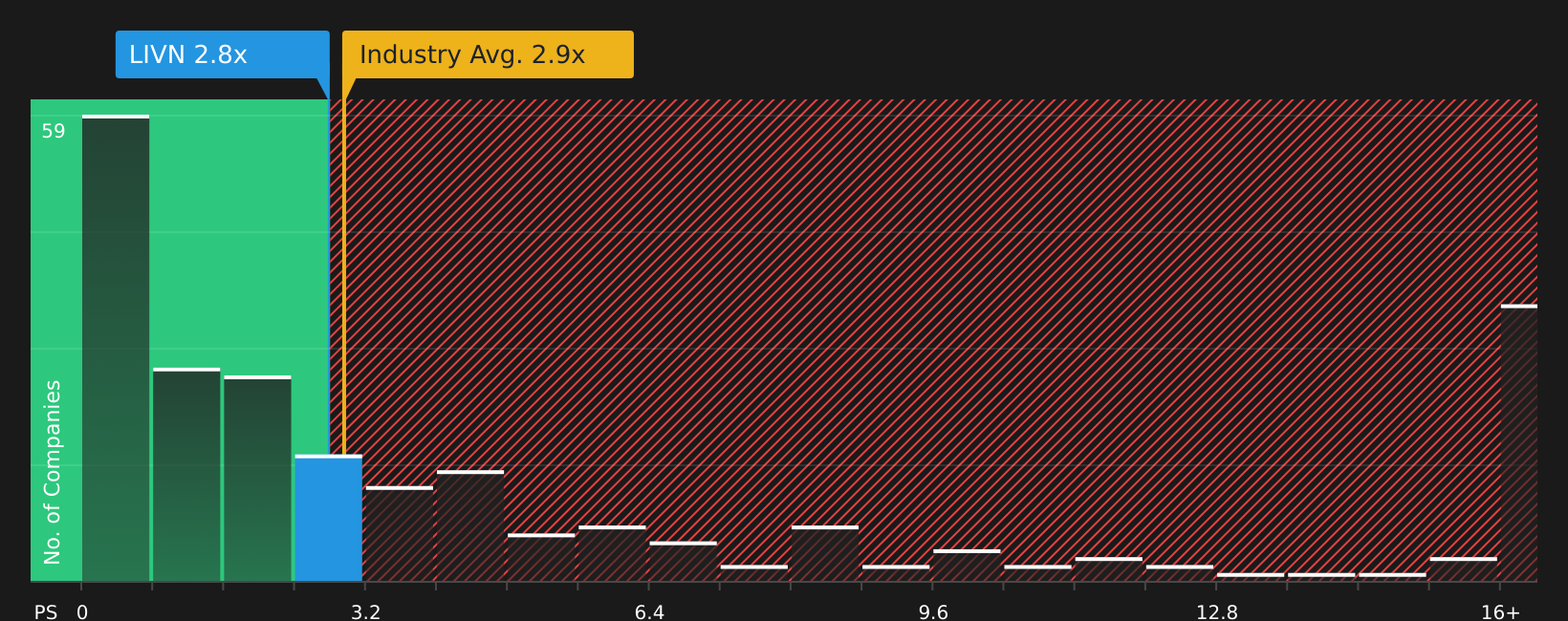

That cash flow based fair value of $90.19 paints LivaNova as 27.1% undervalued, but the revenue multiple sends a different signal. The current P/S is 2.7x, above peers at 2.3x yet slightly below the 2.9x fair ratio estimate, which suggests a more balanced risk reward picture. Is this a margin of safety or just a full price for future growth?

Build Your Own LivaNova Narrative

If you are not on board with this view or prefer to rely on your own analysis, you can stress test the numbers yourself in minutes, then Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding LivaNova.

Looking for more investment ideas?

If LivaNova has sharpened your focus, do not stop here. Use the Simply Wall St Screener to quickly spot other opportunities that fit your style.

- Target potential mispricing by scanning these 887 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Explore long term themes in computing by checking out these 22 quantum computing stocks that are working on next generation hardware and software.

- Put income first by focusing on these 12 dividend stocks with yields > 3% that offer yields above 3% and may suit a returns focused watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.