Please use a PC Browser to access Register-Tadawul

A Look At LTC Properties (LTC) Valuation After Insider Buying And Expanded Credit Facility

LTC Properties, Inc. LTC | 36.92 | +1.54% |

Insider Buying, Expanded Credit Facility, and Steady Dividend Shape LTC Properties Story

LTC Properties (LTC) has drawn fresh attention after its Executive Vice President and Chief Investment Officer, David M. Boitano, bought 10,000 shares and the company expanded its credit facility to US$800 million while reaffirming its monthly dividend.

LTC’s recent insider buying, larger credit facility and reaffirmed dividend sit alongside a 7 day share price return of 3.84% and a 1 year total shareholder return of 11.25%, suggesting momentum has been gradually building rather than fading.

If this kind of income focused REIT interests you, it can be worth widening the lens to see how other healthcare names stack up, starting with healthcare stocks.

With LTC shares up over the past year and trading at US$35.70 against an analyst price target of US$38 and an indicated intrinsic discount of about 54%, you have to ask yourself whether there is still a buying opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 5.6% Undervalued

Compared with the last close of US$35.70, the most widely followed narrative points to a modest upside based on its fair value estimate.

The company's ability to recycle capital out of older skilled nursing assets (via portfolio sales and potential loan prepayments) and redeploy proceeds into higher-yielding, modern properties enhances rent growth potential and operating efficiency, which supports higher net margins and long-term NAV growth.

Curious what has to happen for that valuation to hold up? Revenue expansion, margin shifts and a future earnings multiple all sit at the center of this story. The full narrative spells out the path.

Result: Fair Value of $37.83 (UNDERVALUED)

However, this narrative could be knocked off course if acquisition prices squeeze yields or if key operators struggle, putting pressure on rents and cash flows.

Another View: Earnings Multiple Sends A Different Signal

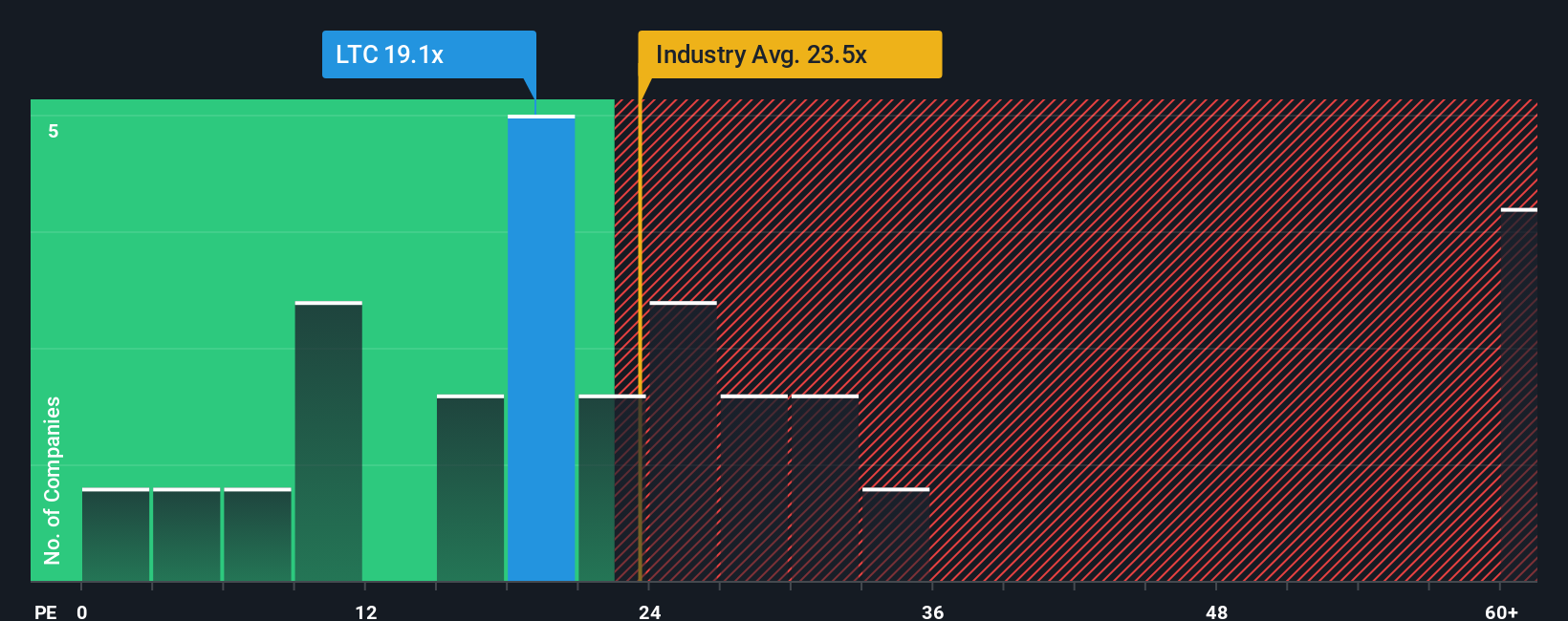

The consensus narrative sees LTC as about 5.6% undervalued, but the earnings multiple tells a different story. At a P/E of 51.2x versus 25.8x for global health care REITs, 28.2x for peers, and a fair ratio of 44.1x, the stock appears richly priced. This may leave less room for error if expectations change.

Build Your Own LTC Properties Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a tailored view in minutes using Do it your way.

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If LTC got you thinking, do not stop here. The real edge comes from seeing how different themes line up with your goals before the market catches on.

- Spot early growth stories by scanning these 3553 penny stocks with strong financials that already show stronger financial foundations than many expect from low priced names.

- Target the intersection of data and medicine by running your eye over these 29 healthcare AI stocks that are using AI to reshape care and diagnostics.

- Zero in on potential income candidates with these 12 dividend stocks with yields > 3% that currently offer yields above 3% while you evaluate the quality behind those payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.