Please use a PC Browser to access Register-Tadawul

A Look At MasTec (MTZ) Valuation After Zacks Rank Upgrade And Infrastructure Optimism

MasTec, Inc. MTZ | 283.86 | +2.99% |

Why MasTec’s latest analyst upgrade matters

MasTec (MTZ) has just been upgraded to a Zacks Rank #2 based on improving earnings estimates, a shift that comes alongside continued analyst support related to the company’s infrastructure and renewable energy exposure.

MasTec’s share price has eased 1.5% over the past day but still sits at US$244.75 after a strong run, with a 30-day share price return of 9.9% and a 1-year total shareholder return of 75.4%. This suggests momentum has been building alongside renewed interest in its infrastructure and clean energy work.

If MasTec’s move has you thinking about other infrastructure and contractor names linked to long term growth themes, it could be a good time to scan fast growing stocks with high insider ownership for fresh ideas beyond this stock.

With MasTec trading near US$244.75 and sitting only a few percent below some analyst targets, the key question is whether recent gains still leave room for mispricing or if the market is already assuming years of future growth.

Most Popular Narrative: 1% Undervalued

MasTec’s most followed narrative pegs fair value at about $246.67, just above the last close of $244.75, which paints a tightly balanced pricing picture.

Multi-year investments in operational efficiency, technology, and customer framework agreements are driving sequential and year-over-year improvements in EBITDA and net margins across segments; continued execution on these initiatives is likely to further support margin expansion and long-term earnings power, which appears underappreciated by the current stock valuation.

Curious how modest margin shifts and steady revenue assumptions can still point to a premium earnings profile by the late 2020s? The popular narrative leans heavily on compounding earnings and a future profit multiple that is below what some peers currently trade on. Want to see which growth and profitability trends this view treats as non negotiable inputs to justify that fair value line?

Result: Fair Value of $246.67 (ABOUT RIGHT)

However, this view can unravel if large customers delay projects or if higher headcount and equipment spending keep margins under pressure longer than expected.

Another angle on valuation

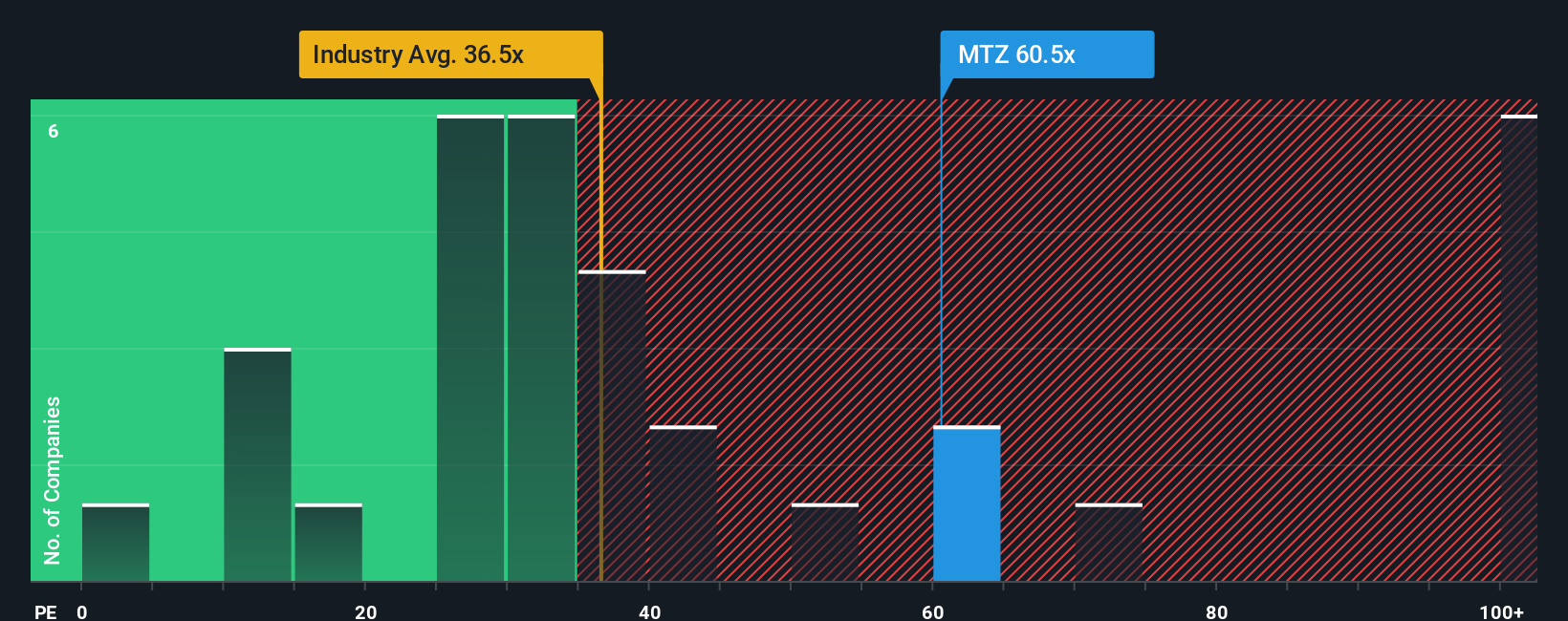

That 1% undervalued fair value story sits awkwardly beside how the market is actually pricing MasTec today. The current P/E of 57.4x is higher than both the US Construction industry at 37.7x and the peer average at 50.4x, and it also sits well above a fair ratio of 35.3x. That gap points to meaningful valuation risk if expectations cool, so the question is whether you think MasTec has earned such a premium.

Build Your Own MasTec Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your MasTec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If MasTec caught your attention, do not stop there. Use the Simply Wall St Screener to uncover other focused ideas before the market moves without you.

- Spot potential value opportunities early by scanning these 880 undervalued stocks based on cash flows that may merit a closer look based on their cash flow profiles.

- Ride fast-moving themes by checking out these 24 AI penny stocks that are tied to artificial intelligence trends across different parts of the market.

- Lock in income-focused ideas by reviewing these 14 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.