Please use a PC Browser to access Register-Tadawul

A Look At Merit Medical Systems (MMSI) Valuation As M&A Becomes A Key Growth Focus

Merit Medical Systems, Inc. MMSI | 82.21 | +0.45% |

Recent comments from Merit Medical Systems (MMSI) leadership put mergers and acquisitions firmly in focus. The company highlighted disciplined deal making, a growing cash war chest, and an intent to target specific gaps in its portfolio.

The recent leadership shift, fresh revenue guidance and clear M&A focus come against a mixed backdrop, with a 1 year total shareholder return of 20% decline contrasting with 17.2% and 42.38% total shareholder returns over 3 and 5 years. This suggests longer term momentum has been stronger than the recent share price reset.

If you are watching how healthcare deal making shapes market opportunities, it could be a useful moment to look across other healthcare stocks that fit your own filters.

With the shares down roughly 20% over the past year, annual revenue growth of 5.96% and net income growth of 15.06%, plus a 25.87% gap to the average analyst price target, is Merit Medical undervalued, or is the market already pricing in what comes next?

Most Popular Narrative: 20.5% Undervalued

With Merit Medical Systems last closing at US$82.31 against a narrative fair value of US$103.55, the gap turns on some firm growth and profitability assumptions.

Ongoing investments in operational efficiency, manufacturing automation, and product portfolio expansion through innovation and strategic M&A are driving improved gross and operating margins (evidenced by record 21% non-GAAP operating margin), supporting higher cash flow and net earnings.

Analysts are banking on quicker revenue progress, thicker margins, and a richer future earnings multiple. Curious which of those levers matters most to this valuation story?

Result: Fair Value of US$103.55 (UNDERVALUED)

However, there is still a risk that delays in WRAPSODY CIE reimbursement or persistent trade and China headwinds could weaken the optimistic growth assumptions behind this story.

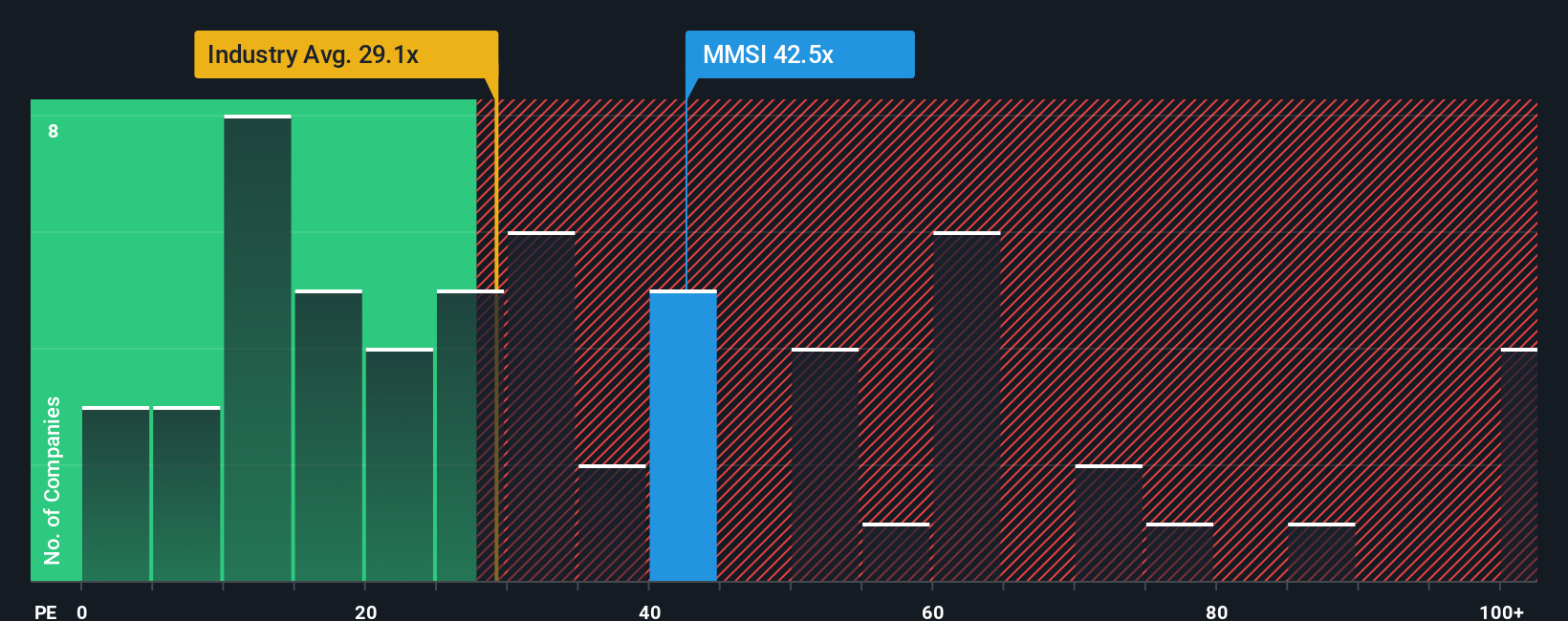

Another View: What P/E Is Saying

That 20.5% “undervalued” narrative sits against a very different message from the P/E. Merit Medical trades on 41.2x earnings, compared with 31.1x for the US Medical Equipment industry, 30.3x for peers, and a fair ratio of 24.4x. Is the market overpaying for the growth story?

Build Your Own Merit Medical Systems Narrative

If you see the numbers differently, or prefer to test your own assumptions, you can build and compare a custom view in minutes with Do it your way.

A great starting point for your Merit Medical Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at just one company, you risk missing other opportunities that might fit you even better, so take a few minutes and widen your watchlist now.

- Spot early stage potential by checking out these 3530 penny stocks with strong financials that pair smaller share prices with solid financial underpinnings.

- Scan these 24 AI penny stocks involved in automation and data to see how different businesses are working with AI.

- Put value front and center by reviewing these 865 undervalued stocks based on cash flows where prices can be compared with cash flow based estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.