Please use a PC Browser to access Register-Tadawul

A Look At Meritage Homes (MTH) Valuation After Earnings, Buybacks And Flat 2026 Revenue Guidance

Meritage Homes Corporation MTH | 77.83 | +0.03% |

Meritage Homes (MTH) is back in focus after its latest earnings release, which combined lower annual revenue and net income with real estate impairments, flat 2026 revenue guidance, sizable buybacks, and record community growth.

At a share price of $75.91, Meritage Homes has seen stronger recent momentum, with a 7 day share price return of 8.15% and a 90 day share price return of 10.21%. Its 5 year total shareholder return of 83.21% shows how the longer term picture has unfolded through different housing cycles.

If Meritage’s update has you thinking about where housing related demand could flow next, it might be worth scanning opportunities in supportive infrastructure such as 24 power grid technology and infrastructure stocks.

With the stock trading close to one analyst’s US$81.50 price target, recent buybacks, earnings pressures, and flat 2026 guidance raise a key question for you: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 8.7% Undervalued

Meritage Homes latest fair value narrative sits at $83.13 per share versus the recent $75.91 close, which puts some pressure on you to judge whether that gap is justified.

Meritage's significant and accelerating growth in community count including double digit expansion for both 2025 and 2026 directly addresses the persistent undersupply of housing in the U.S., positioning the company to capture increased new home demand and drive future revenue and earnings growth as macro headwinds abate.

The company's focus on entry level, move in ready homes aligns with favorable demographic shifts driven by Millennials and Gen Z entering homebuying age, expanding Meritage's addressable market and providing a foundation for long term stable order growth and volume, which supports higher revenue and EPS stability.

Curious how that community build out, margin reset, and future earnings multiple all connect to an $83 plus fair value? The narrative leans on moderate growth, tighter profitability assumptions, and a higher future P/E than today. The exact mix of revenue, margins, and discount rate is where the story really gets interesting.

Result: Fair Value of $83.13 (UNDERVALUED)

However, you also need to weigh margin pressure from affordability incentives, as well as the risk that entry level buyers pull back if rates or sentiment turn less friendly.

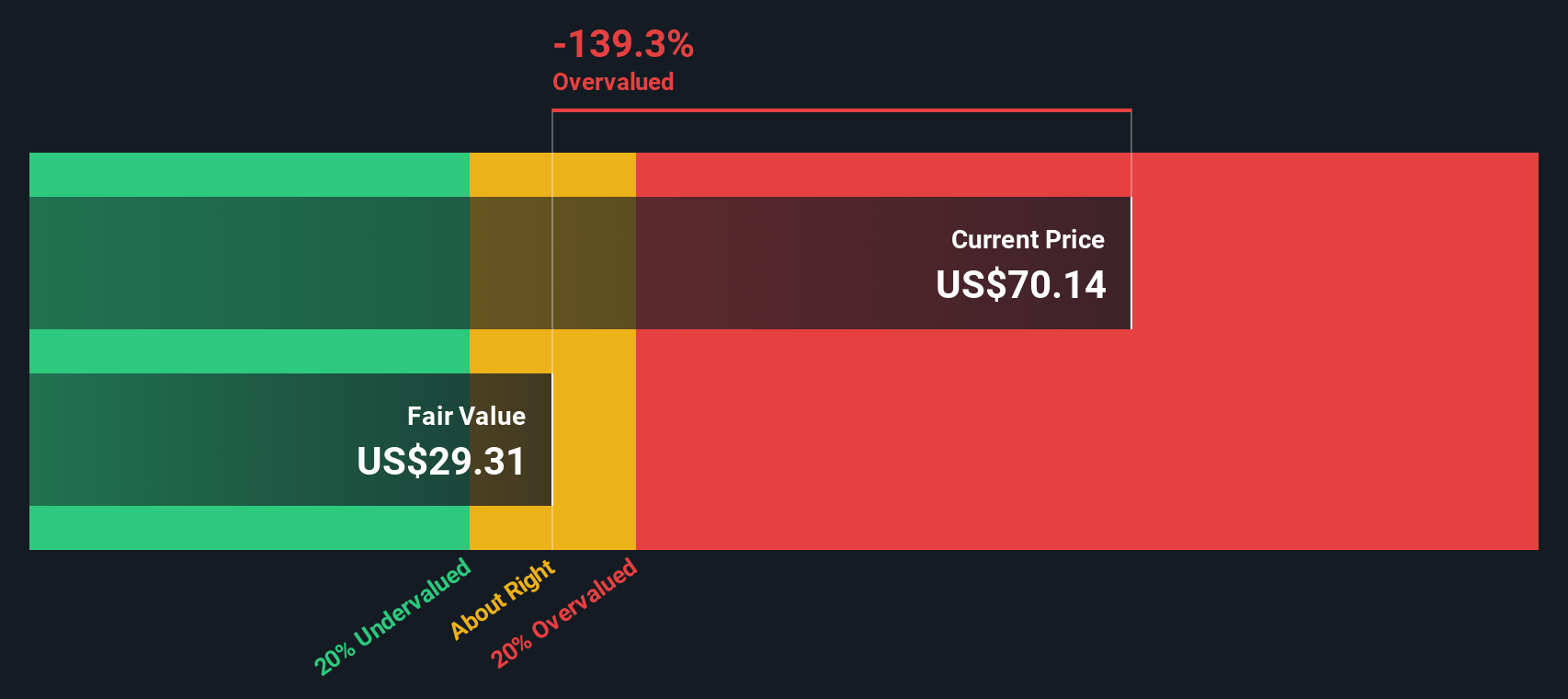

Another View: Cash Flows Paint a Tougher Picture

There is a sharp contrast between the $83.13 fair value narrative and our DCF model. On a cash flow basis, Meritage Homes is valued at $34.15 per share, which points to the stock trading well above that estimate and screens as overvalued using this method. Which story feels more convincing to you?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Meritage Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 52 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Meritage Homes Narrative

If you feel the numbers tell a different story, or you simply prefer to test your own assumptions, you can build a fresh Meritage view in just a few minutes with Do it your way.

A great starting point for your Meritage Homes research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single housing stock. Broaden your watchlist with fresh ideas that match your style before the next big move slips past you.

- Target long term compounding potential by scanning 52 high quality undervalued stocks that combine quality fundamentals with prices that sit below our fair value estimates.

- Reinforce your income stream by reviewing 14 dividend fortresses that pair 5%+ yields with a focus on stability.

- Sleep easier at night by filtering for 84 resilient stocks with low risk scores that score well on resilience and balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.