Please use a PC Browser to access Register-Tadawul

A Look At Mueller Water Products (MWA) Valuation After Passing A Peter Lynch GARP Investment Screen

Mueller Water Products, Inc. Class A MWA | 29.97 | +0.64% |

Mueller Water Products triggered by GARP screen

Mueller Water Products (MWA) recently passed a Peter Lynch Growth at a Reasonable Price screen, highlighting a mix of earnings growth, PEG based valuation, financial strength, and return on equity that has caught investor attention.

The GARP trigger comes after a steady run, with a 7 day share price return of 4.24% and a 30 day share price return of 6.39% at a latest close of $26.31, while 1 year total shareholder return of 15.93% and 3 year total shareholder return of 130.17% point to momentum that has built over time rather than short term speculation.

If Mueller Water Products has you thinking about long term compounding, this is a good moment to broaden your search with fast growing stocks with high insider ownership.

With MWA trading at $26.31, modestly below an average analyst price target of $27.67 and showing solid earnings growth, the key question now is whether the stock is still mispriced or if the market is already pricing in potential future gains.

Most Popular Narrative: 4.9% Undervalued

The most followed narrative sees Mueller Water Products trading slightly below its modelled fair value of US$27.67, compared with the recent close at US$26.31, and builds that view on specific assumptions about future growth, margins and valuation multiples.

Operational efficiency initiatives, including legacy foundry closures and modernization of iron foundries, are expected to further lower production costs and enable scalable capacity, resulting in sustainable improvements to net margins and increased free cash flow generation over the coming years.

Curious what kind of revenue lift, margin expansion and future P/E this outlook leans on, and how a higher discount rate still supports that fair value? The full narrative lays out the numbers backing this view.

Result: Fair Value of $27.67 (UNDERVALUED)

However, this depends on federal infrastructure funding arriving on time and municipal budgets holding up, with any delays or cuts potentially resetting that undervaluation story.

Another View on Mueller Water Products' Value

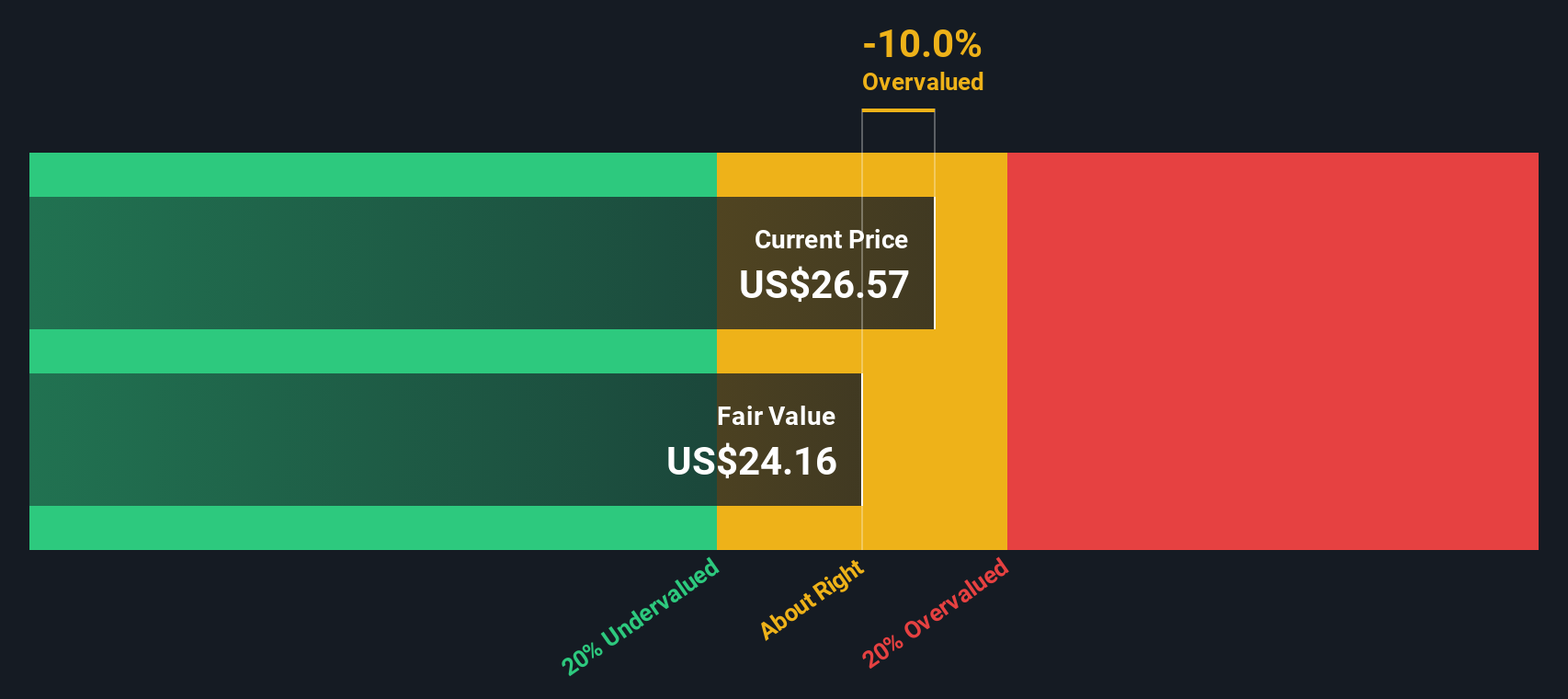

There is also a contrasting signal from our DCF model, which puts fair value at about US$24.10 per share versus the current US$26.31. That points to MWA trading above this estimate, so instead of a 4.9% undervaluation, you are looking at a potential premium. Which story do you think fits the risks better?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mueller Water Products for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mueller Water Products Narrative

If you see the data differently or prefer to test your own assumptions, you can build a custom thesis in a few minutes using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Mueller Water Products.

Ready for more investment ideas?

If Mueller Water Products has sharpened your thinking, do not stop here. Expand your watchlist with a few focused idea sets that could sharpen your next move.

- Capture potential value by scanning these 862 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride the AI trend by zeroing in on these 24 AI penny stocks that tie real businesses to machine learning and automation themes.

- Tap into digital asset trends through these 80 cryptocurrency and blockchain stocks linked to blockchain infrastructure, payment networks, and related platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.