Please use a PC Browser to access Register-Tadawul

A Look At National Energy Services Reunited (NESR) Valuation After New Analyst Support And Major MENA Contract Wins

National Energy Services Reunited Corp. NESR | 19.68 | +0.05% |

National Energy Services Reunited (NESR) has drawn fresh attention after supportive analyst coverage coincided with a multi billion dollar five year Jafurah contract in Saudi Arabia and additional multi year production services wins in Libya and Algeria.

Those contract wins and fresh analyst coverage have arrived alongside a sharp acceleration in momentum, with a 64.18% 90 day share price return and a 124.36% 1 year total shareholder return. The 1 day share price move has cooled slightly.

If NESR’s recent run has you thinking about what else might be setting up for growth, it could be a good time to scan fast growing stocks with high insider ownership.

With NESR trading at US$20.26, sitting below an analyst price target of US$22.14 and alongside an estimated intrinsic value gap, the key question is simple: is there still upside here or is future growth already priced in?

Most Popular Narrative: 2.3% Overvalued

The most followed narrative pegs National Energy Services Reunited’s fair value at $19.80, slightly below the last close of $20.26, and builds its case around long term contract visibility and rising activity across key MENA markets.

Secured multi-year (3-9 year) contract durations, growing contract awards, and a backlog that extends to 2030+ give NESR a high degree of earnings visibility and reduce volatility, supporting more stable cash flow and profitability.

Curious what kind of revenue climb, margin lift and future earnings multiple have to line up for that fair value? The full narrative spells out the growth pacing, the profit step up and the cash flow assumptions that sit behind that $19.80 figure, all anchored on a 7.41% discount rate and long dated contracts that run well into the next decade.

Result: Fair Value of $19.80 (OVERVALUED)

However, those long term contracts still sit against concentrated MENA customer exposure and high capital needs. As a result, any contract delays or cash flow pressure could quickly challenge that upside story.

Another View: Cash Flows Tell a Different Story

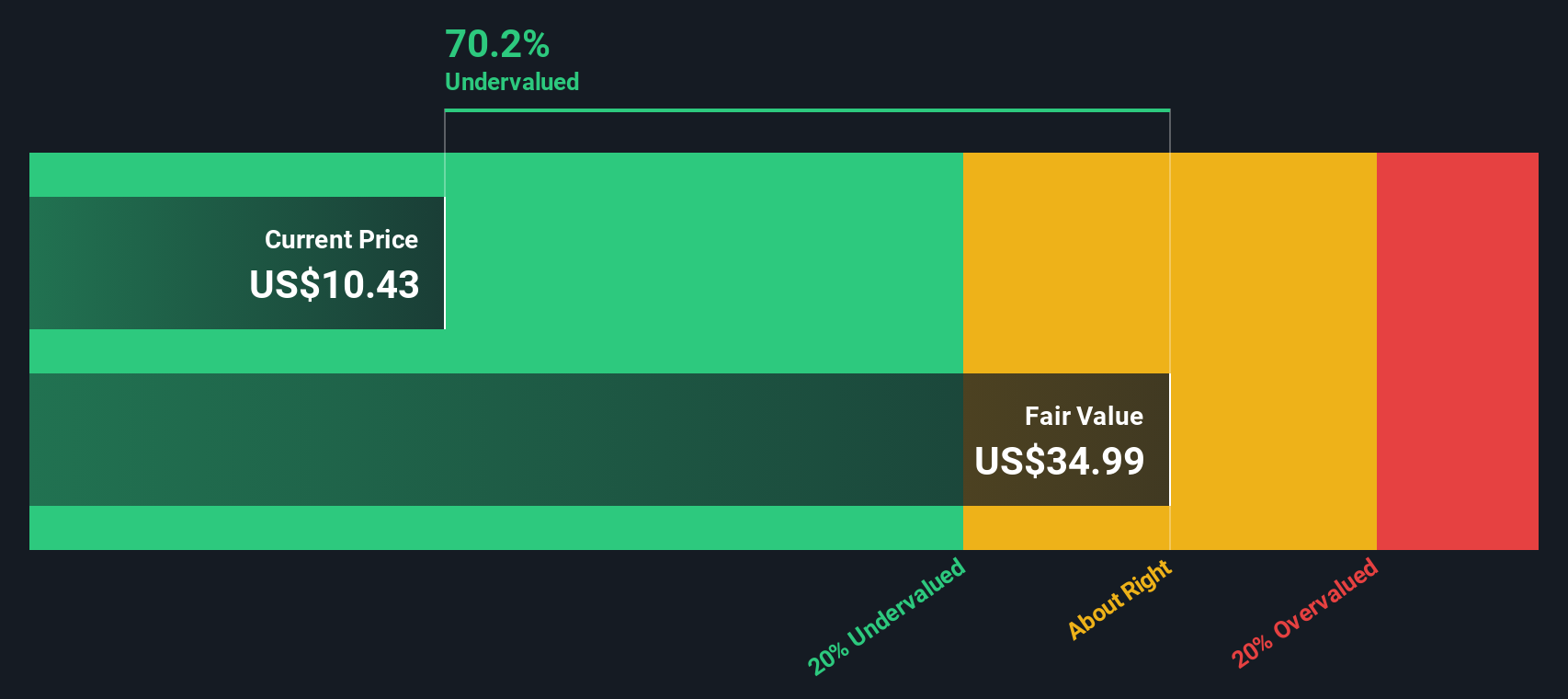

While the popular narrative sees National Energy Services Reunited as 2.3% overvalued at a fair value of $19.80, our DCF model presents a different perspective. On that framework, NESR’s future cash flows point to a value of $49.56 per share, which is far above the current $20.26 price. So which story do you trust more: the nearer term narrative or the long term cash flow math?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out National Energy Services Reunited for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 888 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own National Energy Services Reunited Narrative

If you read these narratives and think the assumptions do not quite fit your view, you can quickly test your own data driven thesis instead: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding National Energy Services Reunited.

Looking for more investment ideas?

If NESR has your attention, do not stop here, the same screener tools can surface other ideas that might fit your style even better.

- Pinpoint value, use these 888 undervalued stocks based on cash flows that line up strong cash flow potential with prices that may not fully reflect it yet.

- Ride big themes, scan these 23 AI penny stocks shaping the future of automation, data analysis, and productivity gains across multiple industries.

- Target income, filter for these 13 dividend stocks with yields > 3% that deliver yields above 3% while still focusing on business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.