Please use a PC Browser to access Register-Tadawul

A Look At NextDecade (NEXT) Valuation After Capital One Initiates Coverage With Buy Rating

NextDecade Corp. NEXT | 5.48 | -1.79% |

Analyst coverage sparks fresh attention on NextDecade

Capital One Financial has initiated coverage on NextDecade (NEXT) with a buy rating, putting fresh attention on the liquefied natural gas developer and its Rio Grande LNG and carbon capture projects in Texas.

NextDecade's share price has climbed 6.3% over the past week and 10.0% over the past month to US$5.38, although the 1 year total shareholder return shows a 32.1% decline and the 5 year total shareholder return is up 120.5%, suggesting recent momentum contrasts with a mixed longer term experience.

If this LNG and carbon capture story has your attention, it could be a good moment to broaden your watchlist with 24 power grid technology and infrastructure stocks that might benefit from similar energy infrastructure themes.

With the stock at US$5.38 compared to an analyst price target of US$9.00, and a recent mix of gains alongside longer term declines, the key question is whether this reflects a genuine opportunity or if the market already expects stronger growth.

Preferred Price-to-Book of 9.2x: Is it justified?

NextDecade is currently trading at a P/B of 9.2x, which is significantly higher than both its direct peers at 1.4x and the broader US Oil and Gas industry at 1.5x. This indicates that the market is assigning a much richer valuation to the company than is typical for the sector.

The P/B ratio compares the company’s market value to its book value. For an early stage LNG and carbon capture developer with minimal current revenue and ongoing losses, a high P/B usually reflects investors focusing on future project potential rather than today’s balance sheet.

Here, that premium sits alongside some clear pressure points, including unprofitability, a loss of $193.476m, less than one year of cash runway and funding that is entirely from higher risk sources such as external borrowing instead of customer deposits.

In that context, paying 9.2x book value when many US oil and gas peers trade closer to 1.5x suggests that the market is pricing in a very different potential outcome for NextDecade than for the average company in the industry.

Result: Price-to-book of 9.2x (OVERVALUED)

However, the story can change quickly if funding tightens or project timelines slip, especially given a recent loss of US$193.476m and less than one year of cash runway.

Another view: cash flows tell a different story

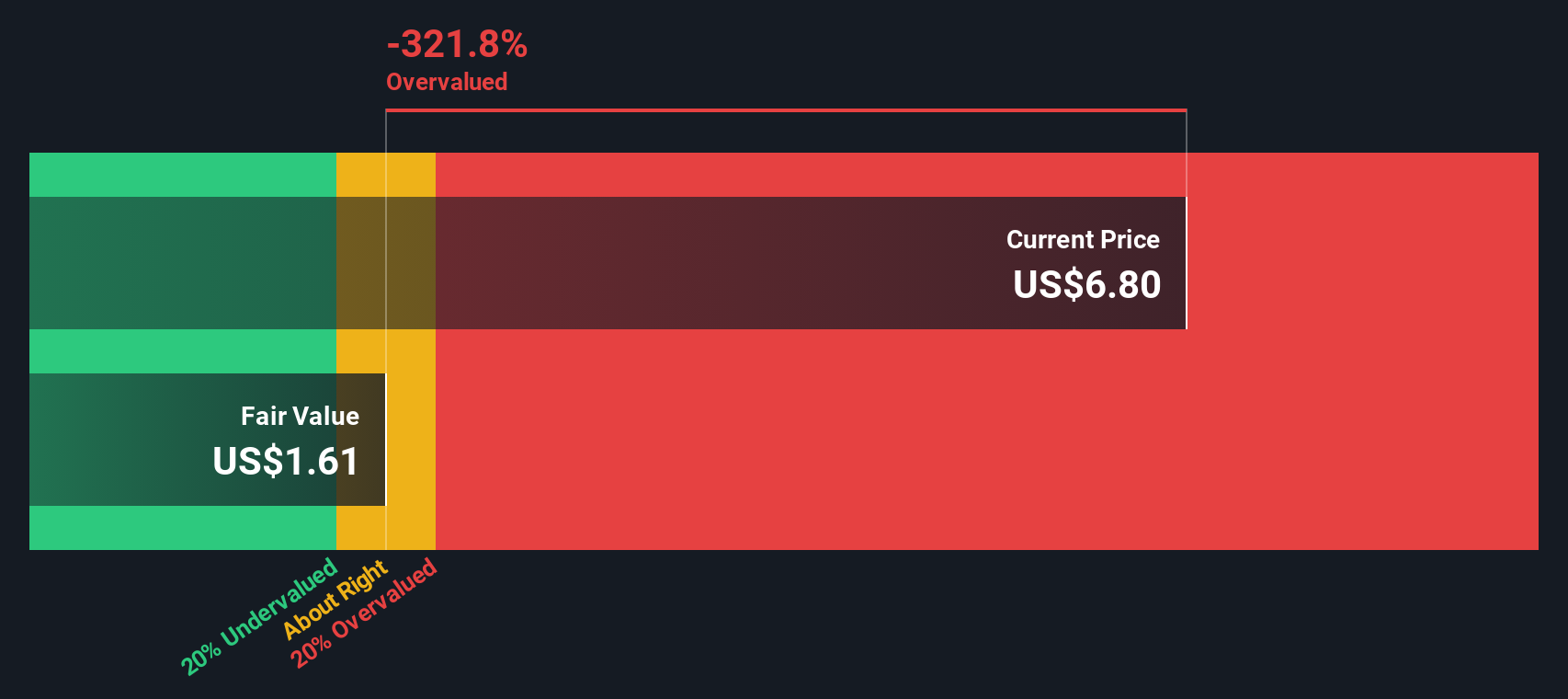

While the 9.2x P/B suggests a rich price tag, our DCF model points in the same direction. With the share price at $5.38 and a future cash flow value estimate of $2.14, the stock screens as overvalued rather than cheap on projected cash flows. So which signal matters more to you: assets or cash?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextDecade for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 51 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextDecade Narrative

If you see the numbers differently or would rather lean on your own work, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If this has sharpened your thinking, do not stop at one stock. Use the Simply Wall St screener to line up your next set of ideas today.

- Target value opportunities that fit your style by scanning our list of 51 high quality undervalued stocks and see which businesses deserve a closer look.

- Prioritise resilience by focusing on companies highlighted in our 83 resilient stocks with low risk scores, so you are not caught off guard by hidden warning signs.

- Get ahead of the crowd by searching through our screener containing 24 high quality undiscovered gems before they land on everyone else's radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.