Please use a PC Browser to access Register-Tadawul

A Look At NRG Energy (NRG) Valuation After Recent Share Price Strength And Long Term Returns

NRG Energy, Inc. NRG | 179.18 | +2.38% |

NRG Energy (NRG) is back on watch for investors after recent share price moves, with the stock closing at $161.80 as the company continues operating across power generation, retail energy and home services.

The latest move to $161.80 extends a 7 day share price return of 12.02% and a 30 day share price return of 7.44%. However, year to date the share price return is slightly negative, while the 1 year total shareholder return of 54.17% and very large 3 year and 5 year total shareholder returns suggest longer term momentum has been strong.

If NRG's recent run has you looking beyond a single utility name, this could be a good time to broaden your search with our screener of 25 power grid technology and infrastructure stocks.

With NRG delivering a 54.17% one-year total return, posting very large multi-year gains, and trading at a sizeable discount to an analyst price target, investors may ask whether there is still value available or if the market is already pricing in future growth.

Most Popular Narrative: 19.9% Undervalued

At $161.80, the most widely followed narrative sees NRG Energy's fair value closer to $201.96, framing the recent rally against a higher long term anchor.

The accelerated adoption of data centers, electrification, and the signing of long term, premium margin agreements for large, multi year power delivery significantly increases NRG's exposure to growing electricity demand, pointing to higher recurring revenue and margin expansion through 2030 and beyond.

This view raises the question of what earnings path and margin profile would support that higher value. The narrative emphasizes firm growth, a richer profit mix, and a future valuation multiple that is usually associated with faster growing sectors.

Result: Fair Value of $201.96 (UNDERVALUED)

However, this hinges on NRG managing its heavier natural gas exposure and executing cleanly on smart home and virtual power plant integration, without margin or debt surprises.

Another Take On Value

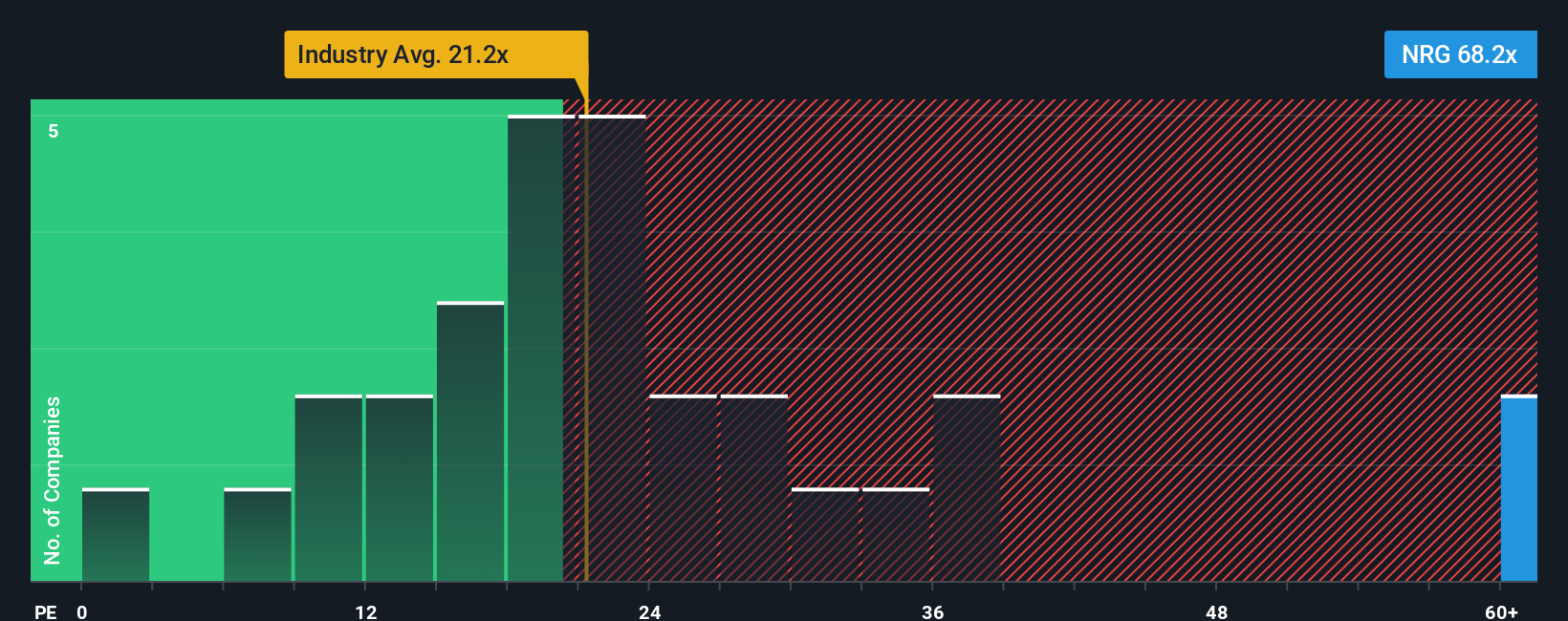

While the AI narrative leans on a fair value of $201.96, the current P/E of 25.3x tells a different story. It sits above the US Electric Utilities industry at 21.9x and the peer average of 20.1x, yet still below a fair ratio of 32.4x. This points to meaningful valuation tension. Is the market paying up too much, or not enough, for NRG's earnings profile?

Build Your Own NRG Energy Narrative

If you see the story differently or prefer to work from the raw numbers yourself, you can build a custom NRG view in minutes and then Do it your way.

A great starting point for your NRG Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready To Find Your Next Idea?

If NRG is already on your radar, do not stop there. Use the Simply Wall St screener to spot other opportunities before they move without you.

- Target resilient income by reviewing companies in our list of 16 dividend fortresses that focus on higher yielding payouts.

- Hunt for mispriced opportunities with our collection of 55 high quality undervalued stocks that combine quality fundamentals with more attractive valuations.

- Prioritise stability by checking companies in the 85 resilient stocks with low risk scores that score well on financial strength and risk metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.