Please use a PC Browser to access Register-Tadawul

A Look At Ollie's Bargain Outlet (OLLI) Valuation After Congress Trims Its Stake

Ollie's Bargain Outlet Holdings Inc OLLI | 108.71 | -0.72% |

Institutional selling sparks fresh interest in Ollie's Bargain Outlet Holdings (OLLI)

Congress Asset Management’s decision to sell 670,615 shares of Ollie's Bargain Outlet Holdings (OLLI) in the fourth quarter, while still keeping a sizeable stake, has put fresh attention on the retailer’s fundamentals.

At a share price of $118.49, Ollie’s has seen a 5.29% 1 day share price return and a 4.02% 30 day share price return. Its 90 day share price return of 8.15% suggests some momentum has faded, even as the 1 year total shareholder return of 17.03% and 3 year total shareholder return of about 120% keep longer term performance in focus.

If this kind of institutional activity has your attention, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Congress trimming its stake and Ollie’s trading around $118.49, recent gains and a value score of 0 raise a key question for you: is this discount retailer still mispriced, or is the market already baking in future growth?

Most Popular Narrative: 16.3% Undervalued

With Ollie's last closing price at $118.49 and a narrative fair value of $141.53, the current setup hinges on how future growth and margins play out.

The company is benefiting from a growing value-conscious consumer base, amplified by economic uncertainty and inflation, which is driving more customers toward discount retailers like Ollie's; this is boosting both store traffic and revenue growth, as seen by accelerated customer acquisition and rising loyalty program membership. (Revenue)

Want to see what underpins that confidence in future sales and profits? The narrative leans heavily on compounding revenue, rising margins, and a rich future earnings multiple. Curious which specific assumptions need to hold for that fair value to stack up?

According to the most followed narrative, the fair value hinges on revenue stepping up each year, earnings growing faster than sales, and profit margins edging higher over time. In addition, the valuation assumes the market will still be willing to pay a premium P/E for those future earnings, even compared with the broader multiline retail space, and that discounting those cash flows back at about 8.7% still supports a value above today’s price.

Result: Fair Value of $141.53 (UNDERVALUED)

However, the story could change if closeout inventory becomes harder to source, or if rapid store expansion leads to cannibalization and weaker returns from new locations.

Another Angle On Valuation

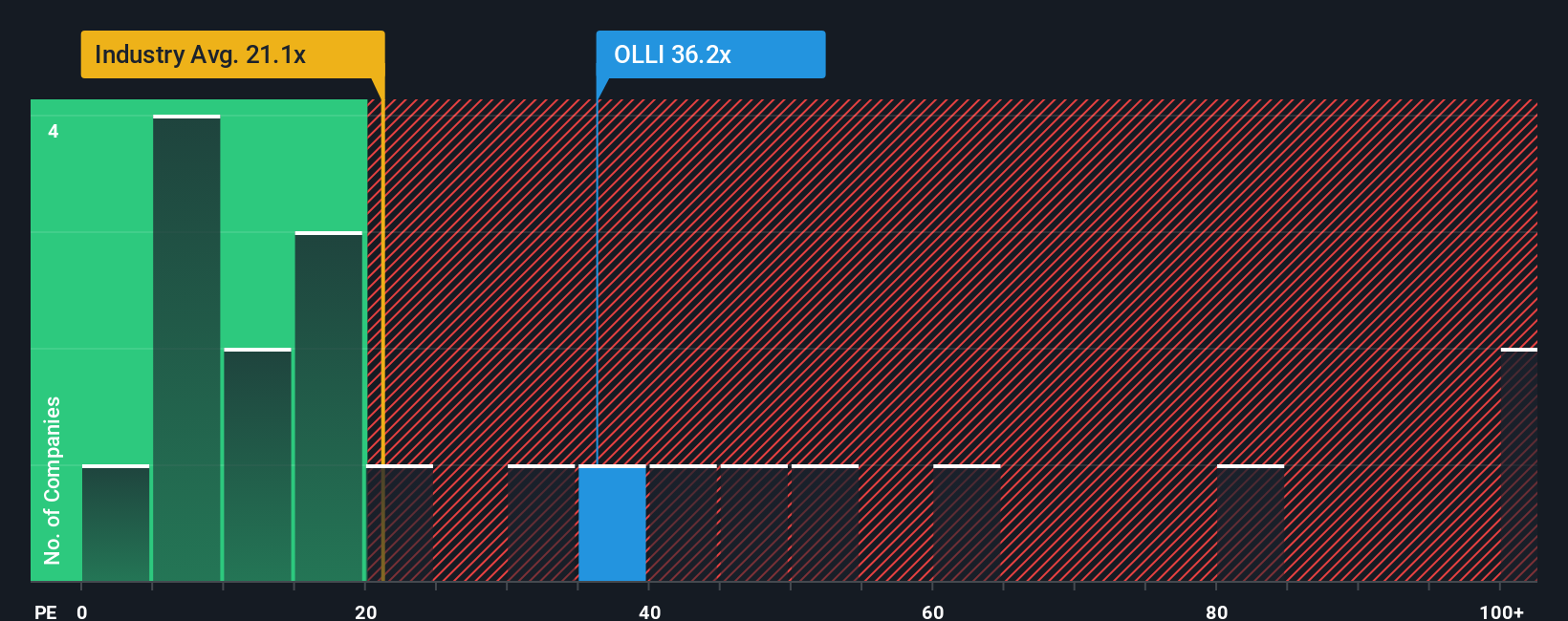

So far the story leans on a narrative fair value of US$141.53 that points to Ollie's Bargain Outlet Holdings as 16.3% undervalued at US$118.49. Yet if you look at the P/E, the picture is very different.

OLLIs shares trade on a P/E of 32.5x, compared with 18.7x for peers and 19.5x for the wider Global Multiline Retail group. Our fair ratio estimate is 18.6x. That gap suggests investors are already paying a rich price for each dollar of earnings, which raises a simple question for you: how comfortable are you paying that kind of premium?

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If you read this and reach different conclusions, or simply prefer to stress test the numbers yourself, you can build a tailored view in minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

If Ollie's has sharpened your focus, now is the time to widen your search and pressure test fresh ideas before the market moves on without you.

- Spot potential value by scanning these 883 undervalued stocks based on cash flows that align with your preferred balance of quality, price, and future cash flow expectations.

- Ride powerful themes by checking out these 26 AI penny stocks that sit at the intersection of data, automation, and long term growth stories.

- Hunt for higher income potential through these 12 dividend stocks with yields > 3% that offer yields above 3% alongside listed financial fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.