Please use a PC Browser to access Register-Tadawul

A Look At PBF Energy’s (PBF) Valuation As Analyst Upgrade Follows Martinez Restart And Insurance Recoveries

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

PBF Energy (PBF) is back in focus after an analyst upgrade tied to expectations for tighter refining balances, as well as the restart of its Martinez refinery operations and insurance recoveries that support liquidity and the balance sheet.

The recent analyst upgrade and Martinez restart come after a mixed stretch for investors, with a 26.66% 1 month share price return contrasting with a 6.56% 3 month share price decline and a 3 year total shareholder return of a 4.94% loss, even as the 5 year total shareholder return has been very large.

If this refinery story has you thinking more broadly about energy and infrastructure, it could be a good moment to check out 22 power grid technology and infrastructure stocks as another area of potential interest.

With PBF trading around $34.49, sitting at a discount to its own intrinsic estimate yet at a premium to the average analyst target, you have to ask yourself: is this a mispriced refiner, or is the market already looking ahead?

Most Popular Narrative: 8% Overvalued

The most followed valuation narrative puts PBF Energy’s fair value at about $31.92, a step below the recent $34.49 close. This frames the upgrade in a very specific way.

The fair value estimate has risen slightly from US$30.58 to US$31.92 per share, reflecting a modest adjustment in the model assumptions.

The discount rate has moved lower from 7.47% to 6.96%, which lifts the present value of projected cash flows in the updated analysis.

Curious what kind of revenue path and margin profile are baked into that fair value, and how much earnings power is being priced in by 2030? The full narrative walks through the growth, profitability, and valuation multiple assumptions that have to line up for that model to hold together.

Result: Fair Value of $31.92 (OVERVALUED)

However, the story can change quickly if Martinez setbacks linger or if environmental and policy shifts on the coasts squeeze refining margins harder than analysts expect.

Another Angle On Valuation

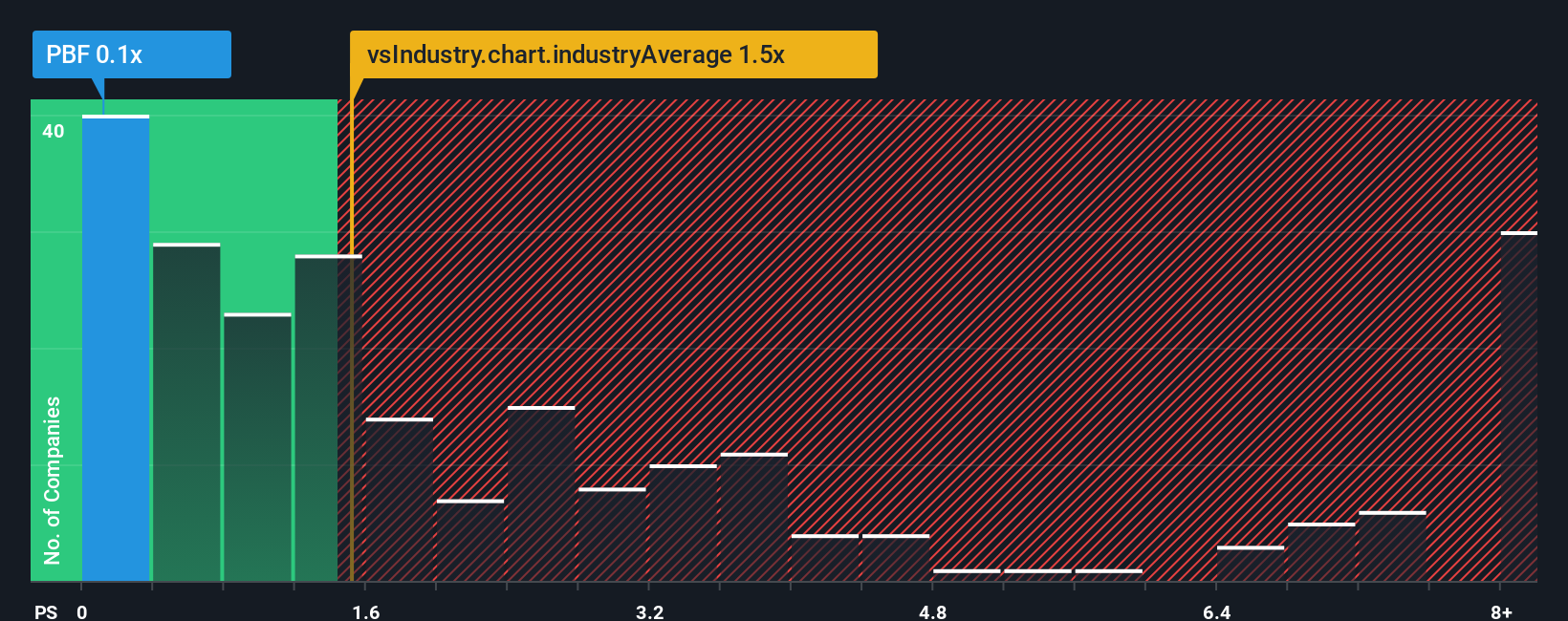

The fair value story does not end with that $31.92 estimate. On P/S, PBF trades at about 0.1x, compared with 1.6x for the wider US Oil and Gas group, while our fair ratio sits closer to 0.5x. That is a wide gap. Is the risk or potential upside being misread?

Build Your Own PBF Energy Narrative

If you interpret the numbers differently or want to challenge these assumptions, you can build your own take on PBF in just a few minutes, starting with Do it your way.

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you only stop at PBF, you could miss other opportunities that fit your style, so take a few minutes to scan what else is out there.

- Target higher quality at lower prices by checking companies our screener flags as 55 high quality undervalued stocks before the crowd pays attention.

- Prioritize resilience by reviewing stocks in our 81 resilient stocks with low risk scores that may better align with a steadier, sleep at night approach.

- Spot lesser known opportunities by browsing our screener containing 25 high quality undiscovered gems that combine solid fundamentals with less market attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.