Please use a PC Browser to access Register-Tadawul

A Look At PROCEPT BioRobotics (PRCT) Valuation As Regulatory And Clinical Catalysts Draw Investor Focus

PROCEPT BioRobotics Corp. PRCT | 27.27 | +1.91% |

PROCEPT BioRobotics (PRCT) is back in focus as investors watch upcoming regulatory decisions and clinical trial readouts for its AquaBeam Robotic System, with rising options activity signaling closer attention to these potential catalysts.

At a share price of $30.73, PROCEPT BioRobotics has had a 90 day share price return of a 12.17% decline and a 1 year total shareholder return of a 55.87% decline, so the recent regulatory and clinical catalysts are arriving against a backdrop of weaker long term performance and relatively muted short term momentum.

If you are following how medical technology stories play out in the market, it could be a good moment to broaden your watchlist with healthcare stocks.

With the stock down 55.87% over the past year yet trading at a roughly 35% discount to the average analyst price target of US$50.73, you have to ask: is pessimism overdone here, or is the market already discounting future growth?

Most Popular Narrative: 39.4% Undervalued

The most followed narrative places PROCEPT BioRobotics' fair value at about $50.73 per share versus the last close of $30.73, setting up a wide gap that hinges on long term growth, margins and future procedure volumes.

The ongoing expansion of HYDROS robotic system placements into both high-volume and mid/lower volume hospitals, in conjunction with rising utilization by a growing base of engaged surgeons, indicates significant untapped market potential that is driving recurring consumables revenue growth and eventual expansion in gross and operating margins.

Curious what has to happen for that valuation to make sense? The narrative leans on faster revenue growth, stronger margins and a richer future earnings multiple. It also assumes funding needs and share count stay manageable while the business scales. If you want to see how all of those moving parts fit together, the full story lays out the numbers in detail.

Result: Fair Value of $50.73 (UNDERVALUED)

However, this story could change quickly if Aquablation adoption slows or if regulatory and reimbursement decisions become less favorable than the market currently expects.

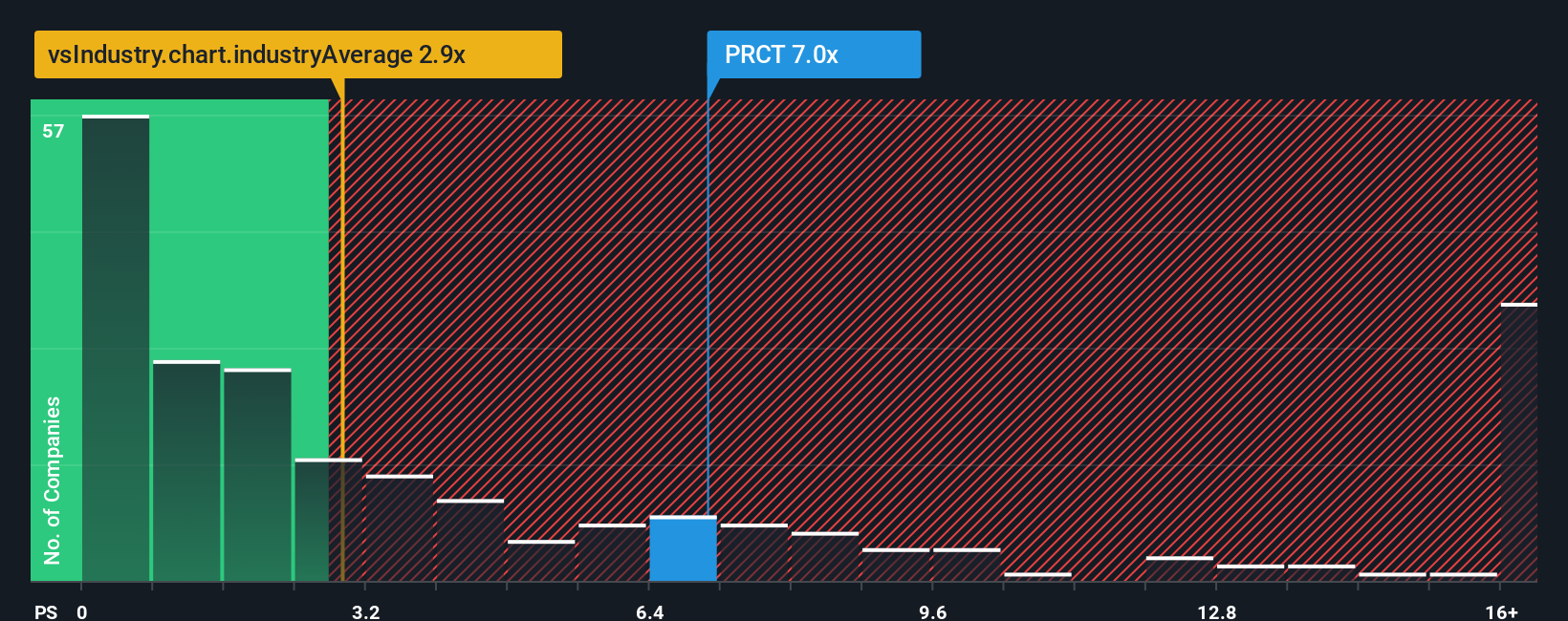

Another View: Price To Sales Tells A Different Story

While the analyst narrative flags PROCEPT BioRobotics as undervalued, the P/S ratio of 5.7x paints a tougher picture. It sits above the US Medical Equipment industry at 3.3x, peers at 5.5x, and the fair ratio of 3.5x. This suggests more valuation risk if growth expectations slip.

Build Your Own PROCEPT BioRobotics Narrative

If you see the story differently or prefer to lean on your own work, you can stress test the assumptions, tweak the inputs and Do it your way in under 3 minutes.

A great starting point for your PROCEPT BioRobotics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop with a single company, you will miss chances elsewhere, so put the same curiosity to work across a wider set of potential opportunities.

- Scan for potential comeback stories by checking out these 3522 penny stocks with strong financials that already show stronger financial underpinnings than many expect from this corner of the market.

- Ride the growth of automation and data by focusing on these 24 AI penny stocks that are directly tied to AI adoption across different parts of the economy.

- Zero in on value oriented ideas through these 880 undervalued stocks based on cash flows that screen for companies priced below what their cash flows might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.