Please use a PC Browser to access Register-Tadawul

A Look At Recursion Pharmaceuticals (RXRX) Valuation After New AI Bioengineering Market Study

Recursion Pharmaceuticals, Inc. Class A RXRX | 3.42 | -8.06% |

Precedence Research has released a broad study on AI-driven bioengineering that spotlights Recursion Pharmaceuticals (RXRX) for its AI biology and phenomics platform, highlighting high-throughput drug discovery and growing government funding across the sector.

Despite the attention around AI-driven drug discovery and growing government support for bioengineering, Recursion Pharmaceuticals’ recent share price performance has been weak. The company has recorded a 30-day share price return of 14.59% and a 1-year total shareholder return decline of 48.04% from a last close of US$3.98, suggesting enthusiasm around the story has not yet translated into sustained momentum.

If this AI biology story has caught your eye, it could be worth widening the lens and checking out 57 profitable AI stocks that aren't just burning cash as a way to find other AI names with more established earnings profiles.

With a recent 1 year total shareholder return decline of 48.04%, a value score of 2, and shares last closing at US$3.98 compared to a US$7.00 analyst target, is Recursion underpriced or already reflecting its future potential?

Most Popular Narrative: 43.1% Undervalued

With Recursion Pharmaceuticals trading at $3.98 against a widely followed fair value estimate of $7.00, the current price sits well below that narrative.

Acceleration of internal drug candidates, especially in oncology and rare diseases, toward key clinical inflection points (e.g., late-stage trial data in FAP, CDK7, RBM39) creates opportunities for value realization through milestone payments, licensing revenue, and eventually commercial product sales, directly impacting topline growth.

Curious what kind of revenue curve and profit margin shift would need to sit behind a $7.00 fair value, and how rich a future earnings multiple that implies? The full narrative walks through those building blocks step by step, including how fast sales might ramp and where profitability could land if everything lines up.

Result: Fair Value of $7.00 (UNDERVALUED)

However, this hinges on early and mid stage trials avoiding clinical setbacks and on Recursion managing cash burn without heavy dilution if funding conditions tighten.

Another Angle on Valuation

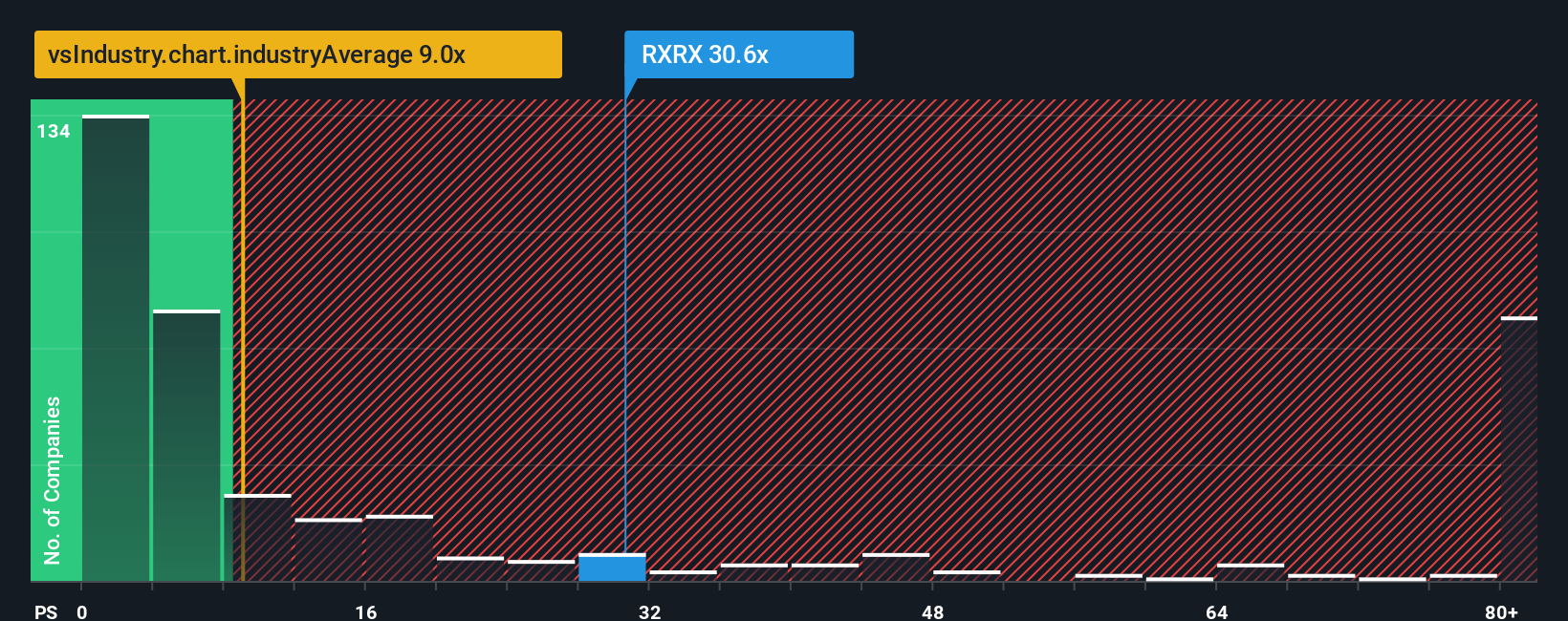

While the $7.00 fair value narrative leans on future earnings and margins, the current P/S of 47.4x versus 11.4x for the US Biotechs industry and 15.2x for peers paints a very different picture. It suggests investors are already paying a steep premium, so the question is how much upside room is really left.

Build Your Own Recursion Pharmaceuticals Narrative

If you see the numbers differently or just prefer to test your own assumptions, you can spin up a custom thesis in minutes with Do it your way

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Recursion’s story has you thinking more broadly about your portfolio, it is worth lining up a few fresh ideas before the market moves without you.

- Hunt for quality at a discount by scanning our 52 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect their strengths.

- Strengthen your core holdings with solid balance sheet and fundamentals stocks screener (45 results) that focus on companies carrying less financial strain and more balance sheet resilience.

- Get ahead of the crowd by reviewing a screener containing 24 high quality undiscovered gems before they end up on everyone else’s watchlist.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.