Please use a PC Browser to access Register-Tadawul

A Look At Rivian Automotive (RIVN) Valuation After Production Gains And Volkswagen Software Partnership

Rivian Automotive, Inc. Class A RIVN | 15.27 | -2.05% |

Rivian Automotive (RIVN) drew fresh attention after reporting fourth quarter and full year 2025 operating results, including 10,974 vehicles produced and 9,745 delivered in the quarter, with 42,284 produced and 42,247 delivered for the year.

Rivian’s recent production update, together with its Volkswagen joint venture and focus on software and services, comes after a 46.49% 90 day share price return and a 42.48% 1 year total shareholder return from a latest share price of US$19.22. This suggests momentum has been building even as the EV sector has faced mixed sentiment.

If Rivian has you rethinking the future of electric vehicles, this could be a good moment to look across the sector and size up auto manufacturers as potential alternatives.

With Rivian posting US$5,835 million in revenue, a net loss of US$3,579 million and an intrinsic discount estimate of 57.15% against a recent 1 year return of 42.48%, is the current price a fresh opening, or is the market already baking in future growth?

Most Popular Narrative: 15.3% Overvalued

With Rivian’s fair value estimate at US$16.67 versus a last close of US$19.22, the most followed narrative sees the market pricing in a premium.

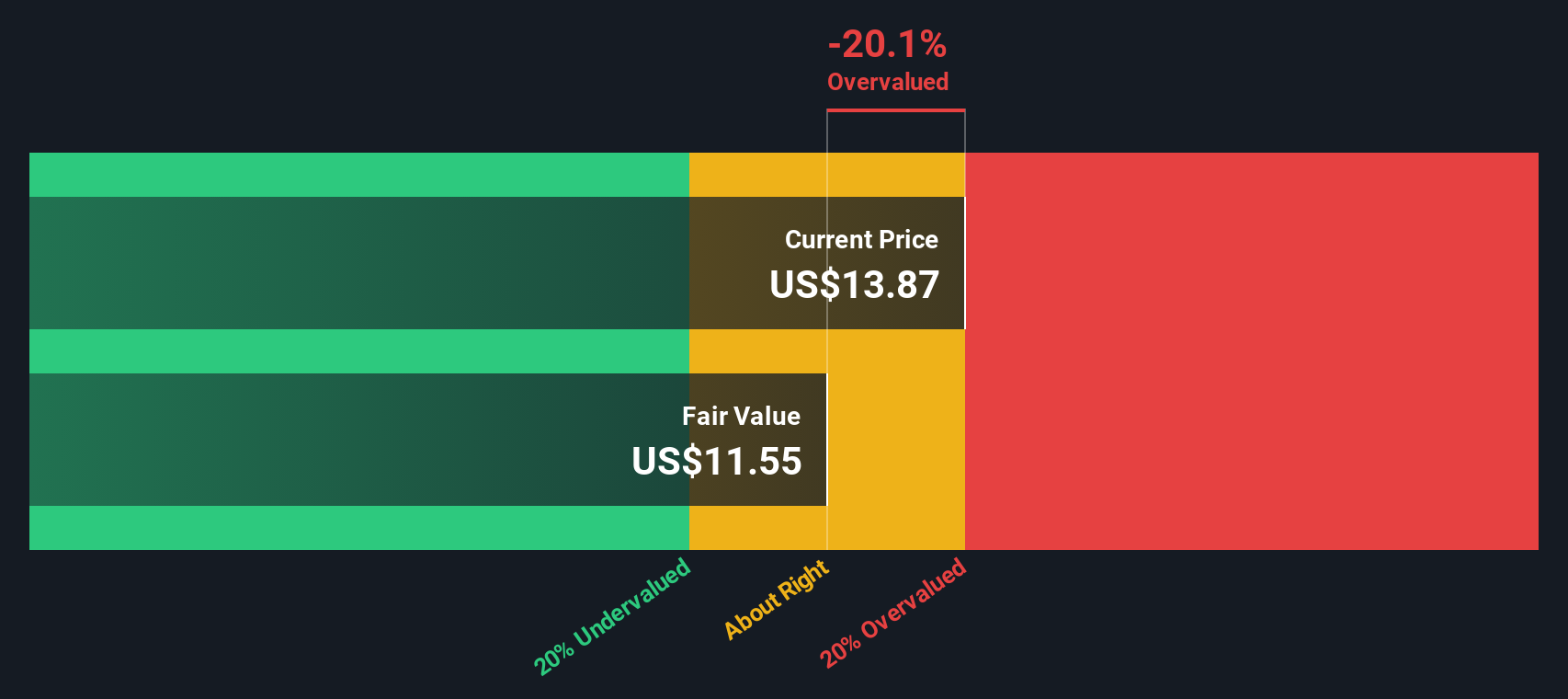

The analysts have a consensus price target of $13.85 for Rivian Automotive based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $7.55.

Curious what justifies a higher fair value than the consensus target and a premium future P/E? The narrative leans heavily on rapid top line expansion, rising margins and a richer earnings multiple that assumes Rivian matures into something closer to a high growth compounder than a typical auto name.

Result: Fair Value of $16.67 (OVERVALUED)

However, you also need to weigh up risks such as expiring EV incentives that could soften demand, as well as ongoing cash burn that may require fresh capital and dilute returns.

Another View: DCF Signals A Very Different Story

While the popular narrative sees Rivian as about 15.3% overvalued at US$19.22 versus a fair value of US$16.67, our DCF model points the other way. It places fair value closer to US$44.85, which implies the shares trade at a 57.1% discount. Same company, very different conclusion. Which set of assumptions do you find more realistic?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rivian Automotive for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rivian Automotive Narrative

If you see the numbers differently or want to stress test your own assumptions, you can create a personalized Rivian view in just a few minutes, then Do it your way

A great starting point for your Rivian Automotive research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready To Find Your Next Idea?

If Rivian has sharpened your thinking, do not stop here. Widen your watchlist with fresh ideas filtered by clear fundamentals, themes and return profiles.

- Target smaller companies with outsized potential by scanning these 3534 penny stocks with strong financials that already show stronger balance sheets and fundamentals than many expect from this corner of the market.

- Ride long term technology shifts by focusing on these 28 AI penny stocks that connect artificial intelligence with real products, revenue streams and measurable traction.

- Zero in on value by reviewing these 884 undervalued stocks based on cash flows where cash flow based pricing may still sit below what the underlying businesses appear to justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.