Please use a PC Browser to access Register-Tadawul

A Look At Rollins (ROL) Valuation After A Weather Hit Earnings Miss And Margin Squeeze

Rollins, Inc. ROL | 61.35 | +0.71% |

Rollins (ROL) is under scrutiny after fourth quarter results fell short of Wall Street expectations on revenue and earnings, with early winter weather weighing on one time and seasonal pest control projects.

That weaker quarter has clearly reset sentiment, with a 1 day share price return of a 1.1% decline and a 7 day share price return of a 9.7% decline, even though the 1 year total shareholder return is 15.8% and the 5 year total shareholder return is 75.9%. This suggests recent momentum has cooled after a stronger multi year run.

If Rollins’ pullback has you thinking about where else growth could come from, it might be a good time to look at 23 top founder-led companies as a fresh source of ideas.

With shares pulling back despite a 1 year total return of 15.8% and net income of US$526.71 million in 2025, the key question is whether Rollins is now attractively priced or if the market already reflects its valuation.

Most Popular Narrative: 8.5% Undervalued

Rollins' most followed narrative sets a fair value of $63.42, which sits above the last close at $58.06 and frames the recent pullback in a different light.

The acquisition of Saela Pest Control is expected to add between $45 million to $50 million in revenue in 2025 and is anticipated to be accretive to earnings, signaling potential revenue growth and earnings enhancement. Rollins' multi brand strategy offers diversified revenue streams and competitive advantages, potentially leading to sustained revenue growth and consistent financial performance across economic cycles.

Curious how that earnings accretion, the recurring commercial mix, and a premium future multiple all fit together into $63.42 per share? The full narrative breaks down the growth run rate, margin profile, and valuation math that underpin this fair value, so you can judge whether those assumptions line up with your own expectations.

Result: Fair Value of $63.42 (UNDERVALUED)

However, softer organic growth tied to weather and higher operating costs, including fleet and potential tariff pressures, could still challenge the earnings and valuation story.

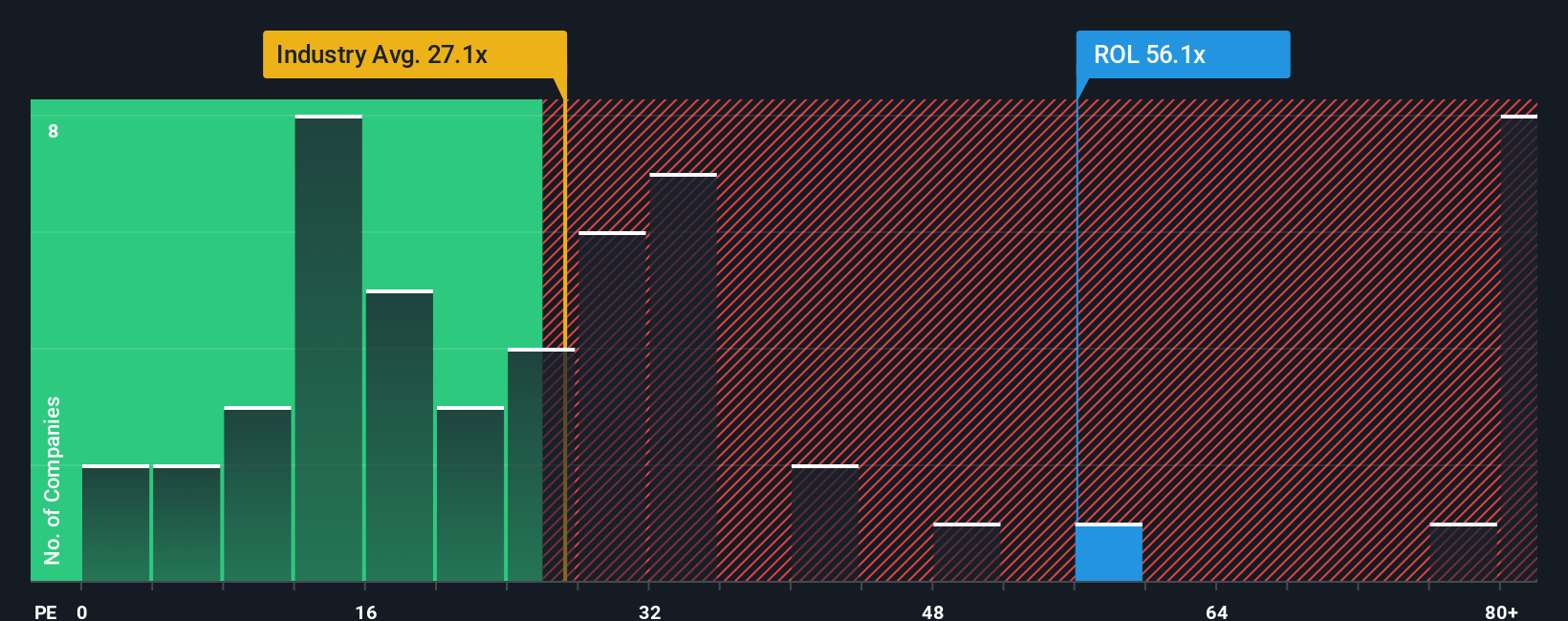

Another View: High Earnings Multiple Raises The Bar

That 8.5% undervaluation story sits alongside a very different signal on earnings. Rollins trades on a P/E of 53x, well above the US Commercial Services average of 25.7x and a fair ratio of 28x. This points to meaningful valuation risk if sentiment or growth expectations cool.

Build Your Own Rollins Narrative

If you interpret the numbers differently or simply want to test your own assumptions, you can build a custom Rollins view in just a few minutes by starting with Do it your way.

A great starting point for your Rollins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Rollins, you risk missing other opportunities that might suit your goals, so give yourself options and see what else stands out.

- Target steadier candidates with 83 resilient stocks with low risk scores, focusing on companies that our process scores with relatively lower overall risk.

- Hunt for potential value across markets using screener containing 24 high quality undiscovered gems, where our filters surface quality names that are not widely followed.

- Prioritize financial strength through solid balance sheet and fundamentals stocks screener (44 results), highlighting businesses that pair balance sheet resilience with underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.