Please use a PC Browser to access Register-Tadawul

A Look At SL Green (SLG) Valuation After Rockpoint Partnership For 100 Park Avenue

SL Green Realty Corp. SLG | 38.04 | -3.23% |

SL Green Realty (SLG) has agreed to sell a 49% interest in its 100 Park Avenue office tower to Rockpoint, valuing the Midtown Manhattan property at US$425.0 million and creating a new joint venture.

That joint venture news comes after a mixed period for investors, with a 30 day share price return of 9.23% but a 1 year total shareholder return decline of 19.06%. Recent momentum has picked up even as longer term performance remains weak.

If this kind of real estate repositioning has you reassessing your portfolio, it could be a suitable moment to widen your search and check out fast growing stocks with high insider ownership.

With SL Green shares up 9.23% over 30 days but showing a 19.06% total return decline over 1 year, and the stock trading below the US$54.50 analyst target, is there genuine upside here, or is the market already baking in future growth?

Most Popular Narrative: 14.1% Undervalued

Compared with SL Green Realty's last close at US$48.76, the most followed narrative points to a higher fair value, built on specific revenue and margin expectations.

Portfolio optimization and disciplined capital recycling, including strategic dispositions and realizing significant gains on debt and preferred equity investments, are strengthening liquidity, setting the stage for new accretive investments, and reducing interest expense to enhance future earnings growth. Value add developments and transformative projects (such as One Vanderbilt and the potential Caesars Palace Times Square casino) have the potential to unlock new high margin revenue streams, increase portfolio valuation, and materially expand SL Green's income base in the medium to long term.

Curious how a slower revenue path can still support a higher value? The narrative leans on a sharp margin reset and a punchy future earnings multiple. Keen to see how those assumptions fit together?

Result: Fair Value of $56.79 (UNDERVALUED)

However, that upside story can quickly fray if higher interest costs squeeze cash flows longer than expected or if major tenants leave and push vacancy and rents in the wrong direction.

Another View: Market Pricing Looks Less Generous

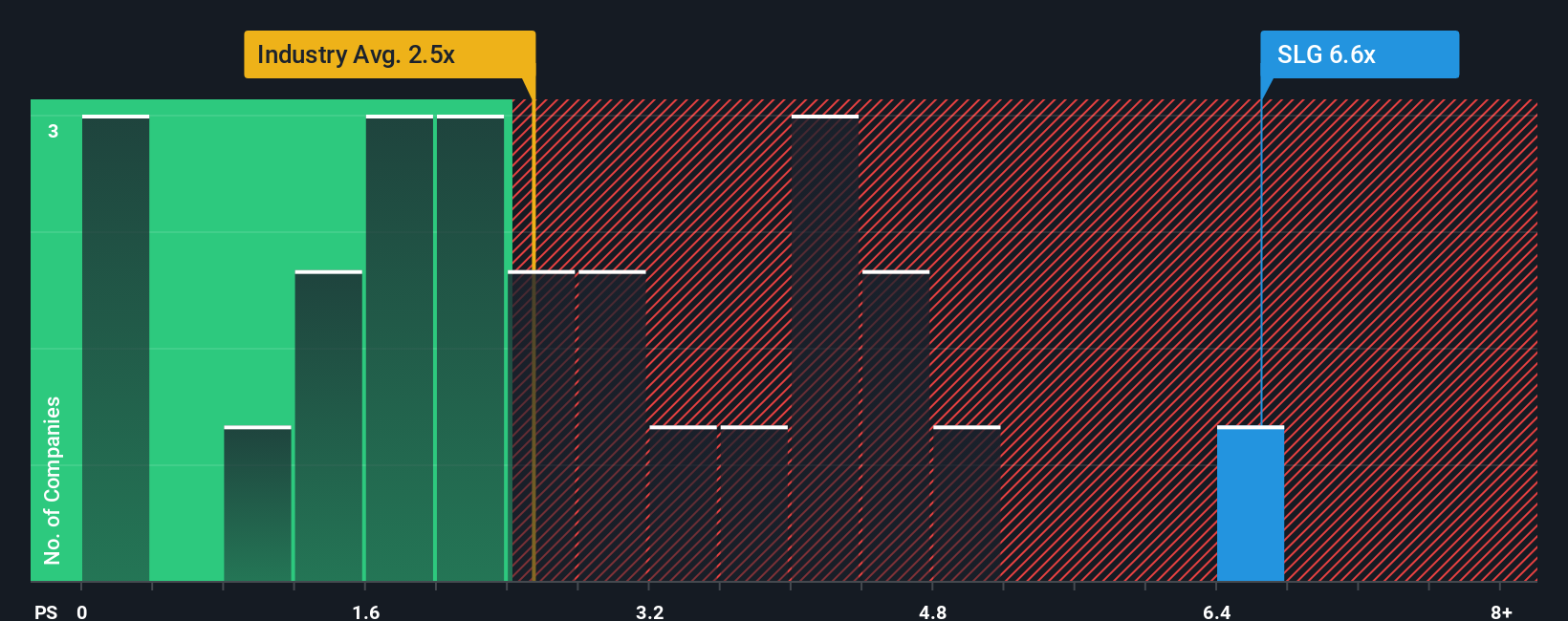

That 14.1% “undervalued” fair value hinges on future earnings, but the current P/S ratio of 5.2x paints a tougher picture. It is higher than the US Office REITs industry at 2.2x, the peer average at 4.2x, and the fair ratio estimate of 2x. This suggests meaningful valuation risk if sentiment cools.

Build Your Own SL Green Realty Narrative

If you look at the numbers and come to a different conclusion, or prefer to base decisions on your own work, you can build a tailored view in a few minutes with Do it your way.

A great starting point for your SL Green Realty research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If SL Green has sharpened your interest in real assets and income potential, do not stop here. Broaden your watchlist with a few focused stock themes.

- Target dependable cash flows by scanning these 13 dividend stocks with yields > 3% that may appeal if you want income to play a bigger role in your portfolio.

- Ride powerful technology shifts by checking out these 25 AI penny stocks that tie artificial intelligence to real business models rather than just headlines.

- Hunt for potential mispriced opportunities with these 884 undervalued stocks based on cash flows that could suit you if you are drawn to buying quality for less than it might be worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.