Please use a PC Browser to access Register-Tadawul

A Look At SmartStop Self Storage REIT (SMA) Valuation After Recent Share Price Moves

SmartStop Self Storage REIT, Inc. SMA | 34.85 | +3.81% |

Why SmartStop Self Storage REIT Is On Investors’ Radar

SmartStop Self Storage REIT (SMA) has drawn attention after recent trading left the stock around $31.75, with mixed returns over the past month and past 3 months. This has prompted investors to reassess its self storage exposure.

At a share price of $31.75, SmartStop’s 7 day share price return of 0.95% contrasts with a 90 day share price decline of 7.03%. This suggests recent momentum has softened after earlier weakness, as investors reassess risk and growth potential in self storage REITs.

If this has you thinking about where else capital might work harder, it could be a good moment to broaden your search with our 22 top founder-led companies.

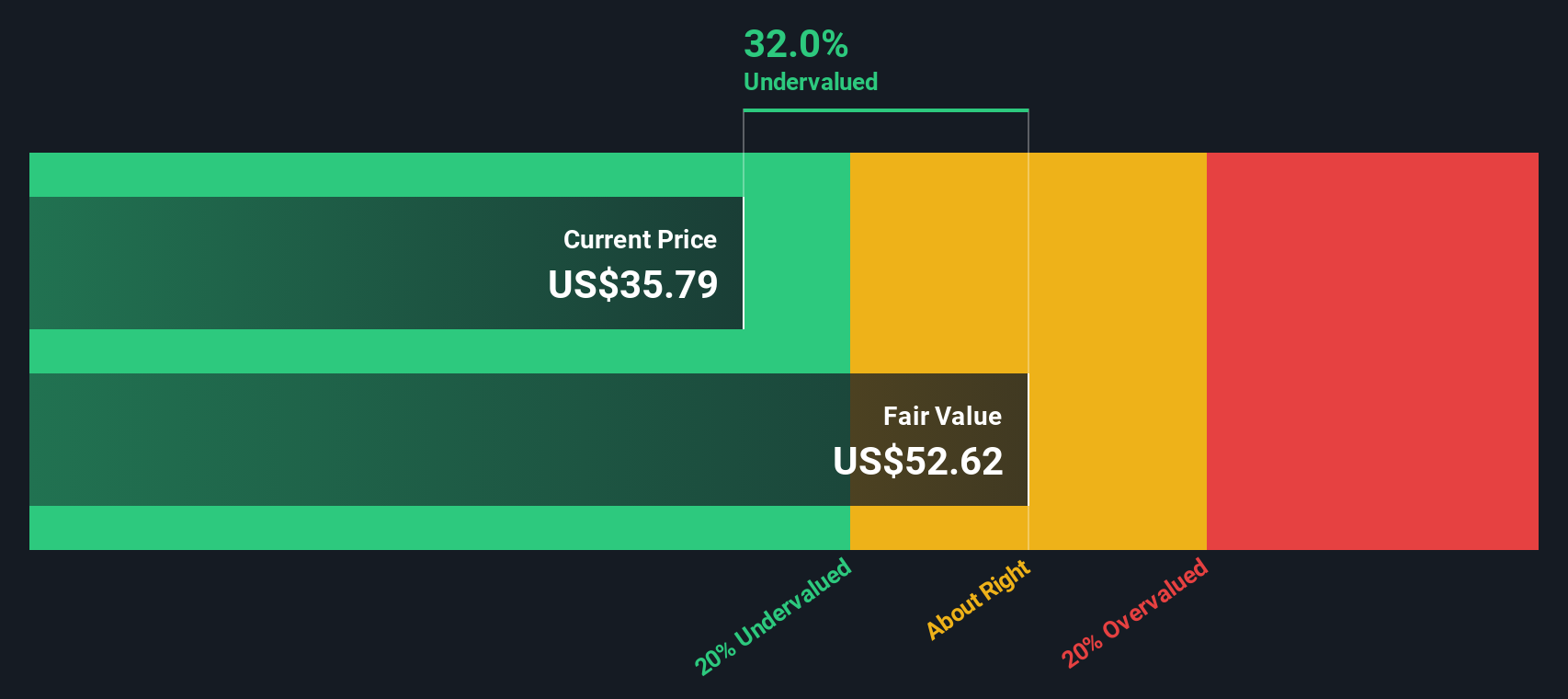

With SmartStop trading at $31.75 and sitting at a discount to an analyst price target of $37.00 with an indicated intrinsic discount of 43.82%, you have to ask whether there is real value here or if the market is already pricing in future growth.

Most Popular Narrative: 19% Undervalued

Compared with the last close at $31.75, the most followed narrative points to a higher fair value that reflects a much stronger earnings profile in a few years.

The Argus third party management acquisition nearly doubles the operating footprint, expands the data set for dynamic pricing and creates a captive pipeline of off market deals, which should support higher revenue growth and fee income as the platform scales.

Curious how a storage landlord ends up with a growth story like this? Revenue expansion, margin rebuild and a punchy future earnings multiple all play a part. The full narrative spells out how those moving pieces line up into that higher fair value.

Result: Fair Value of $39.18 (UNDERVALUED)

However, this hinges on self storage supply not flaring up again, and on Argus keeping enough deal flow and owners to support those higher fee streams.

Another Lens On Value

The earlier view leans on earnings based fair value, but our DCF model presents a more detailed perspective, estimating SmartStop at $56.51 per share, compared with the current $31.75. This also suggests potential undervaluation. When two very different tools indicate a similar conclusion, is the market overlooking something, or are the inputs too optimistic?

Build Your Own SmartStop Self Storage REIT Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own assumptions with the data in front of you, it only takes a few minutes to shape a version of the story that fits your view, so why not Do it your way

A great starting point for your SmartStop Self Storage REIT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

SmartStop might be on your radar, but you do not want your watchlist to stop there. Use the tools available and keep fresh ideas coming.

- Target potential mispricings by scanning our list of 55 high quality undervalued stocks that pair solid fundamentals with restrained valuations.

- Prioritise resilience with 81 resilient stocks with low risk scores, focusing on companies that score well on stability so single stock shocks are less likely to catch you off guard.

- Spot earlier stage opportunities by reviewing the screener containing 25 high quality undiscovered gems, where smaller names with strong numbers are easier to miss if you rely only on headlines.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.