Please use a PC Browser to access Register-Tadawul

A Look At Telephone And Data Systems (TDS) Valuation As Investors Await First Post Transformation Earnings Report

Telephone and Data Systems, Inc. TDS | 45.29 | -0.55% |

Why this earnings report matters for Telephone and Data Systems

Telephone and Data Systems (TDS) is set to report fourth quarter results, giving investors their first full look at the company as a focused fiber broadband and tower infrastructure business after last year’s divestiture.

The update should provide details on how its fiber buildout is progressing, how Array Digital Infrastructure is contributing within the tower segment, and how management is approaching capital allocation between share repurchases and further fiber investment.

The share price has climbed to US$47.59, with a 24.19% 90 day share price return and a very large 3 year total shareholder return that reflects how investors have been reassessing the company around its fiber and tower shift.

If you are looking beyond telecoms for other infrastructure linked ideas, it could be a good moment to scan our list of 25 power grid technology and infrastructure stocks for potential opportunities.

With TDS trading at US$47.59, only about 6% below the average analyst price target and sitting on a very large 3 year total shareholder return, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 2.2% Undervalued

With TDS last closing at $47.59 against a narrative fair value of $48.67, the widely followed view has the shares priced just below its estimated worth using a 6.96% discount rate.

The divestiture of UScellular and major spectrum assets has substantially deleveraged TDS's balance sheet, freeing up capital for aggressive expansion in fiber infrastructure and providing flexibility for opportunistic M&A, both of which are positioned to drive long-term revenue and earnings growth as broadband demand intensifies.

Want to see what this transformation really assumes? The narrative leans on a sharp earnings ramp, firmer margins, and a future valuation multiple that has to shift meaningfully from today. Curious how those pieces fit together and what has to go right for $48.67 to hold up?

Result: Fair Value of $48.67 (UNDERVALUED)

However, the story could change quickly if spectrum sales close on weaker terms or if heavy fiber spending fails to offset pressure in legacy copper and cable revenues.

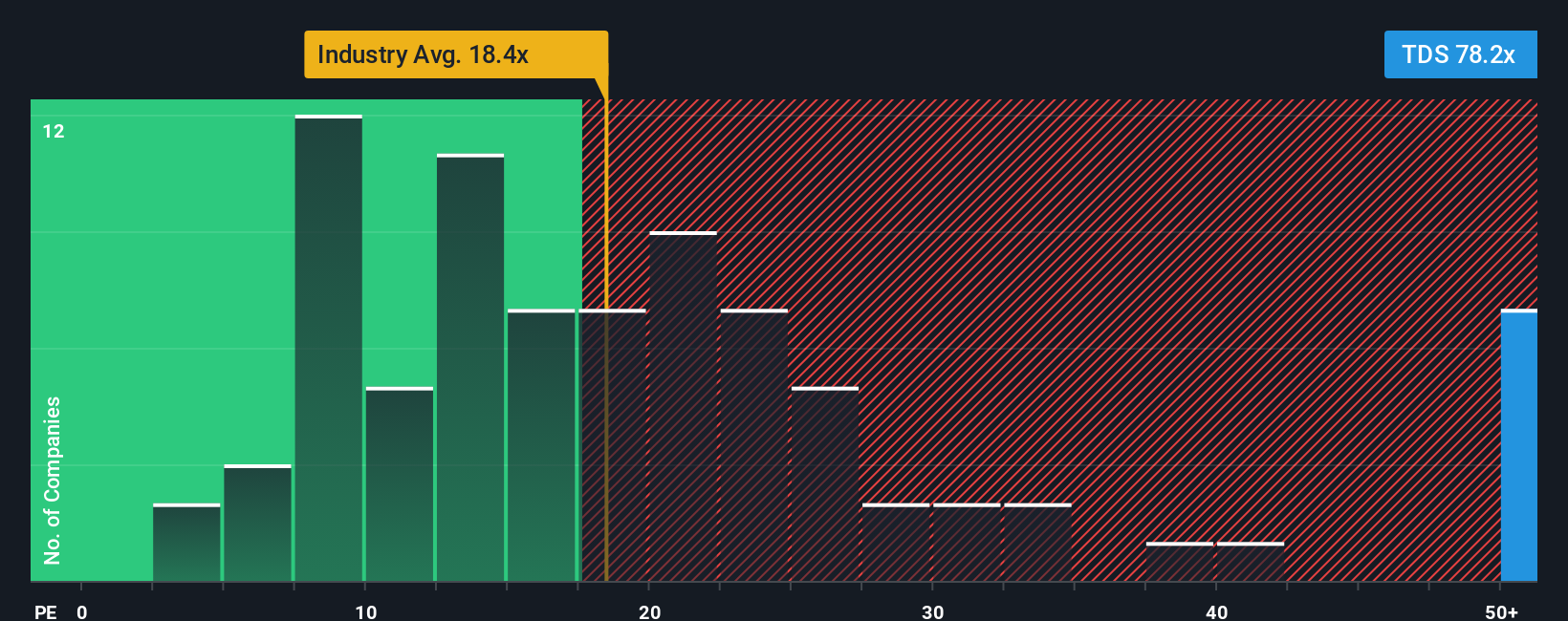

Another View: Earnings Multiple Sends A Different Signal

If you step away from the narrative fair value and just look at the current P/E, the picture gets trickier. TDS trades on about 97.6x earnings, versus 15.5x for peers, 19.4x for the wider wireless industry, and a fair ratio estimate of 35.8x. That kind of gap suggests valuation risk as much as opportunity. The question becomes how comfortable you are paying that sort of premium for this transformation story.

Build Your Own Telephone and Data Systems Narrative

If you look at these numbers and reach a different conclusion, or prefer to test your own assumptions, you can build a custom TDS story in a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Telephone and Data Systems.

Looking for more investment ideas?

If you stop with just one company, you miss the chance to compare business models, balance sheets, and income streams across a wider set of opportunities.

- Spot potential bargains early by scanning our screener containing 23 high quality undiscovered gems that pair solid fundamentals with lower market attention.

- Prioritise resilience by reviewing companies in the 85 resilient stocks with low risk scores that focus on steadier risk profiles and financial strength.

- Target quality at a reasonable price by checking the 53 high quality undervalued stocks built around strong cash flows and supportive balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.