Please use a PC Browser to access Register-Tadawul

A Look at Texas Instruments’s Valuation Following Its Latest Dividend Increase and Growing Analyst Optimism

Texas Instruments Incorporated TXN | 221.44 | -1.13% |

Texas Instruments (TXN) just made a move that should catch the eye of anyone watching for signals about where this chipmaker is headed. The company announced a 4% increase to its quarterly cash dividend, raising it from $1.36 to $1.42 per share, effective later this fall if the board gives it final approval. A dividend increase like this signals management’s confidence in the business and can be a powerful message for those considering whether to hold, buy, or avoid the stock at this time.

This dividend boost comes at a time when Texas Instruments is attracting increased investor attention, with shares up about 1% over the past day and 3% this week, even as the stock remains down almost 9% over the past year. While momentum has improved in the short term, there is still caution reflected in the price, particularly after a year of volatility and changing sentiment in the semiconductor sector. Recent positive commentary about steady revenue and net income growth, as well as anticipation of earnings improvement, is adding to the ongoing discussion about the stock’s value.

With this year’s performance mixed but optimism building, some may wonder whether Texas Instruments is trading at an appealing discount or if the market has already accounted for its future growth potential.

Most Popular Narrative: 10.2% Undervalued

The most widely followed analyst narrative sees Texas Instruments as trading below its estimated fair value, pointing to a potential upside for investors if current trends play out as expected.

Strategic investment in U.S.-based 300mm wafer fabs and a diversified global manufacturing footprint uniquely position TI to benefit from evolving supply chain localization and customer preferences for geopolitically resilient suppliers. This advantage is likely to help win incremental business, strengthen preferred supplier status, and improve long-term gross margins and pricing power.

Curious what’s fueling the analysts’ bullish stance? Major assumptions behind this valuation could surprise you, and they go far beyond just short-term swings in share price. The calculations dig deep into where revenue, profits, and future margins are headed, as well as the role of high-value product lines. Want to discover which big levers steer this fair value? The real story is in the numbers driving these forecasts.

Result: Fair Value of $205.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, there are still credible risks such as increased competition and possible underutilization of manufacturing capacity. These factors could challenge the bullish scenario.

Find out about the key risks to this Texas Instruments narrative.Another View: Discounted Cash Flow Model Takes a Different Stance

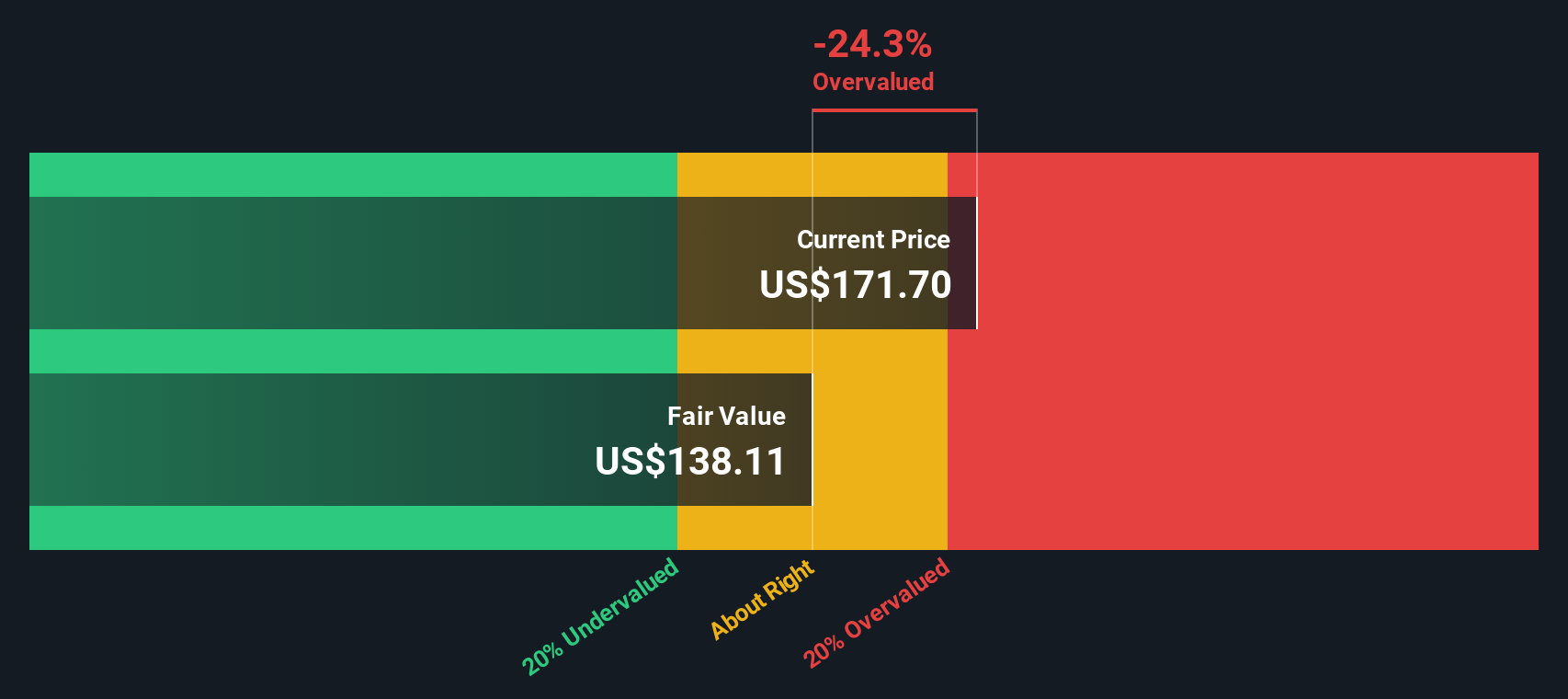

While analysts see upside based on projected earnings and margins, our DCF model suggests a different story. It indicates Texas Instruments might actually be overvalued at today’s prices. Which viewpoint aligns more with reality?

Build Your Own Texas Instruments Narrative

If you want to take a different angle or back up your own view with the facts, you can build your own narrative based on the data in just a few minutes. Do it your way

A great starting point for your Texas Instruments research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Make sure you do not miss out on some of the strongest trends and fresh ideas. Use the Simply Wall Street Screener to hunt for standout stocks that fit your goals and open up your investing universe.

- Uncover tomorrow’s leaders in artificial intelligence by scanning for emerging innovators with AI penny stocks right now.

- Zero in on value by seeking companies that look undervalued based on real cash flows, all with the help of our undervalued stocks based on cash flows.

- Tap into income potential and find stocks paying attractive yields over 3%, starting your search with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.