Please use a PC Browser to access Register-Tadawul

A Look At Toast (TOST) Valuation After New AI Tools And Rising Investor Attention

Toast, Inc. Class A TOST | 27.07 | -2.06% |

Why Toast stock is back in focus

Toast (TOST) is attracting fresh attention after rolling out new AI powered tools for catalog management, pricing, and marketing that aim to reposition its platform as a broader retail operating system.

This product shift, paired with a recent analyst upgrade and a rebound in risk appetite for tech names, has pulled the stock back onto many watchlists as investors reassess what they are paying for in Toast today.

Toast's 1 day share price return of 1.2% decline and 30 day share price return of 7.37% decline sit against a 1 year total shareholder return of 14.06% decline and 3 year total shareholder return of 48.44% gain. This suggests recent momentum has cooled even as interest has picked up again around its AI rollout, executive changes and upcoming earnings release.

If Toast's AI push has caught your eye, this could be a good moment to broaden your search and check out other high growth tech and AI stocks that are reshaping how software meets real world businesses.

With Toast trading at US$33.80, sitting at a 37.9% discount to the average analyst price target and an intrinsic value estimate that is roughly 9.7% richer than today’s quote, is this genuine upside, or is the market already baking in future growth?

Most Popular Narrative: 29.2% Undervalued

Toast's most followed valuation story puts fair value at about $47.75, well above the last close at $33.80. This frames a clear gap the narrative is trying to explain.

Expansion into new market segments (enterprise chains, food and beverage retail, and international markets like Australia) is expected to create diversified and fast-growing high-ARPU customer streams, which will drive top-line growth and help improve earnings resilience.

Curious what kind of revenue growth, margin lift and future earnings multiple are baked into that fair value? The full narrative spells out an ambitious earnings path, rising profitability and a premium P/E that together need to line up for $47.75 to make sense.

Result: Fair Value of $47.75 (UNDERVALUED)

However, this hinges on Toast keeping hardware costs and tariffs in check, and avoiding a squeeze from rivals that could pressure ARPU and margins.

Another View: Paying Up For Toast Today

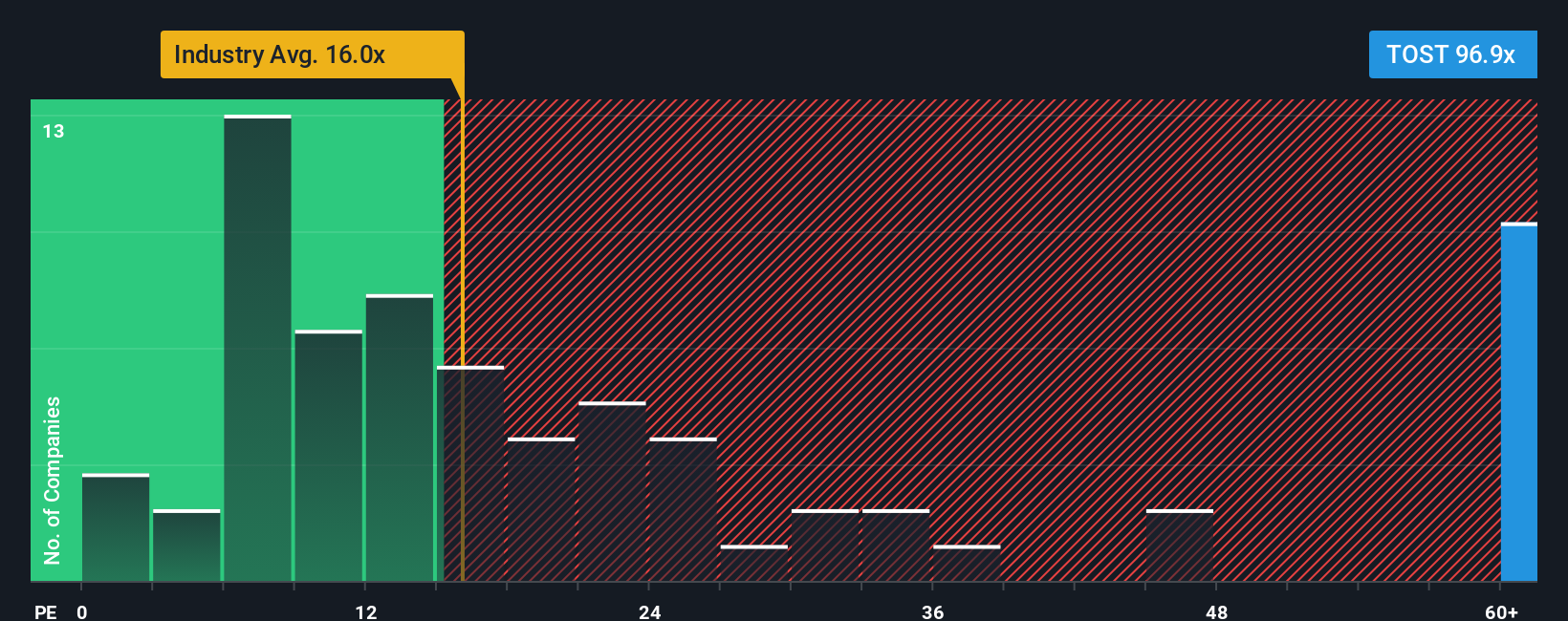

The first story leans on future earnings and a premium P/E to argue Toast is 29.2% undervalued. The current P/E of 72.8x tells a very different story, especially against a fair ratio of 22x, a peer average of 40.8x and a sector average of 14.5x. That gap suggests investors are already paying a heavy premium, so how comfortable are you with that much optimism baked in?

Build Your Own Toast Narrative

If parts of this story do not quite fit your view, or you would rather work from the raw numbers yourself, you can build your own Toast narrative in just a few minutes with Do it your way.

A great starting point for your Toast research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Toast is on your radar, do not stop there. Widening your search across other themes can help you spot opportunities you might otherwise miss.

- Spot potential value opportunities early by checking out these 864 undervalued stocks based on cash flows, which screens for companies trading at a discount to their cash flow strength.

- Position yourself for long term tech shifts by reviewing these 24 AI penny stocks, which highlights companies applying artificial intelligence across real world products and services.

- Put income at the heart of your plan by scanning these 13 dividend stocks with yields > 3%, which focuses on companies offering dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.