Please use a PC Browser to access Register-Tadawul

A Look At Twilio (TWLO) Valuation After Analyst Downgrade And Earnings Expectations

Twilio, Inc. Class A TWLO | 113.14 | +1.96% |

Twilio (TWLO) is back in the spotlight after a mix of cautious analyst signals, including a downgrade to Neutral, intersected with expectations for strong upcoming earnings and recent share declines.

The recent pullback, including a 9.4% 7 day share price return and 14.5% 30 day share price return, follows cautious analyst commentary and tech sector weakness. Twilio’s 6.4% 1 year total shareholder return and very large 3 year total shareholder return suggest longer term momentum has recently been fading.

If Twilio’s recent swings have you thinking more broadly about software and AI, this could be a good moment to scan high growth tech and AI stocks for other ideas on your radar.

With Twilio trading at US$119.07 against an average analyst target of about US$145.77, plus mixed signals on future growth, you have to ask: is this a genuine opening, or is the market already pricing in what comes next?

Most Popular Narrative: 13.7% Undervalued

With Twilio last closing at US$119.07 against a narrative fair value of US$138.04, the current price sits below what this widely followed view considers reasonable. This sets up a clear tension between market caution and growth expectations.

The analysts have a consensus price target of $130.885 for Twilio based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $170.0, and the most bearish reporting a price target of just $75.0.

Curious what kind of revenue path, margin lift and earnings jump are built into that fair value and future P/E? The core assumptions are bold. The spread between bullish and bearish is wide. The full narrative lays out the numbers that connect today’s share price to that valuation.

Result: Fair Value of $138.04 (UNDERVALUED)

However, heavy reliance on lower margin messaging and rising regulatory and compliance demands around privacy and sender identification could still pressure profitability and weaken the bullish case.

Another Angle On Value

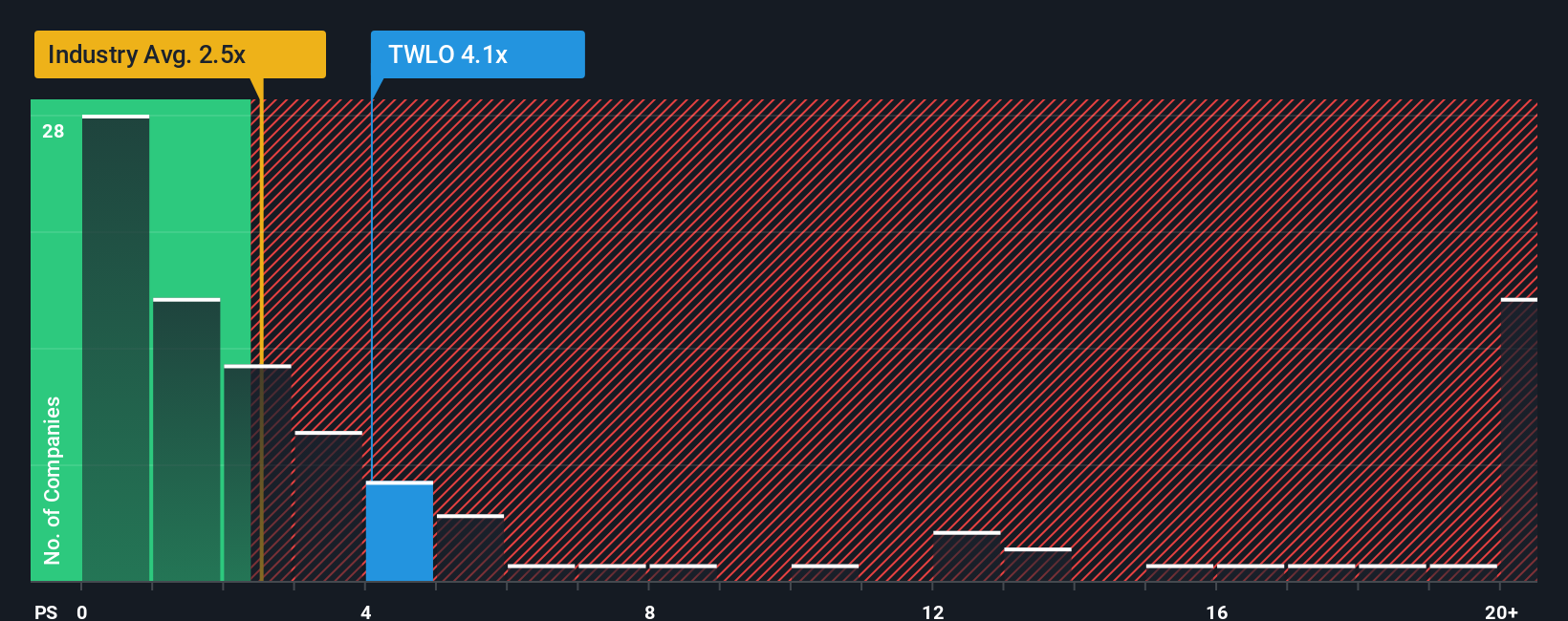

While the narrative fair value points to Twilio looking 13.7% undervalued, the picture changes when you zoom in on the revenue multiple. Twilio trades on a P/S of 3.7x, richer than the US IT industry at 2.4x, even though our fair ratio estimate is higher at 4.6x. That gap highlights both potential valuation support and potential downside risk if sentiment cools, so which side matters more to you?

Build Your Own Twilio Narrative

If you look at the inputs and come to a different conclusion, trust your own work and shape the story yourself in just a few minutes: Do it your way.

A great starting point for your Twilio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Twilio has sparked your interest, do not stop here. Broaden your watchlist with a few focused stock ideas that match what you care about most.

- Capture potential upside in mispriced businesses by scanning these 863 undervalued stocks based on cash flows that line up current prices with underlying cash flow strength.

- Explore technology-oriented opportunities by checking out these 24 AI penny stocks at the intersection of artificial intelligence and established revenue models.

- Consider income-focused opportunities by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.