Please use a PC Browser to access Register-Tadawul

A Look At Vita Coco (COCO) Valuation After Strong Revenue And EBITDA Beat

Vita Coco Company, Inc. COCO | 53.96 | +4.25% |

Vita Coco Company (COCO) has been drawing fresh attention after its latest quarterly report, which showed revenue up 37.2% year on year and EBITDA well ahead of analyst estimates, with the stock rising 23.6% since.

Those quarterly numbers arrived on top of an already strong run, with a 90 day share price return of 30.71% and a 1 year total shareholder return of 54.74%. Newer efforts in sports hydration marketing and a recent board appointment have kept attention on how the business is evolving beyond its core coconut water offering.

If Vita Coco’s move into sports hydration has caught your eye, this could be a moment to see what is happening across other beverage and consumer names through fast growing stocks with high insider ownership.

After a quarter that beat revenue and EBITDA expectations, a 1 year total return of 54.74% and the stock now around US$53.54, the real question is whether COCO still trades at a discount or if future growth is already priced in.

Most Popular Narrative: 7.7% Undervalued

With Vita Coco last closing at US$53.54 against a narrative fair value of US$58.00, the current setup focuses on how future earnings power might bridge that gap.

Recent research updates focus heavily on tariff relief for coconut water, future earnings power, and how those factors feed into valuation and execution risk for Vita Coco.

Curious what justifies that higher fair value? The narrative leans on steady revenue gains, firmer margins and a richer future earnings multiple tied to upgraded forecasts. Want to see exactly how those assumptions stack together? Read on and test whether you agree with the path behind that US$58 figure.

Result: Fair Value of $58 (UNDERVALUED)

However, tariff uncertainty and volatile freight costs could still squeeze margins. At the same time, weaker private label demand may challenge the earnings path behind that US$58 view.

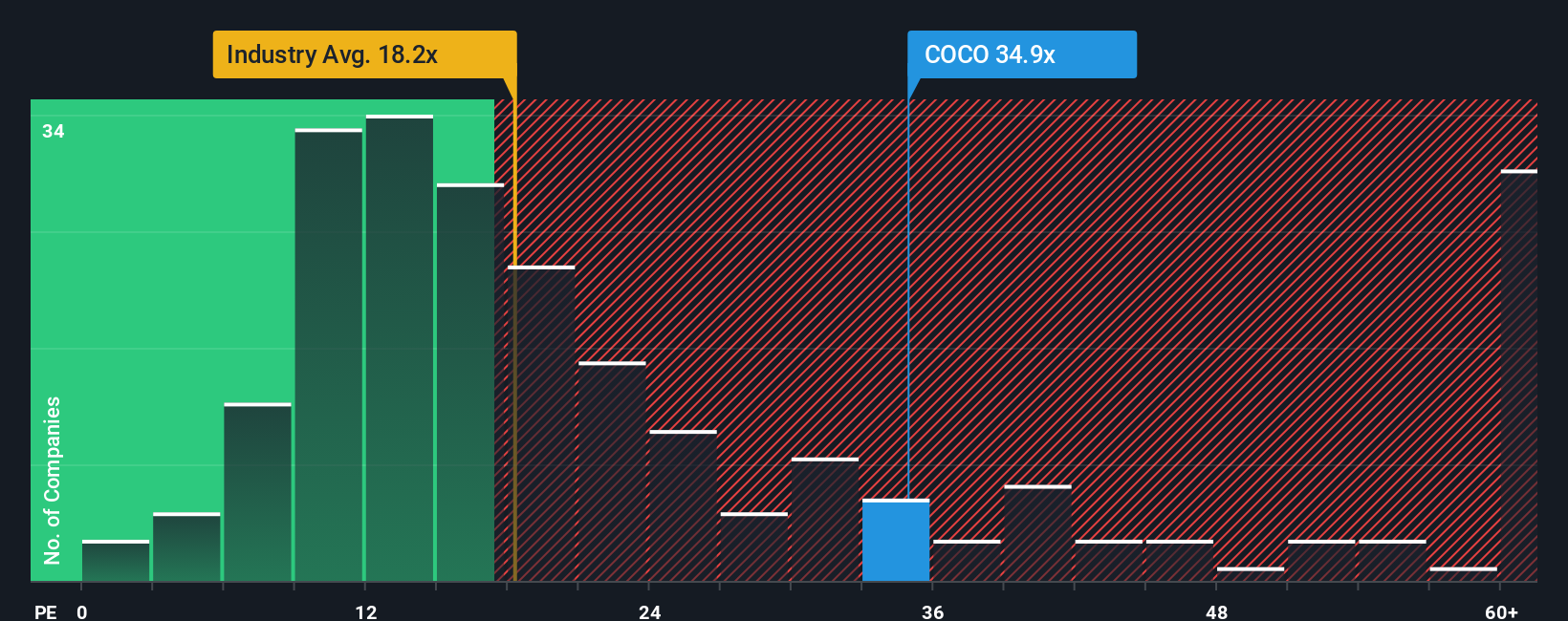

Another View: Rich P/E Puts Pressure On The Story

There is a clear tension between the 7.7% “undervalued” narrative fair value and how the market is already pricing Vita Coco today. At around US$53.54, the shares trade on a P/E of 44.1x, compared with 19.3x for peers and 18.1x for the global Beverage industry. The Simply Wall St fair ratio points to 21.2x instead, suggesting the current P/E is roughly double where the market could eventually settle if expectations cool. For you, that raises a simple question: is this more a valuation risk to be careful with, or a quality premium you are comfortable paying?

Build Your Own Vita Coco Company Narrative

If you do not see the story the same way, or prefer to trust your own work, you can build a fresh data driven view in minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vita Coco Company.

Looking for more investment ideas?

If Vita Coco has sharpened your focus, do not stop here. Broaden your watchlist with fresh ideas that could complement or contrast your current thinking.

- Target income first by scanning these 12 dividend stocks with yields > 3% that might suit investors who want regular cash returns alongside potential capital growth.

- Spot future tech trends early with these 24 AI penny stocks that put artificial intelligence at the center of their business models.

- Add some higher risk, higher potential names to your research list through these 3531 penny stocks with strong financials before the crowd pays closer attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.