Please use a PC Browser to access Register-Tadawul

A Look At Weatherford International (WFRD) Valuation After Venezuela-Linked Oil Services Rally

Weatherford International plc Ordinary Shares - New WFRD | 104.44 | -1.04% |

Weatherford’s Venezuela-linked surge and what it might mean

Weatherford International (WFRD) jumped after the US announced investments to restore crude production in Venezuela, a move that lifted oil services stocks as investors reassessed exposure to energy service providers.

That Venezuela linked jump sits on top of a strong recent run, with a 7 day share price return of 12.95%, a 90 day share price return of 37.17%, and a 1 year total shareholder return of 21.55%. This suggests momentum has been building rather than fading.

If this kind of move in energy services has your attention, it could be a good moment to widen the search and check out fast growing stocks with high insider ownership.

With Weatherford now trading very close to the average analyst price target, and still showing recent revenue and net income growth, it raises a key question for investors: is there real value left here, or is the market already pricing in future growth?

Most Popular Narrative: 6.8% Overvalued

The most followed narrative sets Weatherford International’s fair value at about US$83.73, compared with the last close of US$89.38. This frames the current price as slightly rich while still grounded in detailed earnings and margin assumptions.

Ongoing company transformation shifting from legacy, low-margin businesses toward higher-margin, technology-enabled services, digitalization, and integrated projects should drive both net-margin expansion and earnings resilience through the cycle.

Want to see what kind of revenue path and margin lift are baked into that view, and what future P/E it relies on, before you judge it for yourself?

Result: Fair Value of $83.73 (OVERVALUED)

However, there are still a couple of pressure points to watch, including softer international activity and payment delays in markets like Mexico, which could unsettle that fair value story.

Another View: Multiples Point to a Very Different Story

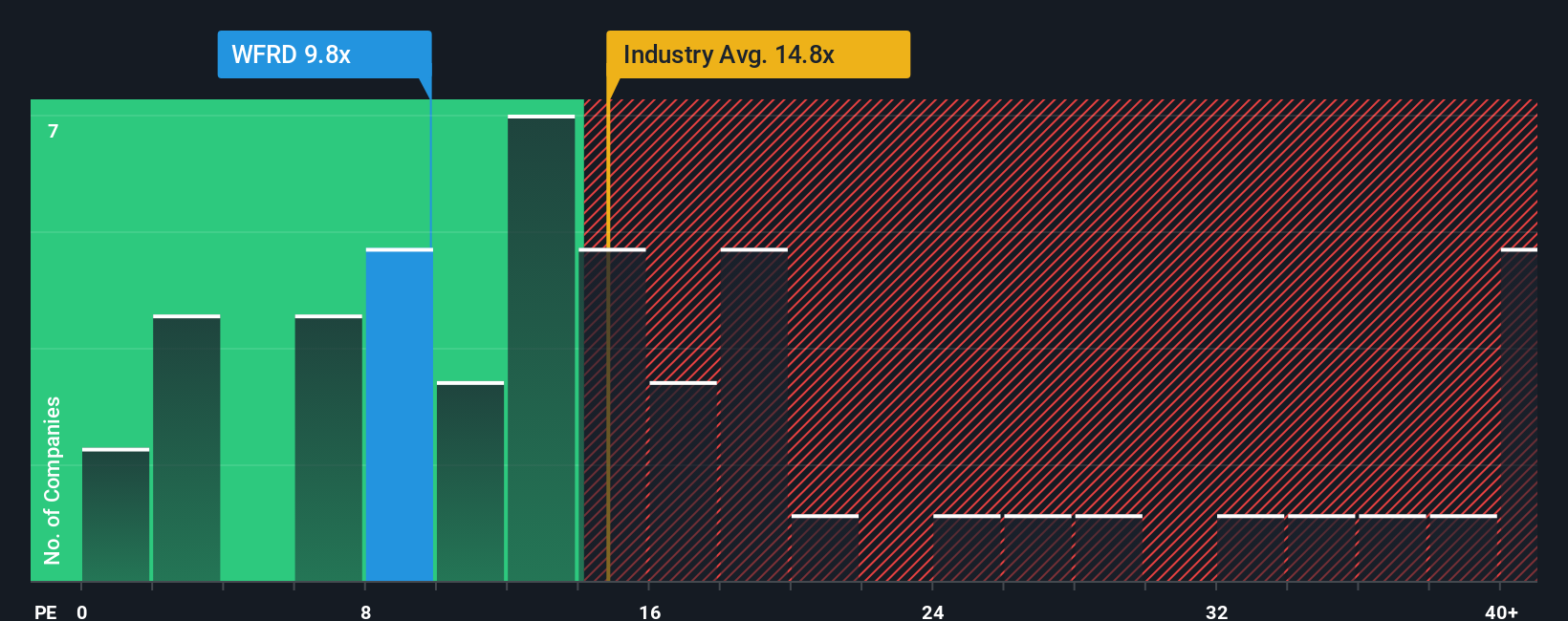

The fair value narrative flags Weatherford as 6.8% overvalued, yet the pricing signals around it look very different. On a P/E of 15.8x, the shares sit below the US Energy Services industry at 20.1x, below peers at 31.1x, and close to a fair ratio of 16x suggested by our work.

That gap implies the market is valuing Weatherford more cautiously than both its sector and peer group, even though the current P/E is almost in line with where the ratio could move toward over time. Is that caution a warning sign, or room for sentiment to catch up if the story holds together?

Build Your Own Weatherford International Narrative

If the current story does not quite match your view, or you prefer to test the assumptions yourself, you can build a full custom narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Weatherford International.

Looking for more investment ideas?

If Weatherford has sharpened your focus, do not stop here. The right screener can surface other opportunities that fit your style and keep you a step ahead.

- Spot potential value plays early by checking out these 877 undervalued stocks based on cash flows that align with your expectations on cash flow and price.

- Capitalize on emerging tech themes by scanning these 25 AI penny stocks that match your view on where AI is gaining real traction.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that could complement a returns focused portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.