Please use a PC Browser to access Register-Tadawul

A Look at Zeta Global’s Valuation Following New Generative AI Solution Launch and Notable Stock Move

Zeta Global ZETA | 18.56 | -4.87% |

Zeta Global Holdings (NYSE:ZETA) just introduced its new Generative Engine Optimization solution, perfectly aligning with the surge in consumers turning away from traditional search engines and towards AI-powered platforms for answers. This announcement marks a strategic play to help brands improve their visibility and accuracy within generative AI systems such as ChatGPT and Claude, at a time when industry data signals a major shift in user behavior. Not coincidentally, shares have responded with a 2.5% jump, fueled further by positive market sentiment following the Federal Reserve's recent rate cut.

The rollout of Zeta's GEO comes at a moment when momentum around the company is clearly building. Over the last year, Zeta shares have outpaced the broader market thanks to strong billings growth and a business model that sees customer acquisition costs recouped in under five months. While year-to-date performance is up nearly 18%, the real story is the 37% surge in the past three months. This reflects enthusiasm for the company’s AI-driven offerings and operational gains, even as the previous year saw more mixed results.

With all this in mind, investors now face a key question: is Zeta’s stock offering a genuine opportunity for those betting on AI-driven marketing, or has the recent run-up already factored in much of its future growth?

Most Popular Narrative: 19% Undervalued

The most widely followed narrative sees Zeta Global Holdings as currently undervalued, reflecting optimism about its path to profitability, expanding margins, and sustained revenue growth fueled by AI-driven marketing technology.

Significant investments in AI/ML (including the Zeta Data & AI Lab and new prescriptive AI products like Zeta Answers) are expected to drive ongoing product innovation, automation, and superior ROI for clients. This is anticipated to improve efficiency and further expand net margins. Zeta's proven land-and-expand sales strategy, discipline in customer acquisition efficiency, and visible ramp in free cash flow conversion suggest increasing earnings predictability and margin leverage, as evidenced by strong free cash flow growth and an aggressive share buyback program.

Curious how Zeta justifies a valuation jump? The narrative’s secret sauce lies in ambitious profit projections and a financial playbook rarely seen in upstart tech firms. Want to glimpse which bold moves and hidden assumptions might unlock big gains? Dig deeper into the narrative’s intriguing growth thesis. It is more than just AI buzz.

Result: Fair Value of $27.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, stricter data privacy regulations or persistent net losses could disrupt Zeta’s growth narrative and challenge analyst expectations for future margins and profitability.

Find out about the key risks to this Zeta Global Holdings narrative.Another View: Discounted Cash Flow

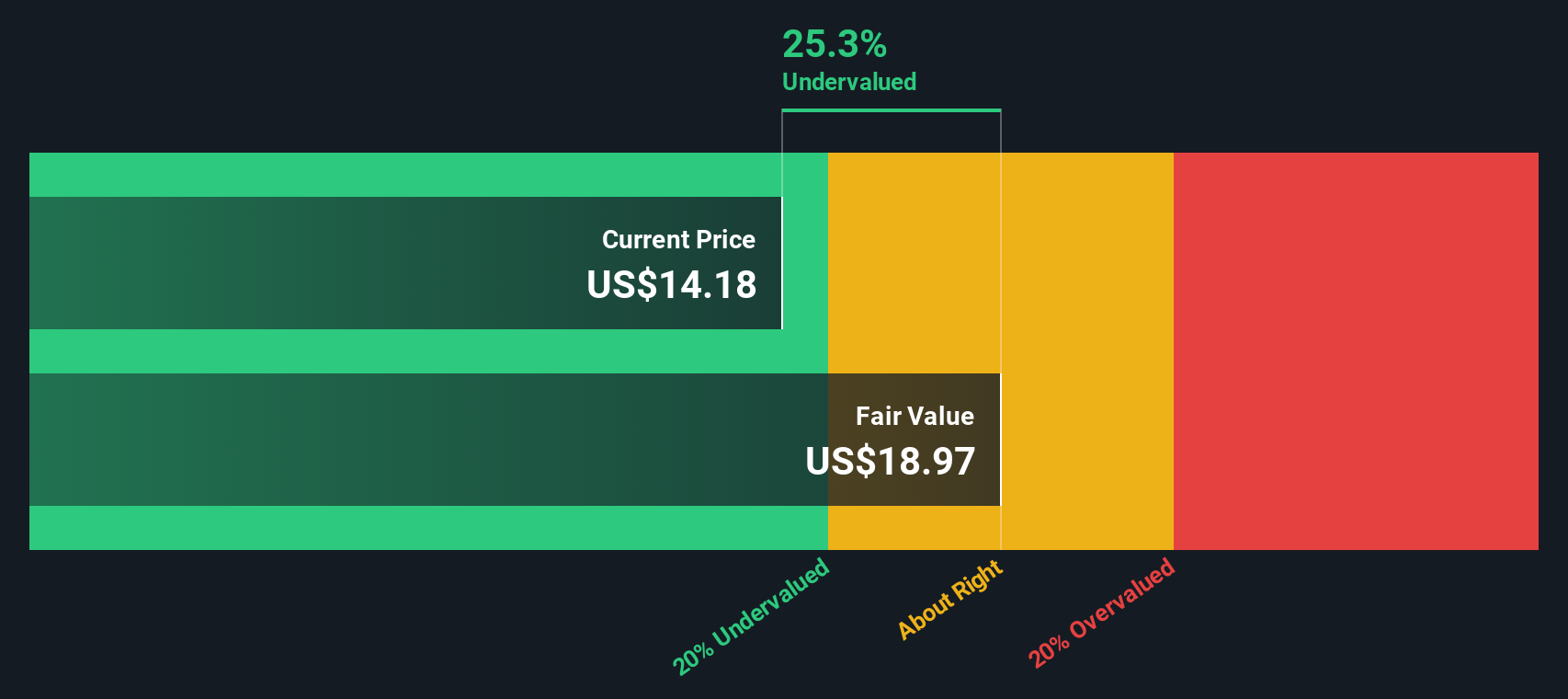

While the previous outlook leans on Zeta’s earnings potential and market optimism, our DCF model arrives at a very similar conclusion. This indicates that the shares are fairly valued based on anticipated future cash flows. However, could a more nuanced scenario change the picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zeta Global Holdings Narrative

If you are skeptical or want to explore the numbers on your own terms, you can build your own personalized narrative in just minutes. Do it your way

A great starting point for your Zeta Global Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. You can enhance your search for the next breakout winner by using powerful stock lists tailored to the biggest trends shaping tomorrow’s markets.

- Unlock potential in lesser-known companies showing solid financials and growth by starting with penny stocks with strong financials.

- Tap into the surging demand for machine learning and automation by checking out AI penny stocks with cutting-edge AI technology at their core.

- Maximize your cash flow strategy by reviewing dividend stocks with yields > 3% featuring companies offering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.