A Look Into Snap-on's (NYSE:SNA) Impressive Returns On Capital

Snap-on Incorporated SNA | 0.00 |

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, the ROCE of Snap-on (NYSE:SNA) looks attractive right now, so lets see what the trend of returns can tell us.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Snap-on:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.20 = US$1.3b ÷ (US$7.5b - US$942m) (Based on the trailing twelve months to December 2023).

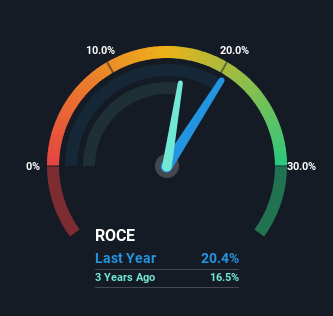

Therefore, Snap-on has an ROCE of 20%. That's a fantastic return and not only that, it outpaces the average of 13% earned by companies in a similar industry.

See our latest analysis for Snap-on

Above you can see how the current ROCE for Snap-on compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Snap-on for free.

So How Is Snap-on's ROCE Trending?

In terms of Snap-on's history of ROCE, it's quite impressive. The company has employed 49% more capital in the last five years, and the returns on that capital have remained stable at 20%. Returns like this are the envy of most businesses and given it has repeatedly reinvested at these rates, that's even better. If Snap-on can keep this up, we'd be very optimistic about its future.

The Bottom Line

Snap-on has demonstrated its proficiency by generating high returns on increasing amounts of capital employed, which we're thrilled about. And the stock has done incredibly well with a 120% return over the last five years, so long term investors are no doubt ecstatic with that result. So while the positive underlying trends may be accounted for by investors, we still think this stock is worth looking into further.

One more thing to note, we've identified 1 warning sign with Snap-on and understanding this should be part of your investment process.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Benzinga News 02/12 13:57

IREN Stock Is Sliding Tuesday: What's Driving The Sell-Off?

Benzinga News 02/12 14:16UPDATE 1-Michael and Susan Dell to put $250 in investment accounts of 25 million U.S. children

Reuters 02/12 14:18FEP To Acquire IMO Cars Wash From Driven Brands; Terms Not Disclosed

Benzinga News 02/12 14:18Here's How Much $100 Invested In Microsoft 20 Years Ago Would Be Worth Today

Benzinga News 02/12 14:30Snap-on Inc. Chairman, President and CEO Nicholas T. Pinchuk Reports Disposal of Common Shares

Reuters 02/12 22:56Option Signals | Boeing Calls Jump 10x; Intel Options Volume Soars 1.7x, 70% Bullish!

Sahm Platform 03/12 07:50Pre-Bell Movers | PLRZ Surges 167.3%; Here Are 20 Stocks Moving Premarket

Sahm Platform Today 10:21