Please use a PC Browser to access Register-Tadawul

A Piece Of The Puzzle Missing From Hawaiian Electric Industries, Inc.'s (NYSE:HE) 27% Share Price Climb

Hawaiian Electric Industries, Inc. HE | 15.86 | +0.51% |

Despite an already strong run, Hawaiian Electric Industries, Inc. (NYSE:HE) shares have been powering on, with a gain of 27% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 81% in the last year.

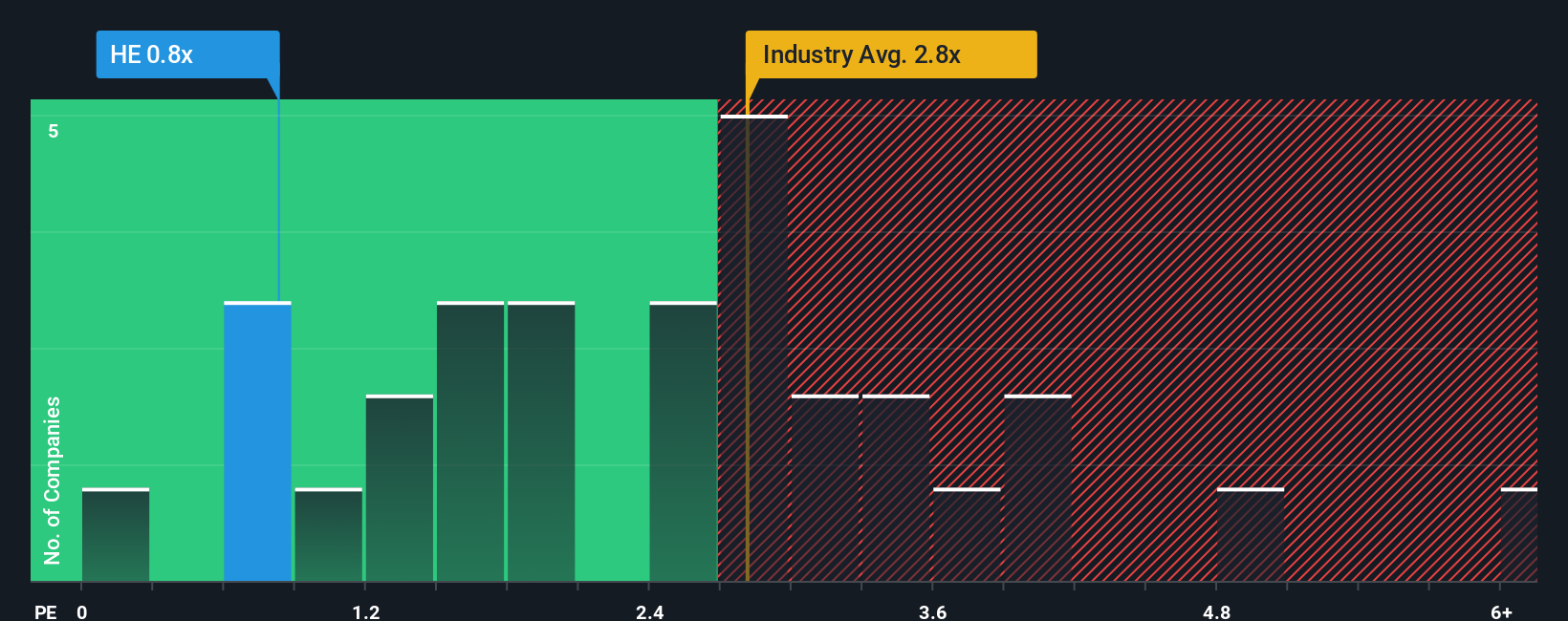

In spite of the firm bounce in price, when close to half the companies operating in the United States' Electric Utilities industry have price-to-sales ratios (or "P/S") above 2.8x, you may still consider Hawaiian Electric Industries as an enticing stock to check out with its 0.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has Hawaiian Electric Industries Performed Recently?

There hasn't been much to differentiate Hawaiian Electric Industries' and the industry's revenue growth lately. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hawaiian Electric Industries.Is There Any Revenue Growth Forecasted For Hawaiian Electric Industries?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hawaiian Electric Industries' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.3% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 12% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 7.0% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 7.1% each year, which is not materially different.

With this information, we find it odd that Hawaiian Electric Industries is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Hawaiian Electric Industries' P/S Mean For Investors?

The latest share price surge wasn't enough to lift Hawaiian Electric Industries' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that Hawaiian Electric Industries currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Hawaiian Electric Industries is showing 2 warning signs in our investment analysis, you should know about.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.