Please use a PC Browser to access Register-Tadawul

A Piece Of The Puzzle Missing From SemiLEDs Corporation's (NASDAQ:LEDS) 34% Share Price Climb

SemiLEDs Corporation LEDS | 1.81 | -6.70% |

SemiLEDs Corporation (NASDAQ:LEDS) shares have continued their recent momentum with a 34% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 82%.

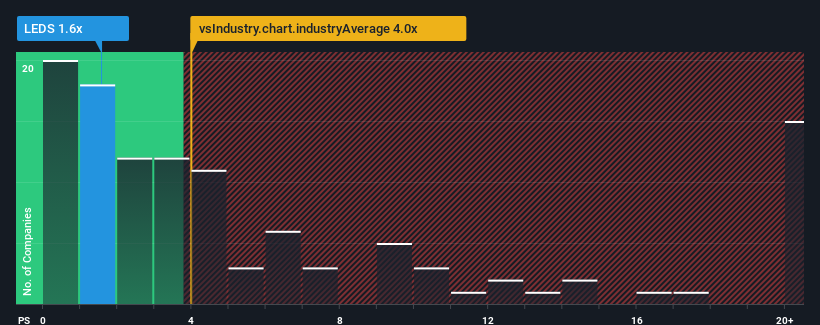

Even after such a large jump in price, SemiLEDs' price-to-sales (or "P/S") ratio of 1.6x might still make it look like a strong buy right now compared to the wider Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4x and even P/S above 10x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 3 warning signs investors should be aware of before investing in SemiLEDs. Read for free now.

What Does SemiLEDs' P/S Mean For Shareholders?

Recent times have been quite advantageous for SemiLEDs as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on SemiLEDs will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for SemiLEDs, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like SemiLEDs' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 161%. The latest three year period has also seen an excellent 129% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 35% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that SemiLEDs' P/S falls short of its industry peers. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On SemiLEDs' P/S

Shares in SemiLEDs have risen appreciably however, its P/S is still subdued. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of SemiLEDs revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

Having said that, be aware SemiLEDs is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

If you're unsure about the strength of SemiLEDs' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.