Please use a PC Browser to access Register-Tadawul

AAR Corp.'s (NYSE:AIR) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

AAR CORP. AIR | 116.97 | +1.23% |

The AAR Corp. (NYSE:AIR) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 53%.

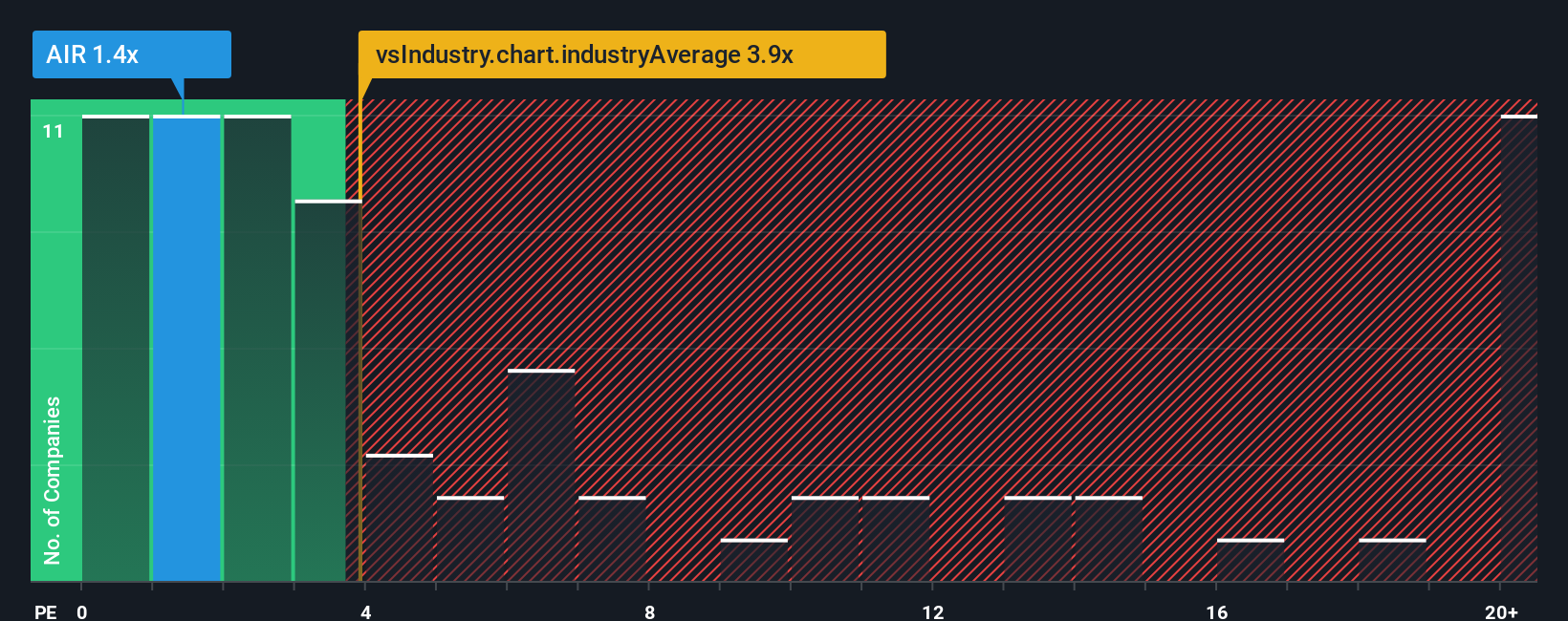

Even after such a large jump in price, AAR may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the Aerospace & Defense industry in the United States have P/S ratios greater than 3.8x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How AAR Has Been Performing

Recent revenue growth for AAR has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on AAR will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on AAR will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For AAR?

In order to justify its P/S ratio, AAR would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. The strong recent performance means it was also able to grow revenue by 61% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 9.3% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 15% per year, which is noticeably more attractive.

With this information, we can see why AAR is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does AAR's P/S Mean For Investors?

Shares in AAR have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of AAR's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.