Please use a PC Browser to access Register-Tadawul

ACM Research (ACMR) Valuation Check After Semiconductor Rally And Upcoming 2025 2026 Outlook Updates

ACM Research, Inc. Class A ACMR | 66.59 | +1.90% |

Why ACM Research is back on investors’ radar

ACM Research (ACMR) has drawn fresh attention after a strong early year move in semiconductor stocks, with traders now zeroing in on two near term company specific events.

The rally has not been limited to a single session, with ACM Research posting an 11.9% 7 day share price return and a 28.2% 30 day share price return, while its 1 year total shareholder return of 178.6% and 3 year total shareholder return of about 3.6x suggest strong momentum has been building rather than fading.

If this kind of semiconductor strength has your attention, it could be a good moment to see what else is moving in high growth tech and AI stocks beyond ACM Research.

After a 1 year total return of 178.6% and a share price near its 52 week highs, the key question is whether ACM Research is still trading below its intrinsic worth or if the market has already priced in the next phase of growth.

Most Popular Narrative: 10.3% Overvalued

With ACM Research closing at US$45.00 against a narrative fair value of about US$40.81, the current price sits above that reference point, setting up a debate around how much future growth is already in the share price.

Recent major investments in new manufacturing and R&D capacity (Lingang in China and Oregon in the US), plus strategic inventory buildup to manage supply chain/geopolitical risks, position ACM to support expanding global sales, mitigate supply disruptions, and scale operations efficiently, which will eventually benefit gross margin and earnings stability.

Curious how this capacity buildout, projected revenue climb, margin assumptions and future P/E all fit together? The full narrative spells out the numbers behind that US$40.81 fair value view.

Result: Fair Value of $40.81 (OVERVALUED)

However, that fair value story could be challenged if export controls tighten around its China focused business, or if ongoing R&D and inventory spending squeeze margins longer than expected.

Another View on Valuation

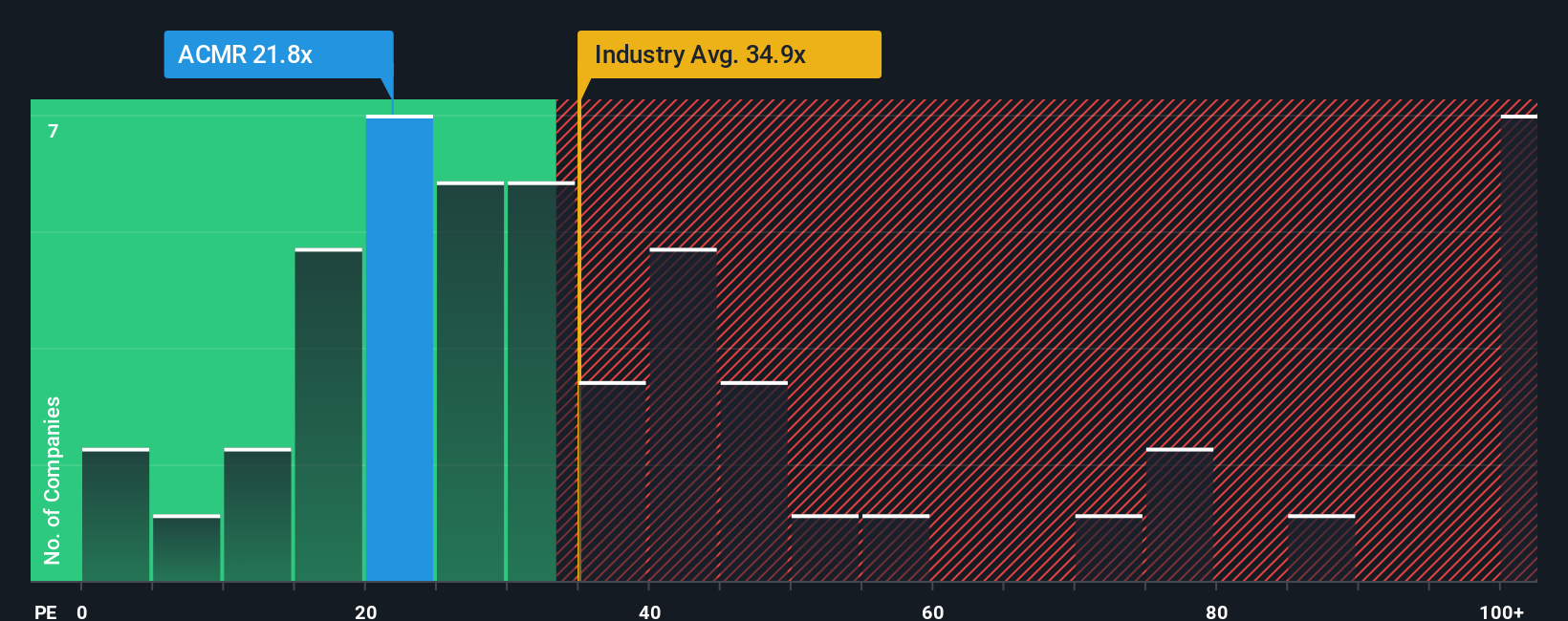

While the fair value narrative points to ACM Research as about 10.3% overvalued, the P/E lens tells a different story. At 24.9x earnings versus 38.7x for the US semiconductor industry and a 36.3x fair ratio, the current multiple sits well below both benchmarks.

That gap cuts both ways, hinting at valuation risk if earnings stumble, but also room for the market to close the distance if results line up with expectations. The real question for you is whether this discount reflects caution that will persist, or hesitation that could eventually unwind.

Build Your Own ACM Research Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions, you can build a full view in minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ACM Research.

Ready to hunt for your next idea?

If ACM Research has your attention, do not stop here. The edge often comes from lining up more candidates that fit your style before the next move.

- Target potential value plays by checking these 880 undervalued stocks based on cash flows that currently trade below what their cash flows might justify.

- Explore major tech themes by scanning these 25 AI penny stocks focused on artificial intelligence and related enablers.

- Tap into income potential by sorting through these 14 dividend stocks with yields > 3% that may suit a yield focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.