Please use a PC Browser to access Register-Tadawul

ACM Research (ACMR) Valuation Check As China Quasi Monopoly And Cleaning Tools Draw Fresh Interest

ACM Research, Inc. Class A ACMR | 66.59 | +1.90% |

Renewed attention on ACM Research (ACMR) is being driven by fresh commentary around its SAPS and TEBO cleaning tools, their role with leading memory makers, and how U.S. sanctions have affected competitors in China.

The recent excitement around ACM Research’s cleaning tools sits alongside sharp market moves, with a 1 day share price return of 14.87% and a 90 day share price return of 89.62%. The 1 year total shareholder return of 174.52% and 3 year total shareholder return above 4x suggest momentum has been building rather than fading.

If ACM Research’s run has you thinking about where chip related demand might flow next, it could be a good moment to size up 33 AI infrastructure stocks as a way to find other potential beneficiaries of AI driven hardware spending.

With ACM Research now trading around US$62.48, ahead of an average analyst price target near US$48.67, the key question is whether the recent surge has run its course or if the market is still underestimating future growth.

Most Popular Narrative: 28.4% Overvalued

At around $62.48, the most followed narrative pegs ACM Research’s fair value at $48.67. At that price, you are looking at a premium that needs strong execution to hold.

Recent major investments in new manufacturing and R&D capacity (Lingang in China and Oregon in the US), plus strategic inventory buildup to manage supply chain/geopolitical risks, position ACM to support expanding global sales, mitigate supply disruptions, and scale operations efficiently, which will eventually benefit gross margin and earnings stability.

Curious how a single growth path, steady margins, and a specific future P/E all feed into that fair value line? The narrative spells out the revenue climb, profit profile, and discount rate that have to line up almost perfectly for today’s premium to make sense.

Result: Fair Value of $48.67 (OVERVALUED)

However, the whole story can change quickly if China-driven demand stumbles or export controls tighten further, especially with high R&D spend already pressuring flexibility.

Another Angle On Valuation

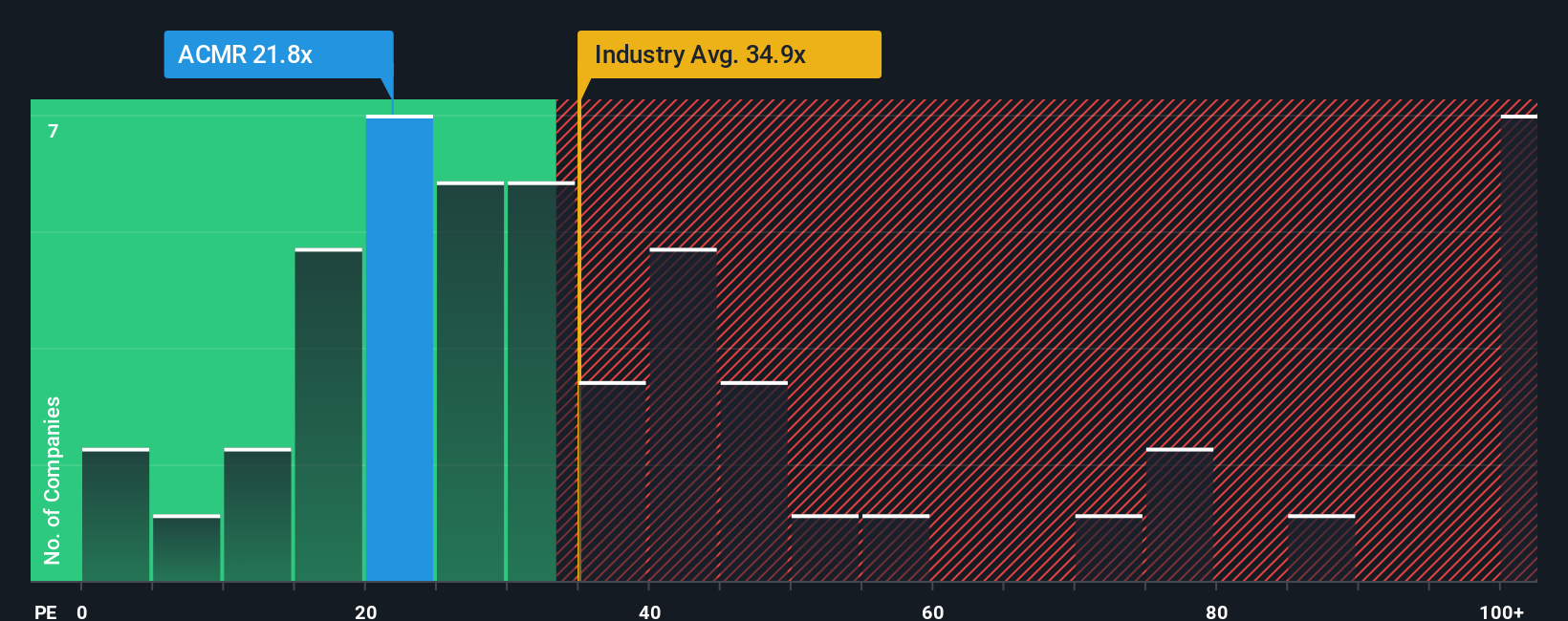

The first view labels ACM Research as 28.4% overvalued relative to a fair value of $48.67. Yet its current P/E of 34.6x sits below peers at 53.9x and under a fair ratio of 38.7x. This implies less stretch than the DCF style fair value suggests. Which signal do you trust more when expectations are this high?

Build Your Own ACM Research Narrative

If you see the data differently or prefer to test your own assumptions, you can build a custom view of ACMR in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ACM Research.

Looking for more investment ideas?

If ACMR has sparked fresh ideas, do not stop here. Use the Simply Wall St Screener to spot other opportunities that could fit your style and goals.

- Zero in on quality at a discount by checking companies that screen as 52 high quality undervalued stocks based on their fundamentals.

- Prioritise resilience and sleep easier at night by focusing on businesses surfaced in our 82 resilient stocks with low risk scores list.

- Hunt for tomorrow’s potential standouts before the crowd by reviewing the screener containing 24 high quality undiscovered gems that currently fly under most radars.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.