Please use a PC Browser to access Register-Tadawul

Advanced Energy Industries AEIS Earnings Jump Tests Bullish Margin Narrative

Advanced Energy Industries, Inc. AEIS | 331.23 | +3.30% |

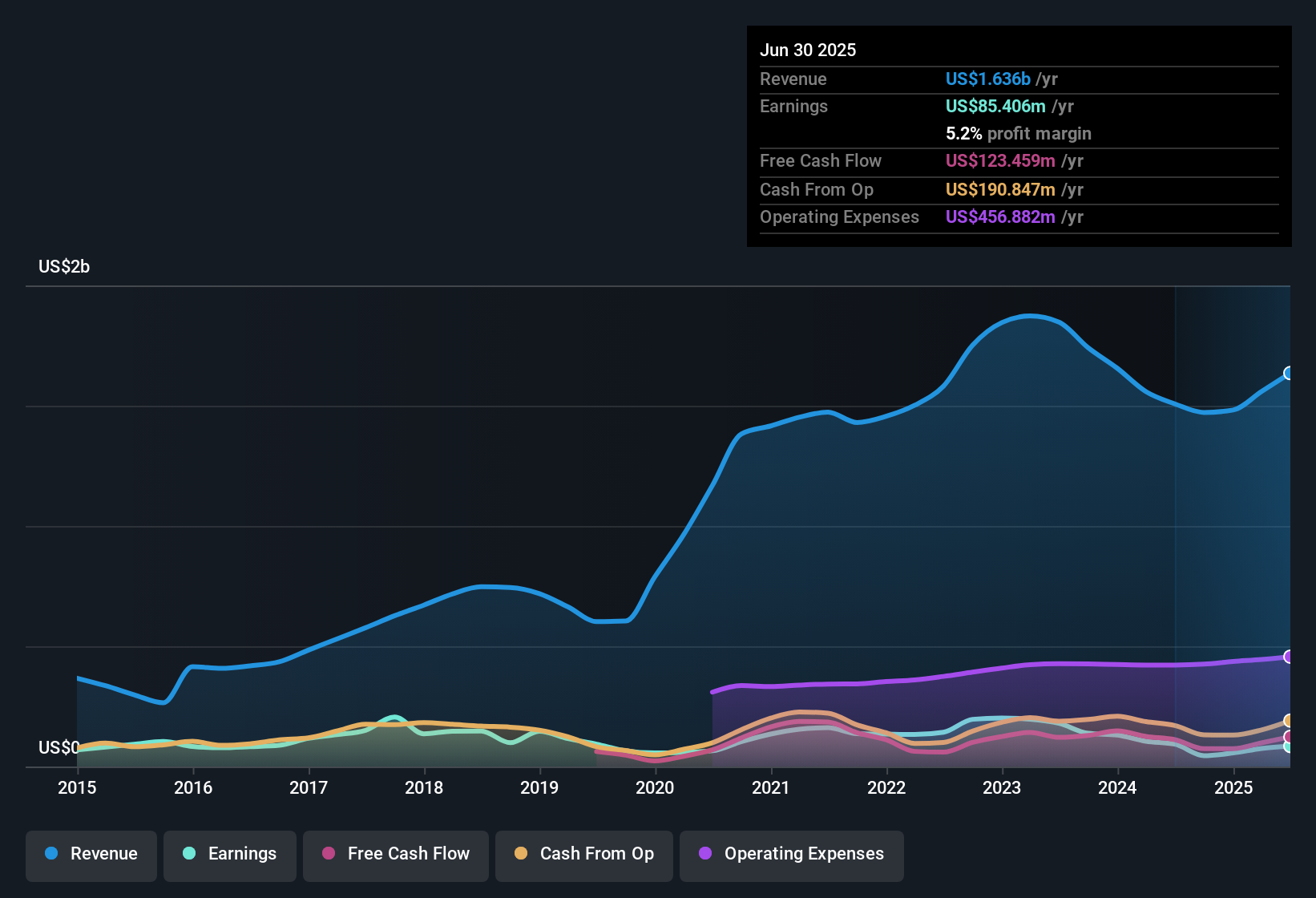

Advanced Energy Industries (AEIS) has just closed out FY 2025 with fourth quarter revenue of US$489.4 million and basic EPS of US$1.40, with trailing twelve month revenue of US$1.8 billion and EPS of US$3.97 framing the full year picture. The company has seen quarterly revenue move from US$374.2 million in Q3 2024 to US$489.4 million in Q4 2025, while basic EPS has shifted from a loss of US$0.38 in Q3 2024 to US$1.40 in Q4 2025 and US$3.97 on a trailing basis, setting up a results season where investors are likely to focus on how durable the current margin profile looks.

See our full analysis for Advanced Energy Industries.With the latest numbers on the table, the next step is to see how this earnings story lines up with the widely followed narratives around growth, cyclicality, and profitability for AEIS.

8.3% net margin marks a very different year

- On a trailing basis, AEIS generated US$1.8b of revenue and US$149.3 million of net income from continuing operations, which works out to an 8.3% net margin compared with 3.8% a year earlier.

- Bulls point to this margin lift as evidence that higher value platforms in data center and semiconductor are starting to show through, yet the numbers also highlight some tension with their story:

- Trailing net earnings are described as having grown 165.2% over the past year, while the 5 year EPS trend is a 10% yearly decline, so the recent margin profile sits against a longer period where profits moved the other way.

- Consensus narrative highlights expectations for margins to reach 16.7% in about 3 years, which is roughly double the current 8.3%, so today’s profitability still leaves a gap between recent delivery and the level bulls talk about over the medium term.

Revenue run rate near US$1.8b vs longer term trend

- The latest trailing twelve month revenue is US$1.8b, up from US$1.5b on the same trailing basis a year earlier, while quarterly revenue through FY 2025 has moved from US$404.6 million in Q1 to US$489.4 million in Q4.

- Supporters with a bullish view often lean on data center and semiconductor demand to justify higher growth expectations, and the current numbers give them some backing but also a check:

- Analysts in the bullish camp assume revenue growth of around 10.7% per year over the next 3 years, which sits close to the 13.4% annual revenue growth forecast cited for the company overall. Yet the five year earnings decline shows that faster sales do not automatically translate into smoother profit growth.

- The consensus narrative talks about revenue reaching about US$2.1b with earnings of US$348.3 million in a few years, so investors following that story will likely compare the current US$1.8b base with how quickly the semiconductor and AI data center funnels can bridge that US$300 million gap.

P/E of 78x with share price well above DCF fair value

- The shares trade at US$308.77, which implies a P/E of 78.1x compared with peer levels of 50.3x and a US Electronic industry average of 26.9x, and sits above a DCF fair value estimate of about US$139.24 and the allowed analyst target reference of US$326.11.

- Bears focus heavily on this valuation gap, and the figures here give their argument some clear reference points:

- The risk summary highlights that the current share price is above the cited DCF fair value, so investors who anchor on discounted cash flows will see a large premium relative to that US$139.24 figure.

- Even with forecasts calling for earnings growth of about 34.5% per year, the combination of a 78.1x P/E and a five year EPS decline of 10% per year shows why skeptics question paying such a multiple for a business whose longer term track record has been more mixed than the last 12 months suggest.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Advanced Energy Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to test your own view against the data and turn it into a clear narrative: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Advanced Energy Industries.

See What Else Is Out There

The combination of a 78.1x P/E, a five year EPS decline, and profitability still below bullish margin narratives leaves plenty of questions around valuation support.

If that kind of rich pricing makes you uneasy, take a few minutes to scan 51 high quality undervalued stocks and focus on ideas where current earnings expectations do more of the heavy lifting.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.