Please use a PC Browser to access Register-Tadawul

Aehr Test Systems, Inc.'s (NASDAQ:AEHR) 34% Price Boost Is Out Of Tune With Revenues

Aehr Test Systems AEHR | 33.60 | +11.00% |

Aehr Test Systems, Inc. (NASDAQ:AEHR) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. The annual gain comes to 131% following the latest surge, making investors sit up and take notice.

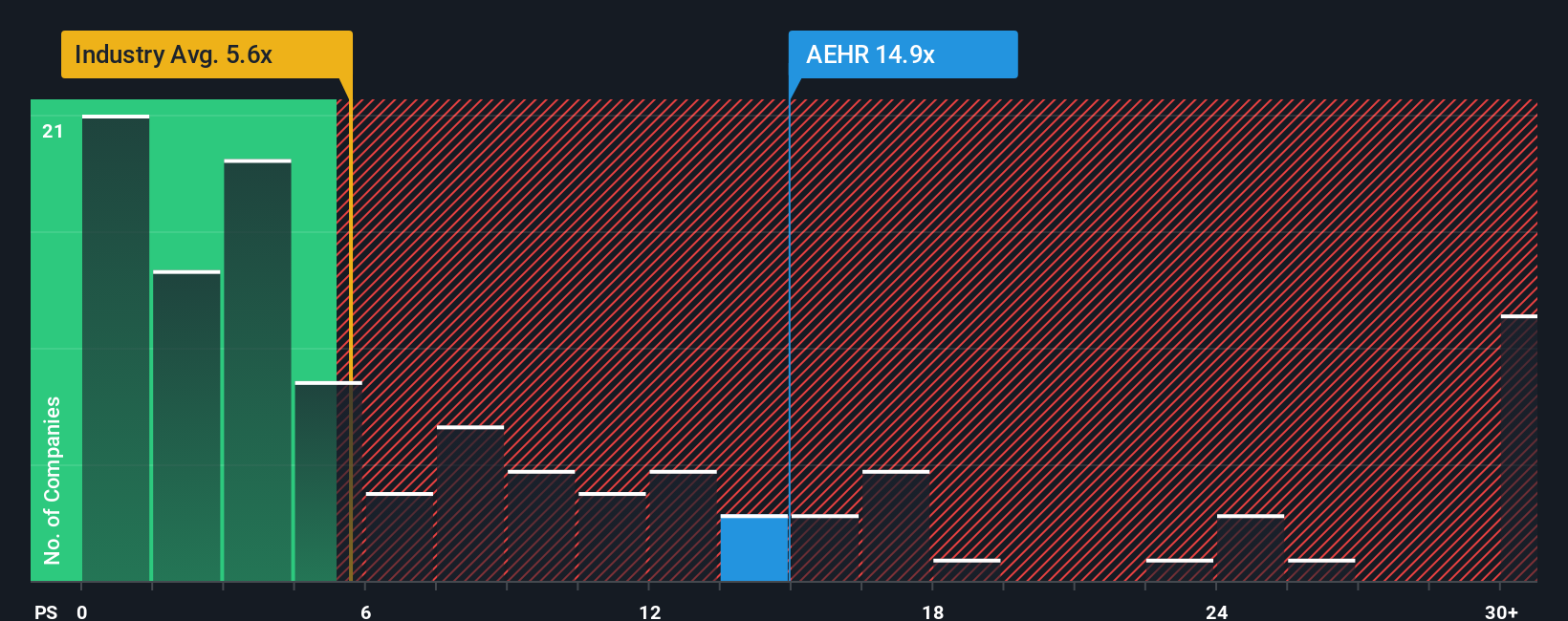

Following the firm bounce in price, Aehr Test Systems may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 16.6x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 5.6x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Aehr Test Systems' P/S Mean For Shareholders?

Aehr Test Systems could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Aehr Test Systems will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Aehr Test Systems would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.8% last year. Still, lamentably revenue has fallen 13% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 45%, which is noticeably more attractive.

In light of this, it's alarming that Aehr Test Systems' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Aehr Test Systems' P/S

Aehr Test Systems' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Aehr Test Systems trade at such a high P/S given the revenue forecasts look less than stellar. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

If you're unsure about the strength of Aehr Test Systems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.