Please use a PC Browser to access Register-Tadawul

Agios Pharmaceuticals (AGIO) Valuation Check After Extended Share Price Weakness

Agios Pharmaceuticals, Inc. AGIO | 29.25 | +2.34% |

What recent performance says about Agios Pharmaceuticals (AGIO)

Agios Pharmaceuticals (AGIO) has drawn attention after recent share performance, with the stock down about 4% over the past week, roughly 3% over the past month, and 35% over the past 3 months.

Stepping back, Agios Pharmaceuticals' recent weakness adds to a tougher stretch, with a 90 day share price return of a 34.7% decline and a 1 year total shareholder return of a 22.8% loss, which suggests momentum has been fading rather than building.

If this volatility has you looking beyond a single biotech name, it could be a good time to scan a wider group of healthcare focused AI opportunities through our list of 25 healthcare AI stocks.

So with Agios trading at a discount to analyst targets and some improvement in annual revenue and net income trends, is the current price underestimating the pipeline potential, or is the market already factoring in the anticipated growth story?

Most Popular Narrative: 27.7% Undervalued

Agios Pharmaceuticals' most followed narrative pegs fair value at $36.75 per share versus the last close of $26.57, framing a wide gap that rests heavily on how its pipeline converts into future cash flows.

Upcoming potential FDA approval and commercial launch of PYRUKYND for thalassemia in the U.S. is set to significantly expand Agios' addressable market, driven by the high rate of disease diagnosis through newborn screening and well-defined patient populations, which should lift revenue growth in coming years.

Curious what kind of revenue ramp, margin shift, and future earnings multiple are baked into that fair value? The full narrative spells out the growth curve and the valuation math behind it in detail, including how analysts weigh rapid top line expansion against ongoing losses.

Result: Fair Value of $36.75 (UNDERVALUED)

However, that upside view still leans heavily on PYRUKYND delivering across new indications, while high R&D and SG&A spending keeps profitability out of near reach.

Another Way To Look At Valuation

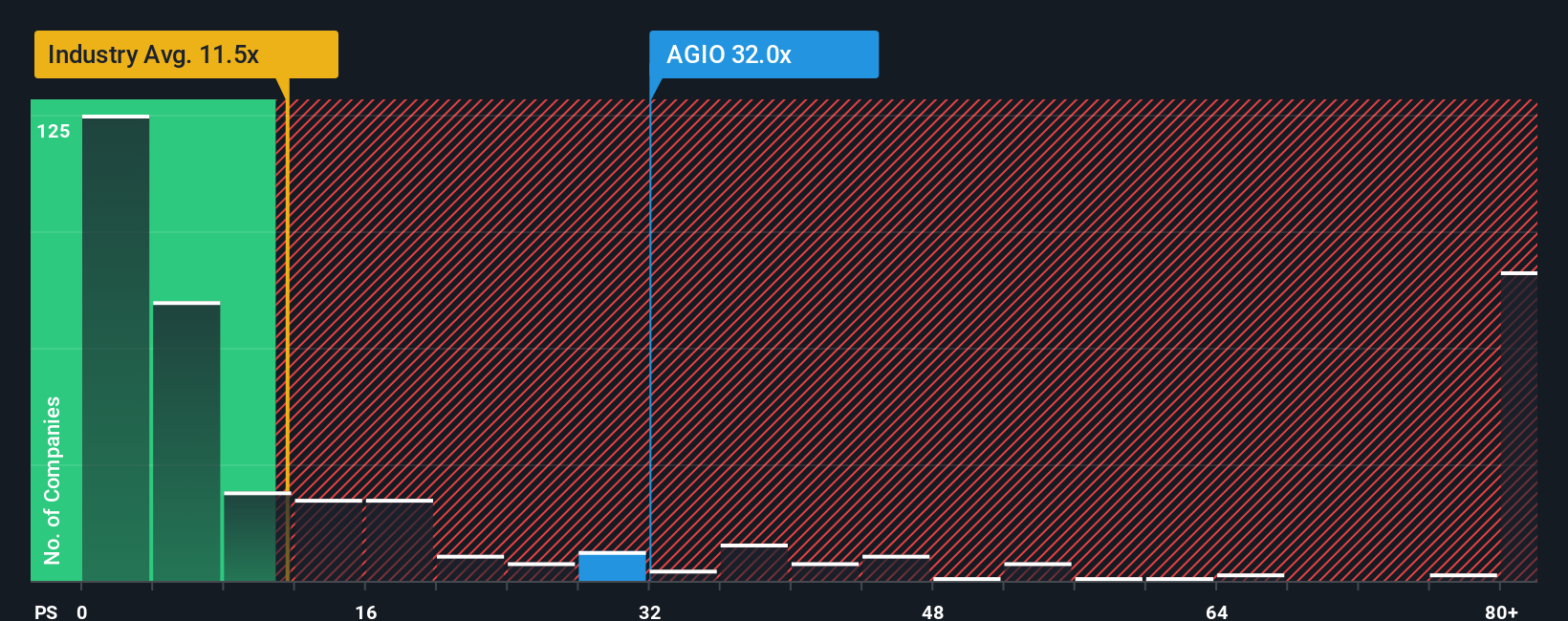

The narrative leans on future cash flows, but the current P/S of 34.6x tells a very different story. That multiple is far above the US Biotechs average of 11.5x and the fair ratio of 0x. This points to meaningful valuation risk if expectations reset. Which signal do you trust more?

Build Your Own Agios Pharmaceuticals Narrative

If you see the numbers differently or want to stress test your own assumptions, you can pull up the same data and build a custom view in just a few minutes, then Do it your way.

A great starting point for your Agios Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with one stock, you miss the bigger picture. Use the screener to quickly surface fresh ideas that match what you care about most.

- Target potential mispricings by scanning our list of 55 high quality undervalued stocks that might not yet be on everyone’s radar.

- Prioritise resilience first by filtering for companies in the solid balance sheet and fundamentals stocks screener (46 results) so you can focus on businesses with sturdier financial footing.

- Get ahead of the crowd by reviewing a screener containing 25 high quality undiscovered gems that could add something different to your portfolio before attention builds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.