Please use a PC Browser to access Register-Tadawul

AI Infrastructure Arms Race: Are Google, Amazon, and Meta Risking a Cash Crunch?

Amazon.com, Inc. AMZN | 199.60 | -2.20% |

Alphabet Inc. Class C GOOG | 309.37 | -0.63% |

Meta Platforms META | 649.81 | -2.82% |

Microsoft Corporation MSFT | 401.84 | -0.63% |

As the AI infrastructure arms race enters “deep waters,” investors are facing an unsettling turning point: to support soaring AI computing demands, Amazon.com, Inc.(AMZN.US), Alphabet Inc. Class C(GOOG.US), and Meta Platforms(META.US) risk seeing their free cash flow depleted—or even turning negative.

According to a JPMorgan research report released on February 5, 2026, America’s four major cloud giants—Amazon, Google, Meta, and Microsoft Corporation(MSFT.US)—are expected to reach a combined capital expenditure of $645 billion in 2026, up 56% year-over-year, with new spending totaling an astounding $230 billion. For investors, 2026 may be the year to watch tech giants’ balance sheets more closely than ever.

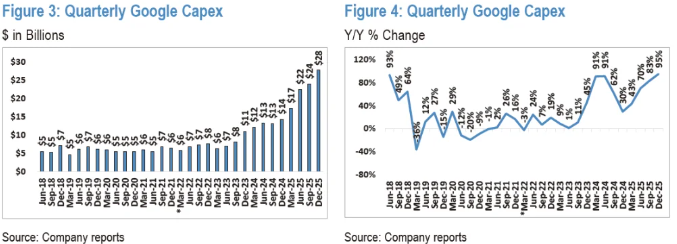

Google’s 97% Increase and Amazon’s “Cash Deficit.”

In this infrastructure boom, Google is investing aggressively. For 2026, Google has raised its capex guidance to $175–$185 billion, marking a staggering 97% year-on-year increase, with most funds flowing into servers and technical infrastructure.

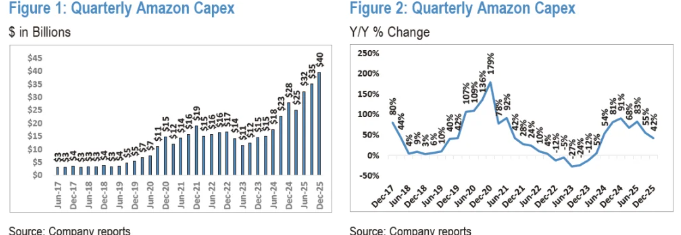

While Google is “spending crazily,” Amazon may be “borrowing from the future.”

Amazon’s capex guidance for 2026 is about $200 billion (up 52%), but the real issue is cash flow: S&P Global analysts predict Amazon’s operating cash flow (OCF) in 2026 will be $178 billion.

This means Amazon’s capex will exceed its OCF, resulting in substantial net cash outflows (“Burn CASH”). Furthermore, as reported by The Information, Amazon is negotiating to invest tens of billions in OpenAI, which would further drain its cash reserves.

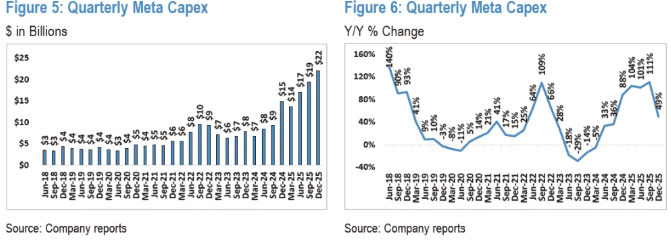

Meta’s outlook is also concerning. Its capex in 2026 is set to rise 75% to $115–$135 billion. While not as cash-strapped as Amazon, Meta’s massive spending will nearly wipe out its free cash flow, sharply tightening its once-abundant financial cushion.

Shareholder Returns Under Pressure—Microsoft May Be an Exception

When cash pools dry up, shareholder return programs come under strain.

Over the past few years, tech giants have used large buybacks to support share prices—but in 2026, this engine may falter:

- Buybacks Shrinking: Last year, Meta spent $26 billion on buybacks. With free cash flow expected to shrink dramatically this year, buybacks will likely be scaled back.

- Dividend Pressure: Google and Meta paid out about $10 billion and $5 billion in dividends last fiscal year. They may still afford these payouts in 2026, but it will further squeeze cash flows.

Amazon doesn’t face the same problem—it hasn’t bought back shares since 2022 and has never paid dividends. With looming cash deficits, a buyback revival is unlikely.

Facing these funding gaps, the giants are leveraging their balance sheet flexibility:

- Google: Despite surging spending, Google currently has “zero net debt” ($127 billion cash vs. $47 billion debt). S&P ratings note Google could add up to $200 billion in net debt without risking a downgrade from AA+.

- Amazon: Despite cash shortfalls, it ended last year with $123 billion in cash and issued $15 billion in bonds last November. Recently, it filed a registration statement with the SEC, ready for further large-scale bond issuance.

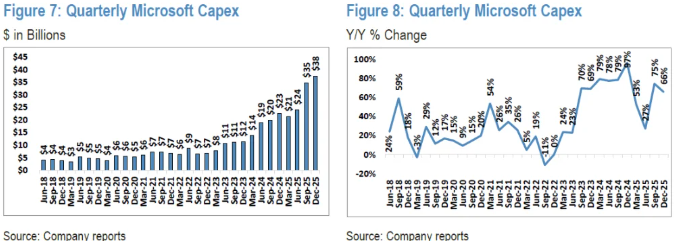

Amidst the “cash burn,” Microsoft stands out for financial resilience.

Despite the expected capex of over $103 billion (+60%) for FY2026, analysts forecast it can still generate about $66 billion in free cash flow—enough to cover the spend.

However, Microsoft faces another unique hurdle: higher dividend commitments. Last fiscal year, it paid $24 billion in dividends and has already boosted payouts by 10% this year.

Conclusion: Beware the Oracle Trap

For investors, 2026 will be a year to watch balance sheets closely.

Oracle Corporation(ORCL.US) offers a cautionary tale—after financing data center builds, its net debt soared to $88 billion, more than twice its EBITDA. This overextension has punished its share price, which is down 27% this year.

The $645 billion bill is now on the table.

As Silicon Valley titans race to use current cash flows—and even future debt—to buy a ticket to the AI age, if these high-stakes bets fail to bring real revenue growth, the 2026 cash flow crunch may be only the first chapter in a larger valuation reset.

The above content is provided solely for informational or educational purposes and does not constitute any investment advice related to Sahm. Sahm endeavors to ensure, but cannot guarantee, the authenticity, accuracy, or originality of all the aforementioned content.