Please use a PC Browser to access Register-Tadawul

Air Products and Chemicals (APD) Valuation Check After Strong Q1 Results and New NASA Hydrogen Contracts

Air Products and Chemicals, Inc. APD | 281.18 | +0.16% |

Air Products and Chemicals (APD) is back in focus after first quarter results showed sales of US$3,102.5 million and net income of US$678.2 million, alongside more than US$140 million in new NASA hydrogen contracts.

The strong first quarter numbers, the new US$140 million NASA liquid hydrogen contracts and the 44th consecutive annual dividend increase have coincided with improving momentum, with a 30 day share price return of 8.59% and a 90 day share price return of 9.21%. The 1 year total shareholder return of a 5.33% decline contrasts with a 5 year total shareholder return of 24.41%, suggesting shorter term sentiment has recently strengthened compared with the longer run picture.

If this mix of earnings, contracts and dividends has you looking beyond a single name, it could be a good time to scan 24 power grid technology and infrastructure stocks as another way to find potential opportunities tied to large scale energy and infrastructure themes.

So with APD up over the past quarter, trading at US$286.37 and sitting only about 5% below the average analyst price target, is the recent strength still leaving room for a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 4.7% Undervalued

At a last close of $286.37 versus a narrative fair value of about $300.43, the current gap is modest, but the story behind that estimate is detailed.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast), are set to come online over the next several years, providing robust and stable earnings and supporting a trajectory of consistently higher operating margins.

Curious what earnings path and margin profile are built into that fair value, and how future valuation multiples tie it all together? The full narrative lays out a detailed earnings ramp, revenue path and profit margin assumptions that underpin the projected return to profitability and the premium multiple required to reach that price.

Result: Fair Value of $300.43 (UNDERVALUED)

However, that story depends on major hydrogen and ammonia projects avoiding delays or cost overruns, and on helium market pressures not creating a longer-lasting drag on earnings.

Another Angle: Multiples Point To A Richer Price

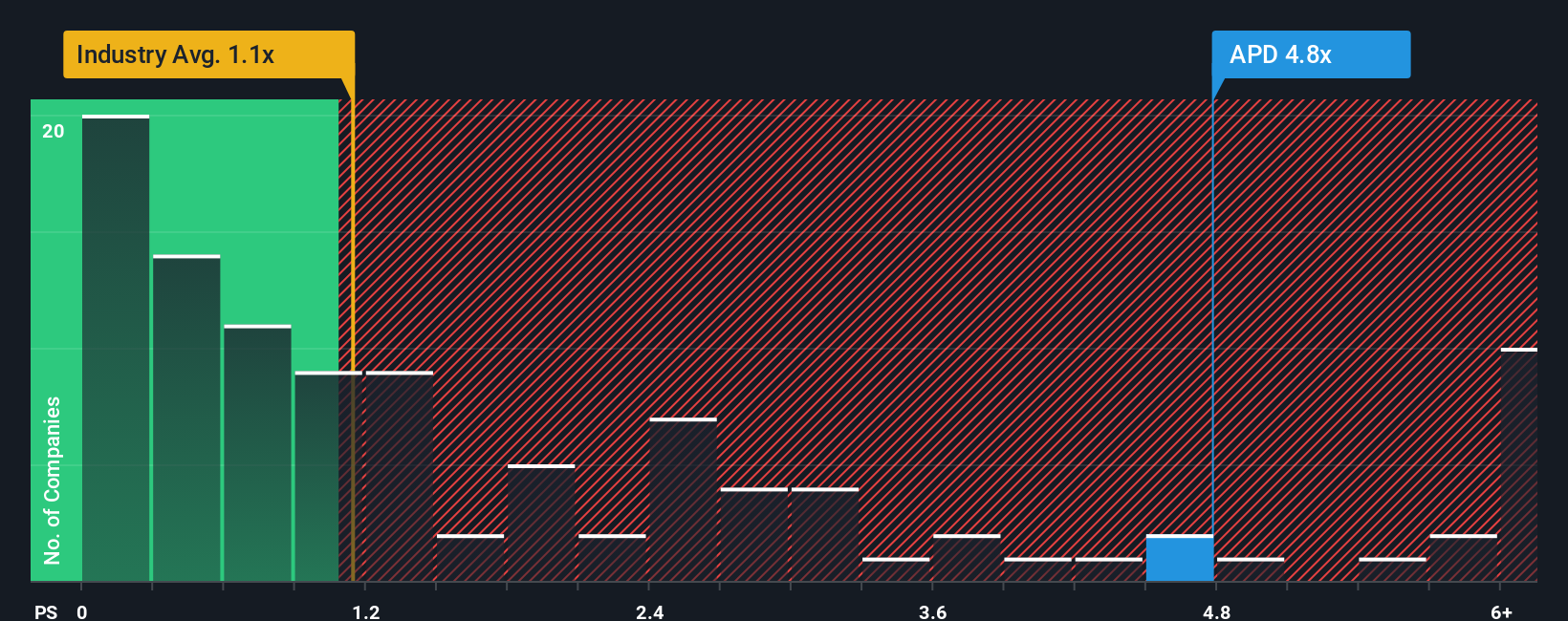

That 4.7% narrative discount to fair value sits alongside a very different signal when you look at simple price ratios. On a P/S of 5.2x, Air Products and Chemicals is priced well above the US Chemicals industry at 1.2x, above peers at 4.5x, and above its own fair ratio of 2.7x, which suggests less margin for error if growth or margins fall short.

Build Your Own Air Products and Chemicals Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom view in minutes, starting with Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready To Hunt For More Investment Ideas?

If APD has sharpened your focus, do not stop here; broaden your watchlist now or you risk missing other opportunities that fit your approach.

- Target value by scanning companies our screener tags as attractively priced with strong fundamentals through 52 high quality undervalued stocks. These might complement or contrast with APD.

- Prioritise resilience by checking stocks with robust finances and staying power using our solid balance sheet and fundamentals stocks screener (45 results) so you are not relying on one theme alone.

- Unearth potential future standouts early by reviewing the screener containing 24 high quality undiscovered gems before they sit on everyone else's radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.