Please use a PC Browser to access Register-Tadawul

Alibaba Valuation in Focus After 66% Rally and New Chip Development Amid Nvidia Ban

Alibaba Group Holding Ltd. Sponsored ADR BABA | 155.68 | -0.78% |

If you are weighing your next move with Alibaba Group Holding stock, you are definitely not alone. There has been a fresh wave of attention surrounding this Chinese tech giant lately, and its price movements might have caught your eye: up 4.6% in just the last week, a strong 17.3% jump over the past 30 days, and a dramatic 66.2% rise since the start of the year. Even more striking, shares have soared 76.3% in the last twelve months. For anyone who rode out the troubling years after 2020, this turnaround probably feels long overdue, especially considering Alibaba is still down 45.8% over five years.

Much of this momentum seems to follow shifting risk perceptions and the market's refreshed optimism around Chinese tech, despite regulatory headwinds and ongoing restrictions on U.S. semiconductor technology. It is worth noting that Alibaba’s drive to develop its own versatile chips is a fascinating response to Nvidia’s regulatory bans, sending a clear signal to investors and competitors alike that innovation is alive and well in the company’s DNA.

So does the recent rally mean Alibaba is overvalued, or is there still hidden potential? To shed light on this, we rely on a tried-and-true valuation checklist. Alibaba currently scores a 4 out of 6, a number that points to significant undervaluation by several key measures. In the next section, we will break down what this score really means through the lens of several standard valuation approaches, before introducing a smarter way to look at a company’s true worth.

Alibaba Group Holding delivered 76.3% returns over the last year. See how this stacks up to the rest of the Multiline Retail industry.Approach 1: Alibaba Group Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach provides a financial snapshot based on how much cash Alibaba is expected to generate for shareholders in the coming years.

Currently, Alibaba's trailing twelve-month Free Cash Flow (FCF) stands at CN¥83.1 billion. Analysts forecast steady growth, with FCF expected to reach CN¥140.9 billion by the year ending March 2028. Projections extend out to 2035, with anticipated FCF increasing each year. These longer-term estimates combine analyst input and in-house calculations. All figures referenced here are in Chinese Yuan (CN¥).

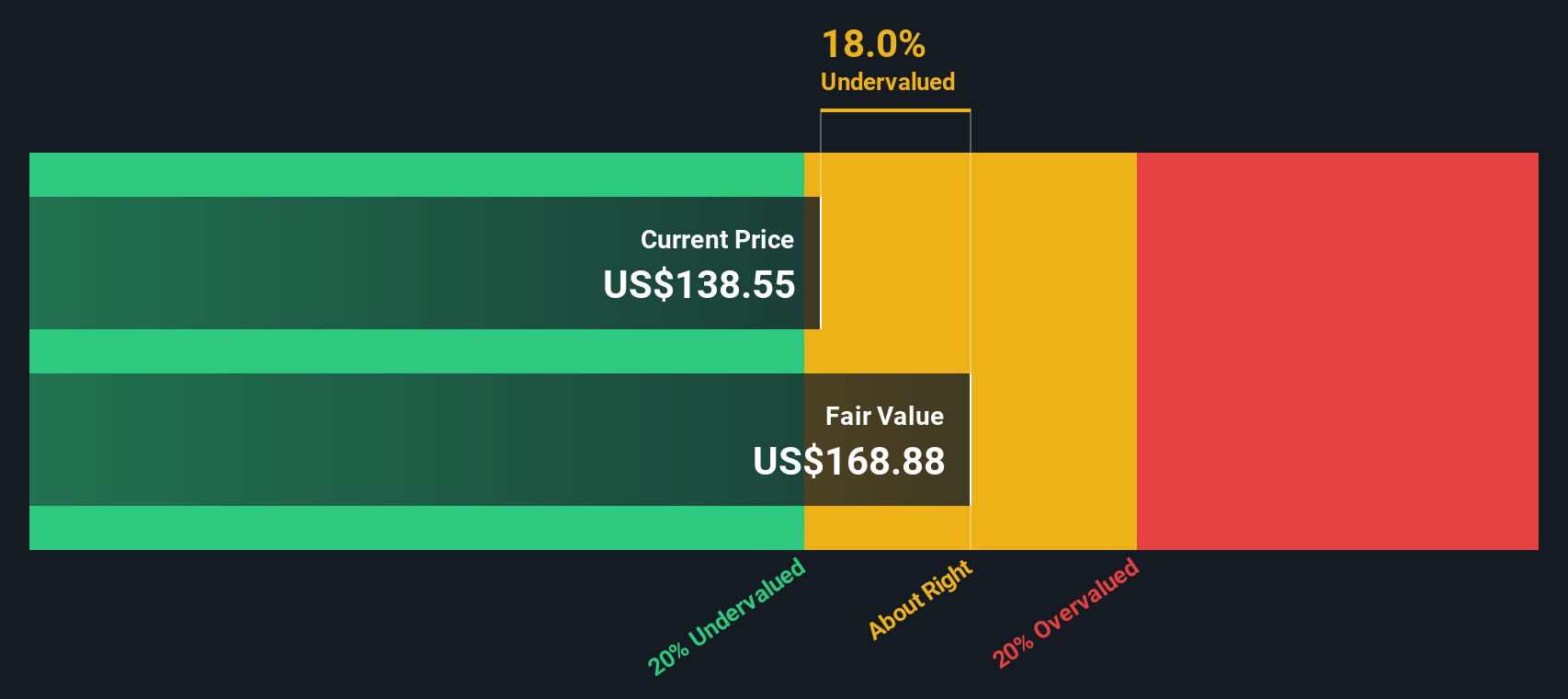

Based on this growth path, the DCF model concludes Alibaba’s intrinsic value is about $169.50 per share. Compared to the current share price, this represents a discount of 16.7%, suggesting the stock is undervalued by a significant margin.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Alibaba Group Holding.

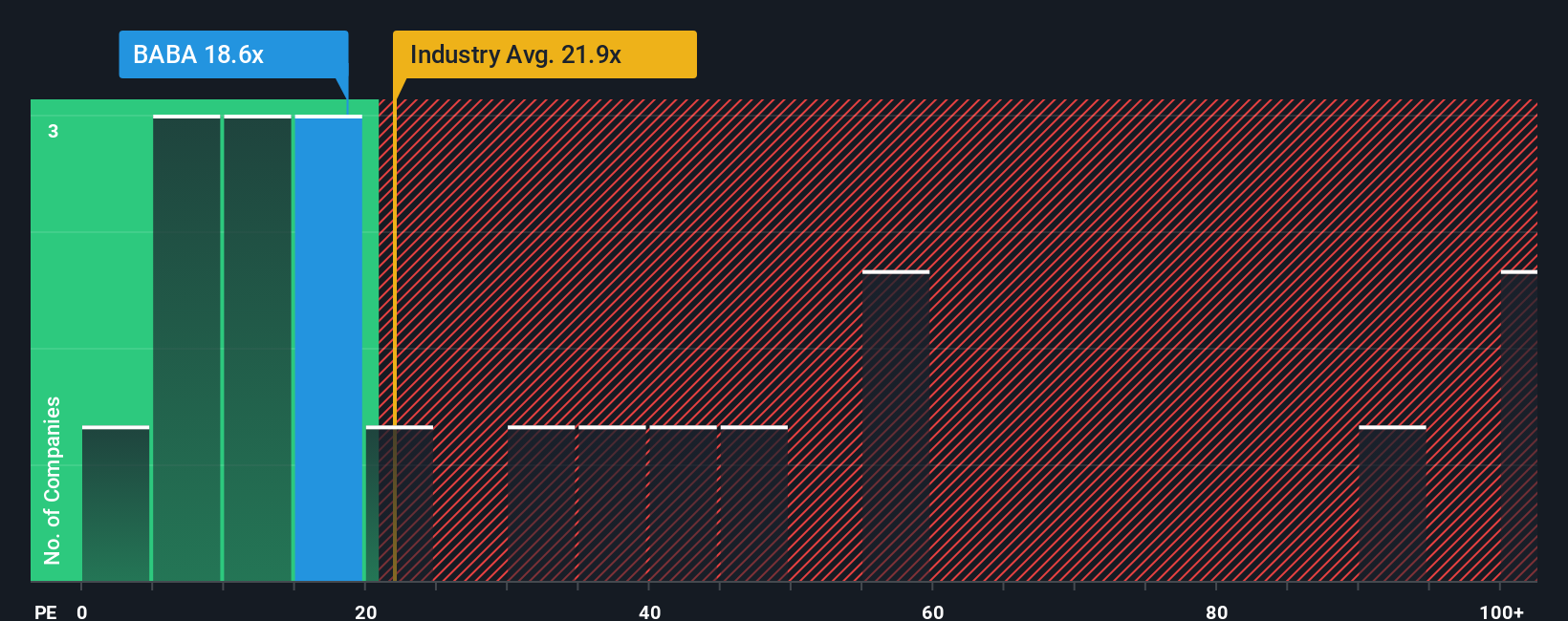

Approach 2: Alibaba Group Holding Price vs Earnings

For profitable companies like Alibaba Group Holding, the Price-to-Earnings (PE) ratio is a tried-and-tested method to gauge valuation. The PE ratio compares a company’s current share price with its per-share earnings, helping investors determine how much they are paying for current profitability. A lower or higher PE can signal a bargain or expensive stock, but growth expectations and perceived risks always play a significant role in what is considered “normal.” Companies with stronger growth or lower risks often justify a higher PE, while slow-growing or riskier firms trade at lower multiples.

Currently, Alibaba trades on a PE ratio of 15.2x, which is well below the industry average of 22.3x for Multiline Retail and significantly lower than the peer average of 43.5x. On paper, this may suggest investors are more cautious about Alibaba or anticipate lower future growth compared to its peers. However, basic comparisons like these can overlook company-specific factors. This is where Simply Wall St’s Fair Ratio comes into play.

The Fair Ratio is a proprietary multiple that factors in Alibaba’s unique combination of earnings growth prospects, profit margins, size, and risk profile, as well as industry and wider market conditions. Unlike basic peer or sector averages, this customized metric aims to deliver a more accurate view of where Alibaba “should” trade. For Alibaba, the Fair Ratio is calculated at 27.0x, a substantial premium to its current 15.2x. This significant gap suggests Alibaba’s stock is notably undervalued on a PE basis, especially when accounting for its financial strength and outlook.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Alibaba Group Holding Narrative

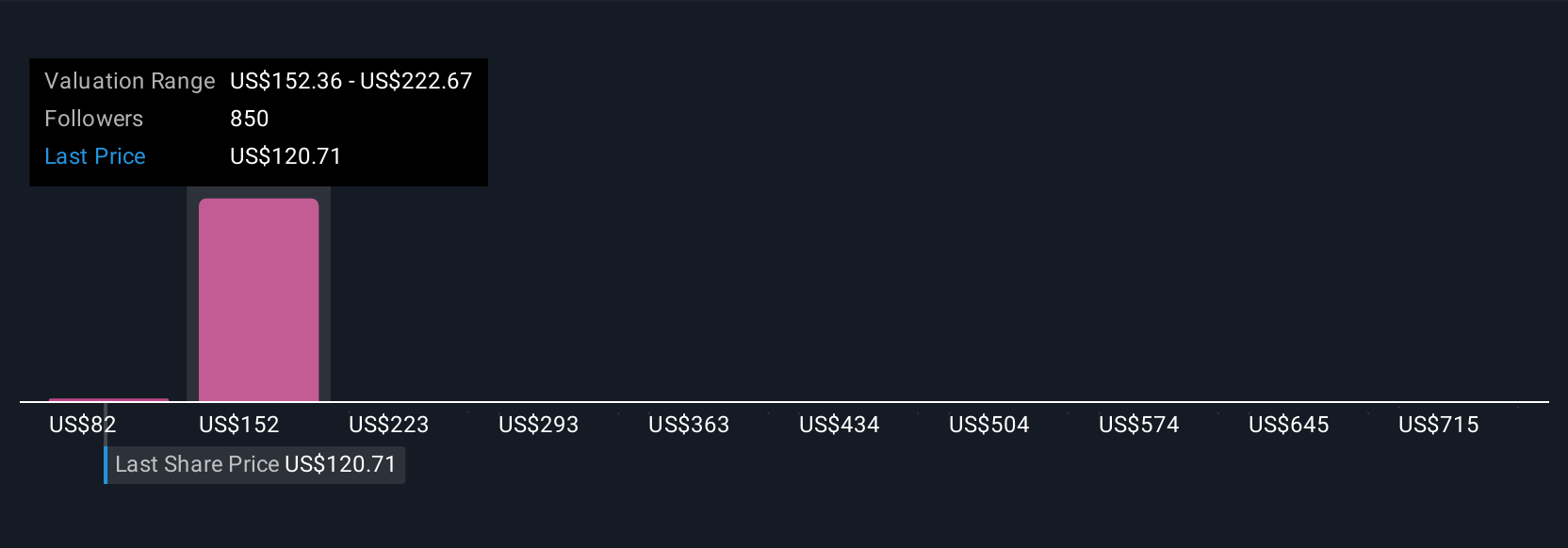

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Put simply, a Narrative is your story about Alibaba, the beliefs and logic that shape your projections for its future revenues, earnings, and profit margins, leading you to your assumed fair value. Think of a Narrative as a bridge between the facts (the numbers) and your personal view of Alibaba’s journey, connecting the company’s story with a financial forecast and then a fair value per share.

Narratives are available within the Simply Wall St Community, used by millions of investors to quickly map their perspectives around a stock, compare with others, and see the impact of fresh information as news or results come in. By laying out your Narrative, you can instantly decide whether Alibaba is a buy or sell for you by comparing your calculated fair value to the current share price.

Best of all, Narratives update dynamically as new developments occur, making sure your investment thesis keeps pace with reality. For example, one investor’s Narrative for Alibaba might reflect strong confidence in AI and cloud growth for a fair value of $169.50 per share, while another may focus more on trade risks and regulatory pressures, landing at $107.09 per share.

Do you think there's more to the story for Alibaba Group Holding? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.