Please use a PC Browser to access Register-Tadawul

Almarai Company's (TADAWUL:2280) Share Price Not Quite Adding Up

ALMARAI 2280.SA | 44.14 | -0.14% |

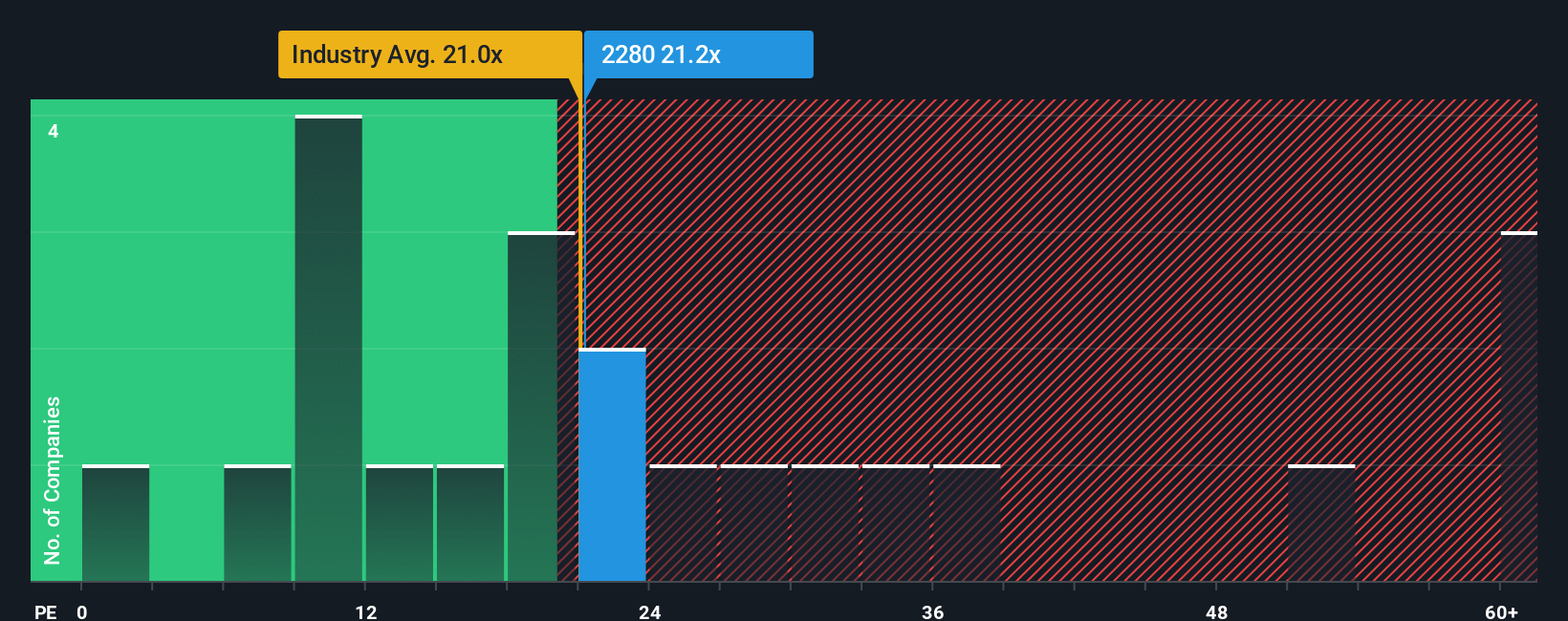

With a median price-to-earnings (or "P/E") ratio of close to 21x in Saudi Arabia, you could be forgiven for feeling indifferent about Almarai Company's (TADAWUL:2280) P/E ratio of 21.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Almarai's and the market's earnings growth lately. The P/E is probably moderate because investors think this modest earnings performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Almarai's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a decent 9.5% gain to the company's bottom line. The latest three year period has also seen an excellent 43% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 8.8% each year during the coming three years according to the twelve analysts following the company. Meanwhile, the rest of the market is forecast to expand by 12% each year, which is noticeably more attractive.

With this information, we find it interesting that Almarai is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Almarai's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.