Please use a PC Browser to access Register-Tadawul

Ambarella, Inc. (NASDAQ:AMBA) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Ambarella, Inc. AMBA | 68.01 | +2.69% |

Unfortunately for some shareholders, the Ambarella, Inc. (NASDAQ:AMBA) share price has dived 26% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 24% share price drop.

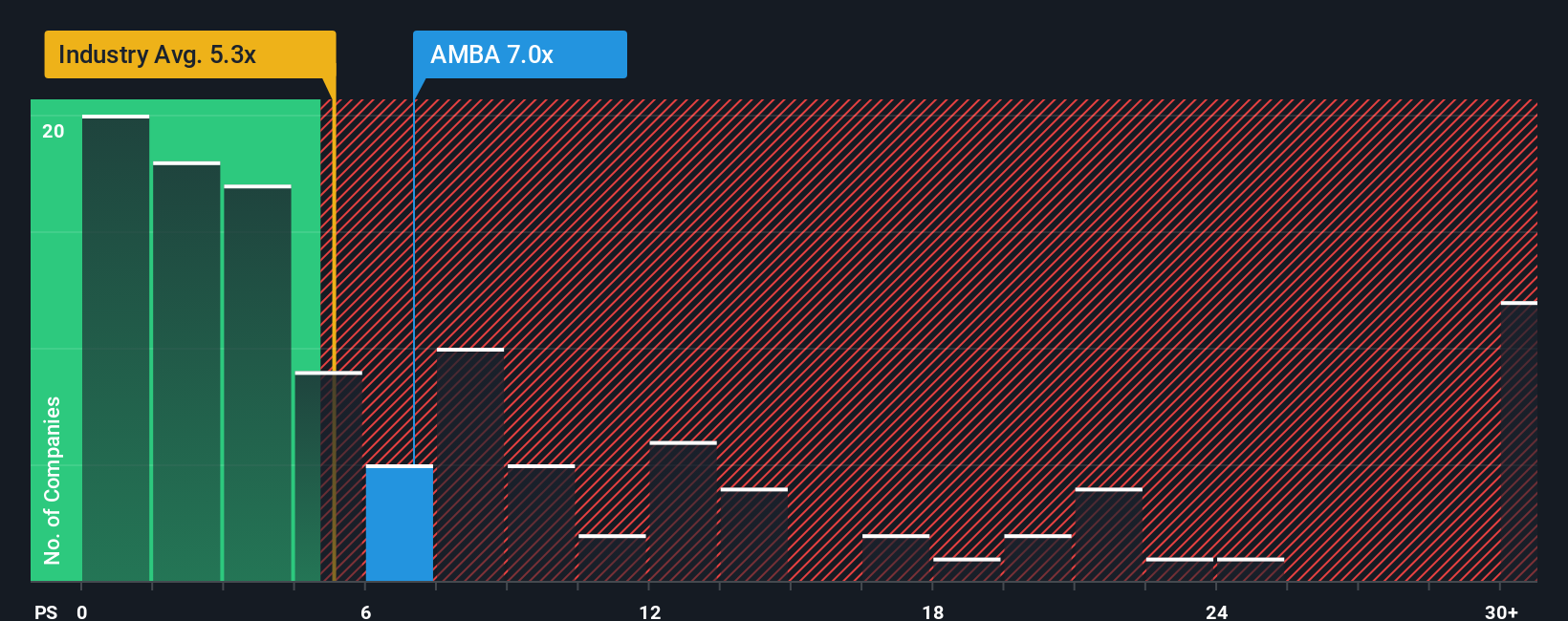

In spite of the heavy fall in price, Ambarella may still be sending sell signals at present with a price-to-sales (or "P/S") ratio of 6.8x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 5.3x and even P/S lower than 2x aren't out of the ordinary. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Ambarella Has Been Performing

Recent times have been advantageous for Ambarella as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Ambarella will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Ambarella?

In order to justify its P/S ratio, Ambarella would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 48% last year. Revenue has also lifted 8.5% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the analysts following the company. With the industry predicted to deliver 30% growth per annum, the company is positioned for a weaker revenue result.

In light of this, it's alarming that Ambarella's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

There's still some elevation in Ambarella's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that Ambarella currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.