Please use a PC Browser to access Register-Tadawul

American Assets Trust (AAT) FFO Softness Tests Bullish Narratives After FY 2025 Results

American Assets Trust, Inc. AAT | 19.55 | +3.60% |

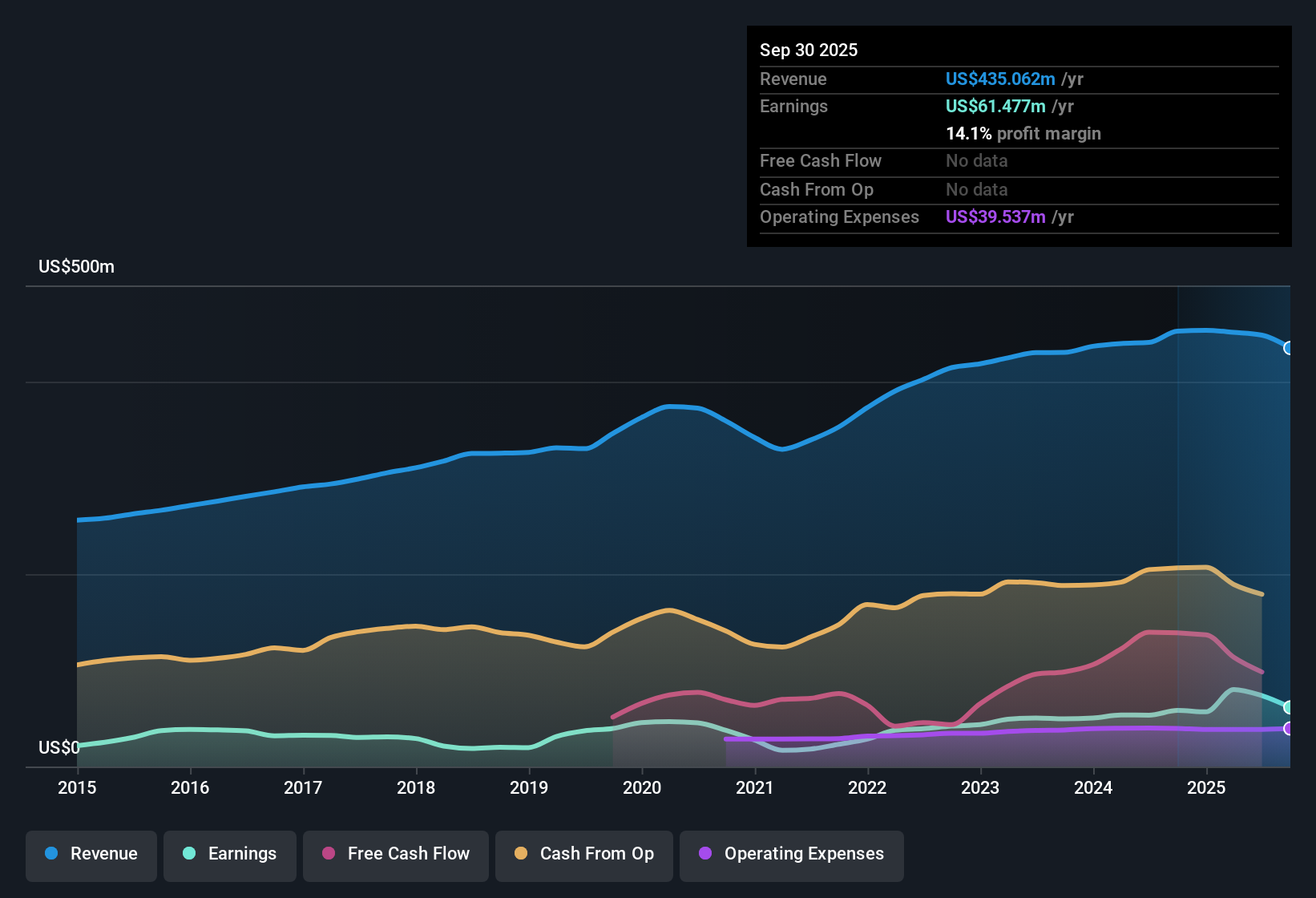

American Assets Trust (AAT) has wrapped up FY 2025 with fourth quarter revenue of US$110.1 million, Funds From Operations of US$36.0 million and basic EPS of US$0.05. Trailing twelve month revenue stands at US$436.2 million with EPS at US$0.92. Over recent quarters the company has seen revenue move from US$112.2 million in Q4 2024 to US$110.1 million in Q4 2025, with basic EPS shifting from US$0.15 to US$0.05 across the same period. Taken together, this sets a cautious tone around earnings quality and margins. For investors, that mix of steady top line, soft EPS and a trailing net margin of 12.8% highlights how much of each revenue dollar is actually making it through to the bottom line.

See our full analysis for American Assets Trust.With the numbers on the table, the next step is to see how this latest earnings print lines up against the widely followed narratives around American Assets Trust, and where those stories might need updating.

FFO Holds Up Better Than Net Income

- Across FY 2025, quarterly Funds From Operations moved from US$39.9 million in Q1 to US$36.0 million in Q4, while quarterly net income moved from US$42.5 million to US$3.1 million over the same span, showing a much bigger swing at the earnings line than in FFO.

- For a more bullish interpretation, REIT focused investors often pay closer attention to FFO, and the step down in quarterly FFO from US$42.1 million in Q4 2024 to US$36.0 million in Q4 2025 is much smaller than the shift in net income, which was helped by a one off US$44.5 million gain in the last 12 months, so:

- Bulls could argue that the US$153.4 million of trailing 12 month FFO still reflects the underlying property cash generation, even as reported net income of US$55.6 million is heavily influenced by that one off gain.

- At the same time, the step down from US$197.5 million to US$153.4 million in trailing 12 month FFO shows that even the more REIT specific metric has softened, which keeps the bullish story more measured rather than outright strong.

Slow 1.1% Revenue Growth Versus US Market

- On a trailing 12 month basis, revenue is US$436.2 million, which lines up with a 1.1% annual growth rate compared with a 10.1% annual growth rate cited for the broader US market.

- Critics highlight that this slower 1.1% revenue growth, together with negative earnings growth in the most recent year, sits awkwardly next to a history of 21.4% annual earnings growth over five years. This creates tension for a more bullish view that leans on that longer track record:

- The large US$44.5 million one off gain in the last 12 months means part of the trailing earnings strength does not come from the recurring rent and fee stream implied by the US$436.2 million of revenue.

- The move in trailing net margin from 12.5% a year earlier to 12.8% now shows only a modest change at the profitability line, which may not fully address bearish concerns about the recent weakness in earnings growth.

P/E Of 20.7x And DCF Fair Value Gap

- AAT trades on a trailing P/E of 20.7x, above the 16x Global REITs average but below the listed peer average of 39.8x, while the current share price of US$18.78 sits about 17.9% below the DCF fair value of roughly US$22.87.

- For a more bearish narrative, what makes the picture tricky is that valuation metrics hint at possible relative value, yet the same data set points to pressure on future earnings and cash coverage:

- The forecast average 44.6% per year decline in earnings over the next three years, together with weak interest coverage, helps explain why some investors treat the discount to the US$22.87 DCF fair value with caution.

- The 7.24% dividend yield is not well covered by free cash flow, which ties back directly to concerns that current cash generation may not comfortably support both income payouts and interest obligations, even if the P/E looks cheaper than the 39.8x peer average.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on American Assets Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

AAT is working through soft earnings, modest 1.1% revenue growth and a dividend that is not well covered by free cash flow or current cash generation.

If stretched cash coverage and income risk bother you, check out these 1775 dividend stocks with yields > 3% today to focus on companies offering yields that look better supported by their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.