Please use a PC Browser to access Register-Tadawul

Amgen (AMGN) Completes US$60,594 Million Share Buyback After 14 Years

Amgen Inc. AMGN | 326.33 | +0.32% |

Amgen (AMGN) recently concluded a buyback period without repurchasing any shares, maintaining its focus on prior buyback strategies. The company's positive earnings announcement highlighted robust year-over-year growth, potentially contributing to its stock price increase of 4.6% over the last quarter. Despite legal issues impacting the broader perception of companies engaged in antitrust activities, Amgen’s legal challenges might have countered market trends. Additionally, ongoing product advancements such as the Phase 3 FORTITUDE-101 trial results could have added weight to its stock performance, aligning with the overall market's cautious optimism despite tariff concerns and economic uncertainties.

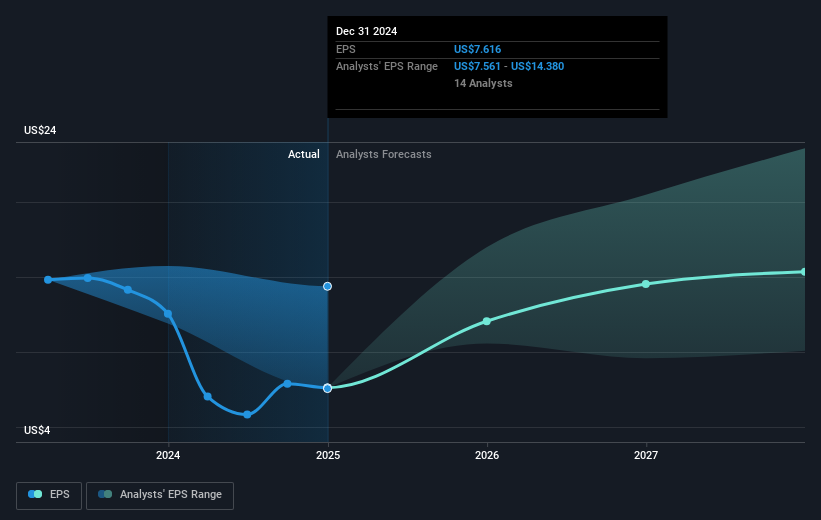

Amgen's recent decision to refrain from share buybacks could play a pivotal role in shaping its future financial strategy and market perception. While the 4.6% quarterly stock price increase after its earnings report appears positive, analysts remain concerned about various pressures such as biosimilar competition and patent expirations, which may impact revenue stability. The company’s strong R&D and ongoing product trials like FORTITUDE-101 may offer growth potential, yet the looming challenges underscore a cautious outlook on earnings forecasts. The influence of legal issues and market regulations remains a wildcard in Amgen’s narrative.

Over the past five years, Amgen's total shareholder return, including dividends, stood at 37.61%. This long-term performance provides context to its current valuation, which some analysts believe reflects excessive market expectations given future risks. Compared to the US market's 22.4% return over the past year, Amgen underperformed, pointing to possible market skepticism about its growth prospects. Furthermore, Amgen's underperformance relative to the US Biotechs industry, which declined by 6.5% over the past year, underscores the competitive and regulatory challenges at play.

With the current share price at approximately $284.67, Amgen trades at a discount to the consensus price target of $314.00, suggesting that there may be room for upward movement if forecasts align with optimistic assessments. However, the bearish analyst cohort projects a fair value significantly lower at $221.31, incorporating assumptions of stagnant revenue growth and rising PE ratios. The outcome of Amgen's strategic focus and market adaption efforts will crucially determine whether the share price aligns with optimistic or conservative targets in the future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.